Global Labor Rates: China is no longer a low-cost country

With worldwide shortages and supply chain disruptions, companies have changed how they source and manufacture parts and finished products. The Reshoring Institute studied and compared global labor rates around the world—and what follows are the high-level results of a study comparing labor rates in 13 different countries.

The race to manufacture and source products in China started in the late 1990s and continued for two decades.

As China ascended to the World Trade Association in 2001, accessibility of this low-cost labor and low-cost operations country looked very attractive to global manufacturers, and many companies set up factories in China or began sourcing Chinese parts and products.

Over this period, Chinese manufacturing became more sophisticated, the quality of products improved dramatically, and Americans and Western Europeans were welcomed with open arms. China was the low-cost and best solution for manufacturing.

However, as China moved up the maturity curve, Chinese workers became more skilled, and manufacturing processes and machinery became more advanced. The Chinese economy strengthened, and nearly 150 million people were lifted out of poverty and into the Chinese middle class through employment in factories mostly in the eastern coastal areas of China. This was the Chinese Industrial Revolution on steroids, and as industrialization gained momentum, labor rates started to rise for Chinese workers.

Recognizing that labor rates in China have been on the rise for several years, the Reshoring Institute studied and compared global labor rates around the world. What follows are the high-level results of our newly published research study comparing labor rates in 13 different countries.

The countries, including the United States, were selected for comparison, based on where Reshoring Institute clients were relocating their manufacturing from or to. European companies such as those located in France and Germany, along with the United States, have been considering moving out of China to other low-cost countries.

Other companies are interested in bringing manufacturing home. While there are many more countries that could be considered, the research focused on this sampling as the most relevant for comparison.

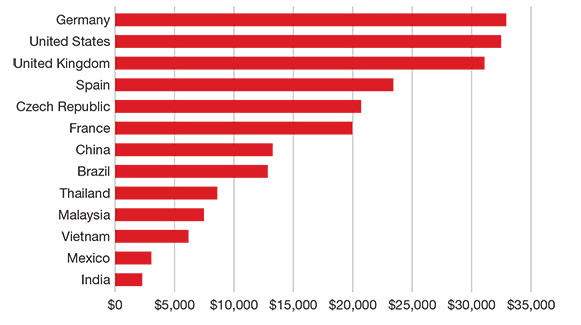

Average salaries of production workers/machine operators (world)

Source: The Reshoring Institute

The average annual salaries of production workers and machine operators in the 13 comparison countries including the United States.

China no longer low-cost

The Reshoring Institute team investigated how manufacturing wages have risen in China and what this means for companies going forward. Wages and salaries of production workers, machine operators, manufacturing supervisors, and managers were compared. The research concluded that China can no longer be considered a low-cost country, as its labor rates have significantly increased.

The lowest-cost countries in the study are now India, Mexico, and Vietnam. And while there are even lower-cost areas of the world, such as Myanmar, Bangladesh and Africa, the Reshoring Institute focused its study on where most manufacturers are moving to now, after leaving China.

How much labor is included in your product?

The production cost impact of rising wages depends on how much labor is required to manufacture a product.

If a product has high labor content as a percentage of its total cost, such as the production of athletic shoes or apparel, then choosing the lowest-cost labor country is very important to keep costs low. In other industries such as textiles and automotive, where automation greatly reduces the need for labor, more country locations may be considered.

Another important factor is the availability of labor in a country or region. As an example, take the production of cell phones. While the cost of labor content may be quite low compared with the retail price of the phone, the availability of thousands of workers to staff a production factory may be an issue.

In many world locations there simply aren’t enough workers to fill the jobs at mega-assembly operations. In the United States and Western European countries, worker shortages to fill existing positions have become a major problem, while in countries such as India, China, and Mexico labor is relatively plentiful.

Productivity rates are also important to compare. If a worker in China is paid $300 per month and one in Vietnam is paid $200 per month, it seems reasonable to consider moving to Vietnam until you compare productivity rates. Chinese workers with more experience and often better skills may work faster and with a low error rate as compared with Vietnamese workers. When all of these comparisons are taken into consideration, the decision to move may not be so attractive.

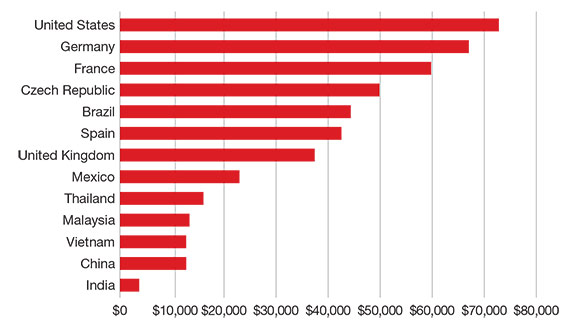

Average salaries in selected countries for production managers and supervisors

Considering management salaries

The research also considered the cost of management and supervisor salaries and wages. These salaries are typically a small portion of the overall labor costs, but they must be considered in a total cost of ownership (TCO) model.

Generic TCO models are readily available on the internet and can also be customized to fit a specific industry. Adding the labor costs plus supervisor and manager costs to the TCO model gives a clear picture for comparison of different countries.

The research found that when it comes to managers and supervisors, China is still at the low end of the comparative countries along with India and Vietnam. The prediction is that this will change in the near future, and place China closer to the middle of comparative countries.

Manufacturing coming back to America

Despite significantly higher labor rates in the United States, manufacturers are coming back to America. To be competitive in world markets and at home, U.S. manufacturers must automate production, reengineer processes to extract labor costs, and make manufacturing more efficient.

When comparing manufacturing in America versus other countries, you must consider the total cost of ownership and include all costs such as logistics, quality, proximity to markets, import duties and penalties, inventory carrying costs, and geopolitical risks. Clients at the Reshoring Institute are often surprised to find that when all costs are considered, American manufacturing can be very competitive.

The pandemic changed almost every aspect of life around the globe, including how and where we manufacture. With worldwide shortages and supply chain disruptions, companies have changed how they source and manufacture parts, sub-assemblies, and finished products. A major factor in these changes is how much manufacturing workers are paid.

Cost of labor just one dimension

In the late 1990s and early 2000s, the decision to manufacture in China was often one-dimensional—based on costs. But government policies, trade wars, and geopolitics have added new variables to the decision-making process.

The Tax Reform Act of 2017 lowered U.S. manufacturers’ tax rates to 21%—lower than the worldwide average manufacturer’s tax rate of 24%. The 301 China penalty tariffs on imports, along with the 232 tariffs on aluminum and steel made imports more expensive, supposedly giving U.S. manufacturers a competitive edge in pricing.

The pandemic introduced risk into the equation and this seemed to have the biggest impact of all, even though risk is nearly impossible to quantify in any economic model.

In addition, the geopolitical environment has increased risk significantly over the past few years. China’s saber-rattling over Taiwan, its draconian “Zero COVID” policy, and the Chinese government’s interference with manufacturers have given pause to foreign companies doing business in China.

Where to manufacture is complicated

Our study has revealed that where in the world to manufacture is a complicated decision and involves a comprehensive analysis of labor costs, productivity, geopolitics, risk, where customers are located, and how markets are growing.

With labor rates in China doubling over the past few years, companies are now considering moving back to America or to alternate low-cost countries. The research study shows that wages in China are now nearly comparable with those in some European countries leaving the lowest-cost manufacturing to India, Mexico and Vietnam.

With new funding and tax incentives now available through the Chips and Science Act, the Inflation Reduction Act, and the Build Back Better Infrastructure Act, reshoring and expanding operations in America have rapidly become popular and economic choices for American manufacturers.

Improved roads, ports, bridges, rail lines, and airports all contribute to the efficiency and viability of manufacturing. New investments in automation, mining, green energy, and STEM education hold the promise of the future of competitive manufacturing in America.

Article Topics

Global Trade News & Resources

UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. More Global TradeLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources