FedEx & UPS Suspended Service Guarantees During Covid. So, How Are They Performing?

At the onset of the Covid-19 pandemic, both FedEx and UPS suspended service guarantees, citing that business closures had impacted their ability to meet high standards of delivery service. However, both carriers have exception codes that invalidate money-back guarantees when delivery is attempted to a business is closed, which left many shippers scratching their heads – and out hundreds or thousands of dollars in lost refunds.

Latest Logistics News

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report More NewsThe New York Times reported on May 14, 2020 that FedEx informed two dozen major retailers, including Kohl’s, Nordstrom and Eddie Bauer, that FedEx was restricting package volumes coming out of certain locations.

With service guarantees suspended, how are shippers to understand how well their delivery partners are performing during Covid?

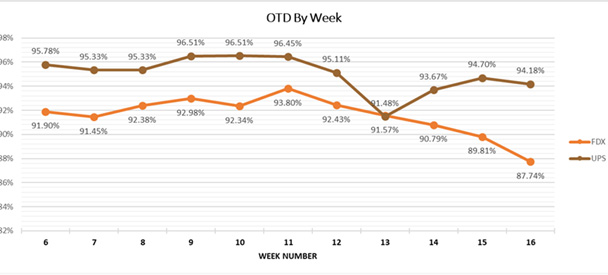

To answer that question, Shipware compiled delivery data for both carriers during the Covid-19 pandemic (Figure 1).

Figure 1

FedEx service performance has been trending worse than UPS thus far during the pandemic. On-time percentage is in the low-90s for most weeks but does lag behind the pre-Covid performance. FedEx maintains separate networks for Ground, SmartPost and Express, which makes them less flexible than UPS in this new environment.

Also noticeable within Figure 1 is that both carriers experienced weekly service degradation over the first few weeks of the pandemic. However, UPS recovered and has been trending up since bottoming in Week 13, illustrating the advantage of a singular delivery network. On the other hand, FedEx has progressively worsened in recent weeks, a clear indication that demand is exceeding capacity.

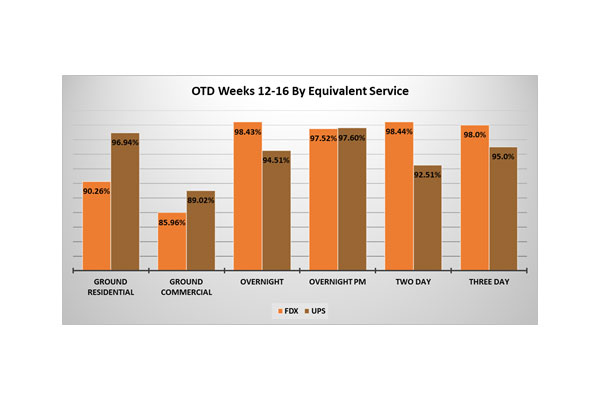

Additionally, Shipware compared service performance between FedEx and UPS based on product (Figure 2).

Figure 2

Both carriers have struggled with their Ground networks, although UPS is performing better on Ground Residential deliveries. Service performance within both carriers’ Air networks has remained relatively consistent, with FedEx outperforming UPS.

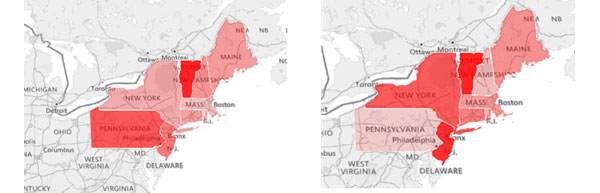

To identify regional service performance inconsistencies, Shipware divided the country into four segments. In the charts below, the deeper red indicates a higher late percentage compared to other states in the region for that carrier. In other words, if UPS is a darker red than FedEx for a state, that does not mean that UPS’s on-time percentage is worse than FedEx’s, and vice-versa. These charts are based on Weeks 12-16 only.

Figures 3-4

Northeast - FedEx (Left), UPS (right)

Northeastern states are represented in Figures 3-4, which demonstrate that UPS has been challenged in New York, New Jersey and Vermont, while FedEx is performing a little worse in Pennsylvania and Vermont.

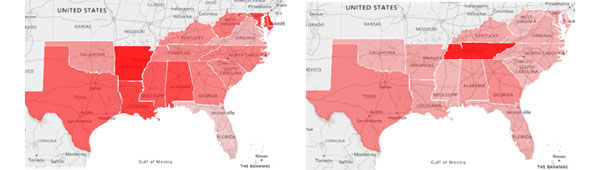

Figures 5-6

South - FedEx (Left), UPS (right)

In the South, FedEx is performing worse in Alabama, Arkansas, Louisiana, Maryland and Texas, which is surprising considering those states are relatively close to Memphis. On the other hand, UPS is struggling with deliveries to Tennessee.

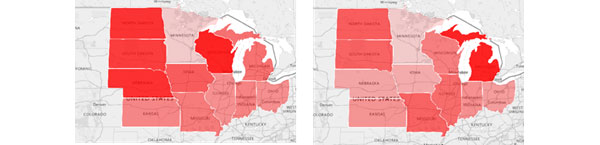

Figures 7-8

Midwest- FedEx (Left), UPS (right)

The Midwest has several states where the carriers are experiencing higher than average late deliveries. North and South Dakota are challenging for both carriers. FedEx is having additional problems with Wisconsin and Nebraska while Michigan is seeing a spike in late shipments from UPS.

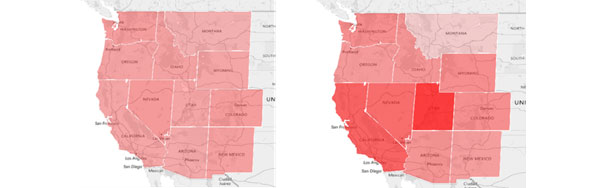

Figures 9-10

Interestingly, FedEx has been performing relatively well out West with on-time percentages around 91%. While UPS has experienced delivery challenges in Utah and California, in direct comparison, UPS’s on-time percentage to California is slightly better than FedEx (91.2% versus 90.3%).

Shippers can use these charts to help inform their customers in impacted states that their shipments might arrive later than expected.

As the country begins to reopen, the overarching question raised by many shippers is, when will FedEx and UPS reinstate these refunds? With the pandemic projected to last for months, and refunds being lost revenue that subtracts from their bottom lines, expect neither carrier to rush to restore these guarantees. However, as businesses return to normal operations, we do expect refunds for late deliveries to be reinstated eventually.

Shipware will continue to update these metrics throughout this pandemic. If you’d you like to know your precise service performance or need help, please contact us at [email protected]. Good luck!

*Data derived from nearly 10 million records from Shipware clients and compares the delivery date with original service commitment. Only shipments delivered after the due date were considered “late” in this analysis. Carrier service exceptions, SmartPost/SurePost packages and international shipments were excluded from our analysis.

Keith Myers is a Senior Consultant, Professional Services for Shipware, LLC, a San Diego based parcel consulting firm that specializes in cost reduction and recovery services. Prior to joining Shipware, Keith was a Senior Pricing Advisor at FedEx where he created and analyzed parcel and LTL pricing for high volume accounts (up to $100 million dollars). Keith has an MBA with certificate in Supply Chain Management from Northeastern University and a BS in Discrete Mathematics from Georgia Tech. He can be reached at [email protected] or 858-879-2020 Ext 136.

Article Topics

Latest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources