IMO-2020: The sky wasn’t falling

During the interim, shippers can expect ample capacity for moving product at rates not seen for quite some time.

Mark Twain said: “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Toward the end of 2019, many of the experts we spoke with were certain that the new IMO-2020 regulations taking effect on January 1 would significantly jack up the cost of fuel for marine operators with a ripple effect on domestic trucking and rail companies. The belief was that this would make an impact on shipping schedules and would inevitably drive up the cost of moving product.

Unforeseen events overtook us and turned all the rational thinking and logic upside down. The onset of the COVID-19 virus pandemic and the virtual shutdown of many parts of the economy altered the impact of the new rules, the cost of fuel and the volume of freight moving through global supply chains.

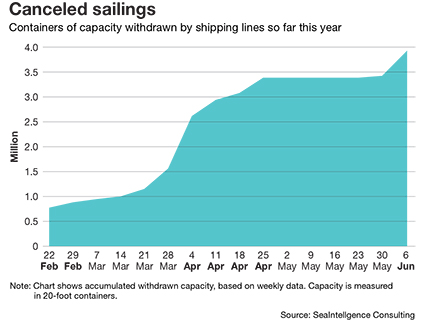

Additionally, refiners have been able to relatively seamlessly shift to producing compliant fuel, which improves availability. So, not only is there no shortage, but there’s a glut on the world market—and it’s only expected to get worse. Coupling this with the number of blanked sailings—upwards of 25% and four million containers worth of capacity—and the industry is awash in fuel at low prices.

Arab News reports record supplies have depressed the delivered very low sulfur fuel oil (VLSFO) bunker spot discount to record lows of about $45 per ton below benchmark gasoil prices and cut Asian refiners’ profits by nearly 80% from their record highs at the start of the year to $10.25 a barrel.

Arab News reports record supplies have depressed the delivered very low sulfur fuel oil (VLSFO) bunker spot discount to record lows of about $45 per ton below benchmark gasoil prices and cut Asian refiners’ profits by nearly 80% from their record highs at the start of the year to $10.25 a barrel.

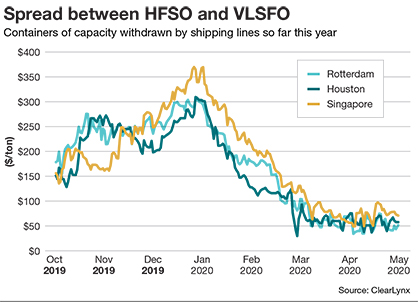

In the crowd-sourced service SeekingAlpha, Robert Boslego noted that in 2019 there were two theories as to why the VLSFO/heavy fuel oil (HFO) spread would remain high and scrubbers would be profitable: “Either HFO would stay the same and VLSFO pricing would surge, or alternatively, VLSFO would be on par with where HFO used to be—but the price of HFO would collapse due to a lack of demand.”

Neither one has proved correct. VLSFO did surge initially, but it fell back quickly and HFO has not collapsed. In fact, the VLSFO/HFO spread has collapsed, decimating scrubber savings. The spread dropped from $300 to $350 per ton to around $50 per ton. If you think about the break-even business case for scrubbers being about $100 per ton, this clearly dampens the economics for installing them.

Interestingly, the lessening of capacity among the ocean carriers and the recent rise in demand has driven freight prices up substantially. According to UK-based media outlet The Loadstar, spot rates have jumped more than $1,000 in the past month, despite the state of the economy: “The Shanghai Containerized Freight Index recorded a second massive spike of over 25% in three weeks to take the spot rate to $2,755 per 40 ft.—double the rate recorded by the index at this time last year.”

When we first reported on the impact of IMO-2020 at the end of 2019, there was an expectation that the surge in demand for low-sulfur and ultra-low-sulfur compliant fuel would spike and simultaneously affect the cost of North American domestic diesel consumed by trucking and railroad companies. Clearly, this has not occurred in much the same way the dire warnings and concern over Y2K evaporated.

This is further affected by nose-diving freight volumes, particularly in the truckload and rail sectors. One pronounced effect of the COVID-19 pandemic has been a dramatic surge in online shopping, shifting volume toward parcel shipments, which have galloped ahead largely at the expense of brick-and-mortar retailers who rely much more heavily on truckload carriers for inbound shipments.

This is further affected by nose-diving freight volumes, particularly in the truckload and rail sectors. One pronounced effect of the COVID-19 pandemic has been a dramatic surge in online shopping, shifting volume toward parcel shipments, which have galloped ahead largely at the expense of brick-and-mortar retailers who rely much more heavily on truckload carriers for inbound shipments.

Looking at DAT data as a proxy for what’s going on in the market, van rates and volumes have fallen and the load-to-truck ratio has nearly doubled since May, which indicates that recovery is not at hand yet.

While there appears to be much consumer frustration with all of the complications associated with COVID-19, from stay-at-home orders, closed stores and high unemployment, there’s also much pent-up demand, which we would assume will make its presence felt as the economy reopens. This will not happen quickly, and is likely to take quite a bit longer than anyone wants.

During the interim, shippers can expect ample capacity for moving product at rates not seen for quite some time. That makes this an excellent time to reevaluate shipper networks in terms of mode and carrier selection, with an eye toward improving supply chain performance.

Article Topics

Ocean Freight News & Resources

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications Expensive, lengthy delays expected before Port of Baltimore can re-open to vessels following Key Bridge collapse More Ocean FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources