Ocean Cargo: Stormy seas ahead for carriers

After posting another record year of profits, worldwide recessionary and inflationary pressures are now chipping away at ocean carrier fortunes. As far as rates are concerned, our analysts suggest that shippers and freight forwarders will be able to do a little window shopping this year.

Global ocean carriers reached the top of the bullish market in 2022 by realizing high profits largely due to tight capacity and exceptionally high container rates. In fact, analysts at Blue Alpha Capital project that the world’s biggest container lines are on course to post profits in 2022 that will top 2021’s record by 73%.

However, worldwide recessionary and inflationary pressures are now chipping away at these fortunes. “Recession now appears likely in Europe and North America—economies that account for half of global output,” says Rahul Kapoor, vice president at S&P Global Market Intelligence.

So, what factors will most affect ocean shipping as it enters these stormy seas? Spencer Shute, principal consultant at Proxima, identifies three trends: overall reduction in consumer demand; new ships adding additional capacity; and souring origin changes (off-shore vs near-shore or re-shore).

“All three factors are leading to reduced ocean rates, which are likely near bottom in most cases, and an increased need to partner with customers [shippers filling containers] to ensure equipment is appropriately positioned around the globe,” says Shute.

Container rates

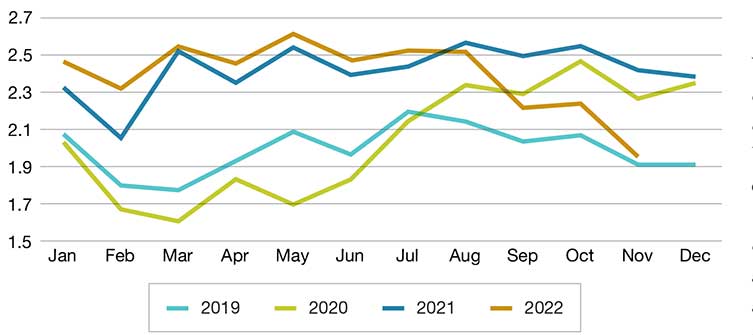

According to Freightos data, freight rates fell 21% to $2,607/forty-foot equivalent unit (FEU) in November, its lowest level since December 2020 due to slowing demand and decreased port congestion levels. Freightos notes, however, that while this rate is 72% lower than a year earlier, it’s still double its 2019 level.

While the continuing Russia war on Ukraine, skyrocketing fuel prices, and a dramatic slowdown in consumer spending are contributing factors, perhaps the biggest impact comes from China’s recent surge in COVID cases and its strict “zero-COVID” strategy.

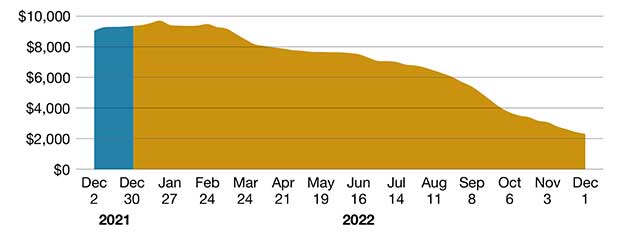

By the latter half of 2022, ocean rates began to plummet and continued to crash. HSBC Global Research reported that the cost of sending a container from Asia to the United States collapsed by nearly 90% in 2022.

“Suddenly, we saw a very heavy decrease in cargo demand,” says Stefan Verberckmoes, an analyst at Alphaliner. “Today, Chinese export freight rates are almost at the same level as pre-pandemic.”

Joe Monaghan, CEO and founder of Worldwide Logistics Group, expects trans-Pacific eastbound ocean rates to be fully restored to pre-pandemic levels within the second quarter of 2023. “They, ultimately, could reach 10-year lows by summer,” he adds.

To protect rate levels in 2023, Monaghan notes that carriers will need to be cautious with the capacity they put into trade lanes. “We may continue to see blank sailing schedules rather strong again,” he says. “With new vessels entering the market this year, this includes continuing to monitor capacity in specific trades to accommodate for the potential downfall in demand in 2023 and the further softening of rates going into the 2023-2024 contract season.”

Record number of ships on order

A potential red flag for container capacity is the large number of ships container lines have on order. For 2023, a record 2.5 million TEU of new containership deliveries is scheduled.

“On December 1, the order book was for about 7.5 million TEU, or 29% of the current fleet. That’s massive,” says Stefan Verberckmoes, an analyst at Alphaliner. “We don’t have a global economy that’s growing 20% to 30%.”

Drewry Supply China Advisors reports how, in late 2021, 1 million TEU of new capacity was scheduled to be delivered in 2022. “The capacity expansion could be up to 250% of what happened in 2022,” says Philip Damas, managing director at Drewry.

However, container lines are currently not seeking to add capacity. Verberckmoes attributes many new orders to carriers’ attempts to satisfy environmental regulations such as IMO 2023. “A lot of these ships are LNG, and some are already on methanol,” he says.

Plus, in January 2023, the International Maritime Organization introduced another set of regulations intended to reduce emissions of GHG from shipping: the Energy Efficiency Existing Ship Index and the Carbon Intensity Indicator.

To avoid a complete market meltdown, analysts predict that carriers will try to defer some of this huge additional capacity to 2024 and reduce capacity by cancelling sailings or by idling ships.

Container lines are also altering the types of vessels that they’re ordering. Rather than investing in large 24,000 TEU ships, orders are being placed for 13,000 TEU to 16,000 TEU neo-Panamax vessels and compact vessels of around 5,000 TEU to 10,000 TEUs.

Compact ships are wide and short, meaning they occupy less berth space at terminals. Neo-Panamax ships are very flexible and can be deployed on almost any route. Verberckmoes surmises that neo-Panamax ships will become the new workhorse.

Analysts predict significant market volatility disrupting container shipping industry this year. Philip Damas, managing director at Drewry Supply China Advisors, says that the consultancy expects ocean carriers to normalize operations and stop chasing spot markets. “They will realize intense price competition,” he says.

The trend of spot ocean freight rates already shows that such rates have fallen nearly as fast as they rose when the shipping boom started in mid-2020. Based on the Drewry World Container Index, average spot rates across eight major shipping routes have dropped by 75% on average through December 2022.

“Year-long, 2023 contract ocean rates will follow the sharp fall in spot rates,” Drewry predicts. “Lower supply-demand, lower fuel costs and lower capacity discipline among ocean carriers are all pointing to much lower ocean rates in 2023.”

Drewry experts calculate that spot ocean rates will continue to dive until the first quarter of 2023, at which time they will reach the break-even cost of carriers. “When this happens, ocean carriers will have to decide whether they engage in a price war—and suffer losses—or whether they pull capacity back and stabilize ocean rates,” Damas says.

In either scenario, Drewry expects contract rates to at least halve in 2023 on most routes. “The $10,000 ocean rates of 2021 to 2022 will soon be past history,” Damas adds.

Less port congestion

Also affecting capacity is the easing of seaport congestion. Last year, much capacity was tied up waiting to berth. In the United States, seaports on both the West Coast and East Coast faced the worst congestion ever since the age of containerization.

Today, Verberckmoes notes that almost all of the about 10 % of the global fleet that was blocked by port congestion is now sailing again.

According to Drewry’s port congestion report tracker, high-volume ports in North America have reduced the incidence of port congestion by about 75% since December 2021, but they have not yet brought congestion back to pre-pandemic levels.

“Less port congestion means both more reliable transportation operations, lower costs from delays and more productivity from ships—and therefore more effective shipping capacity,” says Damas.

World container index ($ per 40 foot container)

Better alignment of operations

One silver lining for shippers is that ocean container rates are finally coming down—and drastically. “We expect all of the pandemic gains [to container lines] to be given away and ocean shipping to become a shipper’s market again,” says Kapoor.

Now with ample capacity on both the vessel and container side of the business, Christian Roeloffs, co-founder and CEO of Container xChange, sees the high possibility of an all-out price war in 2023. “With the competitive dynamics in the container shipping and liner industry, I especially don’t expect the big players to hold back, and we do expect prices to come down to almost variable costs,” he says.

Drewry predicts carriers will try to restore the many damaged business relationships with manufacturers and retailers who suffered poor transportation service at high prices for nearly two years. Analysts there expect that with a lower supply-demand balance in shipping, manufacturers and retailers will regain bargaining power in 2023 and negotiate the return of more favorable contract terms that many enjoyed before the pandemic.

“Areas to focus on are capacity guarantees, ‘dead freight’ as well as demurrage penalties and payment terms,” says Damas. Drewry also sees a better alignment of ocean shipping operations and inland flow planning at origin in Asia—now called “origin management.” “This should once again become possible, now that ocean shipping is becoming more reliable,” he says.

U.S. container import volume (TEUs, millions)

Monaghan adds: “We fully expect [our customers] to ask for fixed rates again to get stability, even if it means the rate is higher than the current spot market. They don’t want to go back to paying $20,000 for a container. The priority is on the ability to plan.”

With a significant oversupply of containers and a further influx of more TEUs in 2023, Container xChange expects shipping lines to continue to reduce vessel capacity and suspend services by introducing considerable blank sailings. Maersk, for one, has already indicated that it will continue “to make capacity adjustments on services from Asia to North America, Europe and the Mediterranean to better align with demand fluctuations.”

“In order to address demand reduction, ocean carriers commonly return to blank sails to reduce capacity available on ships,” says Shute. “In addition to blank sailings, ocean carriers have looked at reducing delivery speed by using slower sailings.”

Roeloffs even foresees market consolidation initially starting with carriers defaulting and reducing their fleet. “Recently, there was news about China United Lines, an emerging carrier on trans-Pacific and Asia-Europe services, being at risk of defaulting on a charterparty involving more than 10 containerships,” he says.

Monaghan predicts that it would not be shocking to see at least one of the top 10 global ocean carriers disappear, likely through merger or acquisition.

The chartering business is particularly feeling the impact of these economic times. Verberckmoes points out that most non-vessel owning charter services that came into the business during the boom—the so-called newcomers—are now out of business. Further, Costco reserved $93 million in the third quarter of 2022 to pay as a compensation for the early termination of seven chartered ships, which were fixed at the height of pandemic congestion.

“The decrease in rates and cargo volumes came much faster than we expected,” says Verberckmoes. “And if you look to the future, fuel capacity is really worrying. Carriers will need to use all their available tools to be disciplined.” This includes managing capacity with blank sailings and closed loops.

Key takeaways

What can shippers learn from the ocean carrier industry this year? For one, they can finally plan their supply chains based on steady and less disrupted ocean transportation operations.

“They should demand from ocean carriers a return to clear service levels and a better monitoring of performance and delays,” advises Damas. “This year should be a buyer’s market and present opportunities to bring ocean contract prices close to pre-pandemic prices. Shippers should spend time getting insight into target rates for 2023 contracts to maximize savings.”

In fact, this year, shippers and freight forwarders will be able to go window shopping. “There’s going to be a lot of room for negotiation, especially in the early parts of the year,” says Roeloffs. “Contract rates will follow suit as spot rates fall significantly.”

However, global re-alignment as a result of supply chain constraints will be the biggest unknown for ocean carriers. “Many companies, particularly small- and medium-sized enterprises, are evaluating their current supply chain strategies and evaluating which models reduce risk as a whole,” adds Shute.

While experts anticipate more efforts toward diversification of supply chain sourcing and manufacturing away from home, many see this as a long-term view that requires vision and strategy from companies looking for a more resilient supply chain. Meanwhile, Roeloffs expects more increased container volumes intra-Asia and more countries will emerge as potential alternatives like Vietnam and India.

Article Topics

Ocean Freight News & Resources

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications Expensive, lengthy delays expected before Port of Baltimore can re-open to vessels following Key Bridge collapse More Ocean FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources