Lift Truck Series: Narrow aisle trucks on the rise

As e-commerce exploded over the past year, so too did the need for narrow-aisle layouts and the trucks that can accommodate them.

The pandemic gave rise to many trends, perhaps the biggest of which was a focus on do-it-yourself home projects. From constructing new sheds to adding home gyms, building decks and more, people have used the past year to enhance their homes.

The pandemic gave rise to many trends, perhaps the biggest of which was a focus on do-it-yourself home projects. From constructing new sheds to adding home gyms, building decks and more, people have used the past year to enhance their homes.

Retailers who carry the materials for all those projects—like Home Depot, Lowes, and ACE Hardware—are dealing with the challenges of keeping up, including inside their distribution centers.

These companies, and others, are having to make the most of their current DC space utilization. Often, this means reconfiguring racks to incorporate narrow aisles.

“Customers with existing facility size restraints are forced to rethink their current layouts and processes, often leading them to re-imagine their racking footprint—narrowing the aisles and building taller shelves,” says Michael Brunnet, systems trucks project manager at Mitsubishi Logisnext Americas. “This allows them to store more product in the same space.”

Narrower aisles means narrow aisle lift trucks are on the rise. The Industrial Truck Association’s Class 2 includes a variety of electric lift trucks built for use in narrow aisles. At 12 feet wide, standard storage aisles allow a counterbalanced lift truck to turn in the aisle and put away a load.

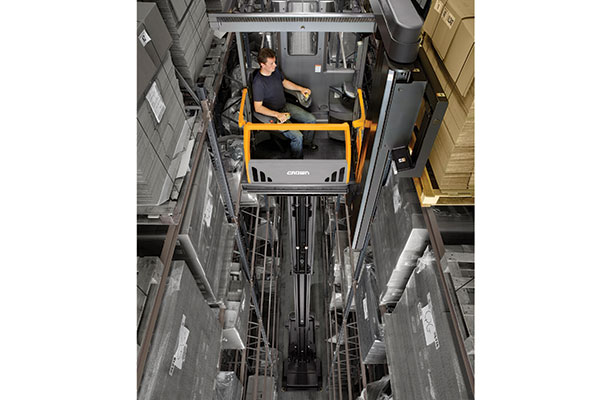

Narrow aisles are typically only 8 feet wide—and very narrow aisles are only 5.5 to 6 feet wide—requiring specialized lift trucks that can put away loads without turning or that are small enough to make tight turns. Three of the most common narrow aisle trucks are reach trucks, turret trucks and orderpickers.

“E-commerce growth was already well under way before the pandemic, affecting DC layouts,” says Chris Grote, marketing product manager at Crown Equipment. “But for many customers, the pandemic served to escalate e-commerce demands—if they weren’t thinking about how to support e-commerce before 2020, they are now.”

The growth in e-commerce DCs goes beyond home improvement retailers. As pandemic quarantines and shutdowns proliferated, a focus on home cooking emerged. And demand for food, especially frozen foods, skyrocketed, putting additional pressures on grocery stores. The early pandemic hording phase extended beyond food and included hand sanitizer, cleaning products, paper products and the like.

The same patterns held true for big e-commerce sites, like Amazon, Wayfair and retail/e-commerce players like Target and Walmart, as the pandemic increased online shopping by about 44% in 2020. As countries begin to emerge from the pandemic, these demands may ease, but in many cases, the trends are here to stay.

This all adds up to increased pressure on distribution centers to carry more and move product through their four walls faster and more efficiently. While leasing or building new, larger space might be a very outside option for some companies, for most, it’s impractical.

The pace and configuration of orders is evolving as a result. “The shift to smaller, more frequent orders is further transforming warehouse spaces with the need to maximize storage and enable easier access to inventory,” says Brunnet. “This, in turn, amplifies the need for efficient materials handling systems, equipment and technology that enables precise and efficient picking and navigation within the warehouse space. “

Essentially, says Jim Hess, director of warehouse business development for Yale Materials Handling Corp., companies are dealing with a combination of increased SKUs and needing more density within their DCs. “We’ve been focused on helping customers maximize their cube utilization,” he says. “Optimization involves moving racks closer together.”

This, in turn, means that the demand for a variety of narrow aisle lift trucks has never been higher. “Many DCs are moving on from the traditional layouts and turning to narrow aisle,” says Grote. “That means they need trucks that can meet their new configurations. In the last decade or so, there have been a lot of advancements in narrow aisle trucks that make that possible.”

As labor shortages continue, and the cost of that labor is often equated to a productivity killer, efficient narrow-aisle trucks are proving their added value. Doing more with less is often a goal in high-density, narrow aisle storage, and that’s what modern lift trucks provide.

With a focus on higher racks, narrower aisles and increased density, trends in this lift truck category include design and technology advances.

Design advances

Today’s narrow aisle trucks can reach heights well beyond earlier generations of trucks. At Crown, says Grote, stock pickers can go higher than 30 feet, reach trucks more than 40 feet, and turret trucks beyond 50 feet. “This was all out of bounds a decade ago,” he says. “Today it’s realistic, and it helps us provide better solutions for our customers.”

Narrow aisle trucks today are also able to lift heavier loads. Yale’s narrow aisle reach trucks can hit the 3,000- to 4,000-pound range, for instance. Raymond’s swing reach trucks offer comparable lifting capacities, as do Combilift’s AisleMaster series of trucks.

Today, narrow also means narrower. Standard racking aisles are generally in the range of 12 feet wide. Today’s narrow aisle configurations—and the width that narrow aisle trucks can manage—can go down to 5.5 feet. Today’s very narrow aisle trucks can manage that, which helps DCs increase density by as much as 50%. Their small frames and better maneuverability—especially the turret truck category—allow for improved stacking capabilities.

Along with reaching new heights and lifting capacities, the latest crop of narrow aisle trucks provides operators with more visibility. Yale’s newest narrow aisle reach truck features a wide mast opening that provides 33% better visibility. Increased visibility improves productivity and safety. Visibility cameras are becoming more common on trucks, too, upping the safety quotient.

Truck design comes with more than functionality in mind today, too. With labor in short supply, DCs look for all the ways they can recruit and retain employees. Narrow aisle trucks that come with ergonomics and comfort in mind can sometimes be selling points.

New features in this arena include things like touch displays, arm and back rests, and easy on/off in the case of stand-up trucks. Yale has recently added a suspended floor system, which amounts to less shock and vibration for the operator. “Every feature has the 21st Century operator in mind,” says Hess.

In the case of expensive cold storage, this means providing operators with warmth. Heated cabs that allow operators to remain on the job with fewer breaks are helping DCs keep up with demands.

Technology, robotics and more

According to Paul Short, president of Combilift North America, many customers are on the hunt for increased automation in conjunction with their narrow aisle trucks. “Automation is great, but we recommend optimizing configurations before automating,” he says.

That said, many technological advances are increasingly helpful when looking at narrow aisle trucks. “An increasing trend is the use of semi-automation,” says Brunnet. “We call this Warehouse Navigation, and it uses RFID transponders embedded in the floor to precisely identify aisle locations and distances.”

The result of a solution like this is that DCs have tools to calculate the fastest, most efficient route to rack locations. Brunnet estimates that about 40% of customers request the feature.

Demand for lithium-battery powered trucks is also on the rise. Short estimates that demand for lithium has increased from about 2% or 3% to 15% or 20% in the past couple of years, and for good reason. “Lithium gives you fast charge times and long run times,” he says, “and there’s zero battery maintenance required.”

Any features that minimize maintenance today are welcomed, too, as DCs have fewer man hours to dedicate to it. “We interviewed operators and maintenance staff to find out what they needed to be more productive,” says Hess. “They want ease of serviceability, improvements to access compartments, and ease of mast adjustments. Anything that can help to make the last hour as productive as the first.”

Autonomous trucks are also becoming more popular. “Automatic guided vehicles (AGVs) can help reduce operator costs by automating repetitive operations, which frees up operators’ time, allowing them to focus on more value-added tasks,” explains Brunnet. “The pandemic has accelerated demands as fewer workers are on the premises, missing shifts due to illness.”

Hess says Yale sees big interest in autonomous vehicles. “Most companies are looking to see if robotics are a good fit,” he says.

With a variety of racking and configurations, features and capacities, odds are most DCs work with a variety of narrow aisle trucks on their floors. This is what Crown sees, says Grote. “Rarely do we sell only one style of narrow aisle to a customer,” he explains. “Usually it’s a complement of narrow and very narrow aisle trucks to serve all their needs.”

The latest iterations of narrow aisle lift trucks bring plenty of bells and whistles to the table for increasing efficiencies in today’s high-density distribution centers. But all of the truck providers emphasize that trucks for trucks’ sake won’t get you where you need to be. Instead, relying on lift truck suppliers as partners in design and operations is critical.

“Our engineers work closely with customers to use their existing infrastructure for an optimal layout,” says Short. “We design the concepts, get them to the customers, and work from there.”

Article Topics

Warehouse News & Resources

2023 industrial big-box leasing activity heads down but remains on a steady path, notes CBRE report Supply Chain Management Software: Build the foundation, deliver the value Ryder opens up El Paso-based multi-client facility logistics facility Equipment batteries get a jolt April manufacturing output takes a step back after growing in March Show Review: Looking back at MODEX 2024 2024 Technology Roundtable: Tools to manage the new complexity More WarehouseLatest in Logistics

Key benefits of being an Amazon Business customer with Business Prime USPS cites continued progress in fiscal second quarter earnings despite recording another net loss U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR New Ryder analysis takes a close look at obstacles in converting to electric vehicles Norfolk Southern shareholders sign off on 10 board of directors nominees Between a Rock and a Hard Place Inflation and economic worries are among top supply chain concerns for SMBs More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources