Ocean Carriers: Service levels jump in wake of alliances

Figuring out appropriate freight movements on the high seas has always been a bit of a chess match for global shippers. And as readers of Logistics Management have learned over the past year, the game could get even more complicated as shippers try to make sense of quickly shifting ocean carrier alliances and partnerships.

Latest Logistics News

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore More Ocean FreightAs executive editor Patrick Burnson has been covering, the ocean carrier race toward consolidation began earlier in 2016 with the announcement of the 2M Alliance, comprising Denmark’s Maersk Line, the shipping unit of A.P. Moller-Maersk A/S, and Geneva-based MSC. Together, they dominate the Asia-EU trade lanes, with almost 35% of market share.

Following the formation of the 2M came the grouping known as the Ocean Alliance that brought together France’s CMA CGM SA and China’s COSCO Group. Tagging along with these two powerhouses were Hong Kong’s Orient Overseas Container Line and Taiwan’s Evergreen Marine Corp. Once the Ocean Alliance begins operations next February, analysts believe that it will control about 26% of Asia-EU share.

According to Burnson’s reporting, there will be more ocean carrier agreements and partnerships being formed over the coming year as the market aims to cure its long-documented financial malaise and justify the current glut of capacity. However, this could be a good thing for ocean shippers, as their carrier partners work feverishly to keep service levels high and costs competitive.

“Shippers have generally supported cooperation through consortia and vessel-sharing agreements as the appropriate means of rationalizing costs, provided that they themselves receive a share of the benefits in terms of enhanced quality and a wider range of services made available to customers,” Chris Welsh, secretary general of the Global Shippers’ Forum recently told LM’s Burnson.

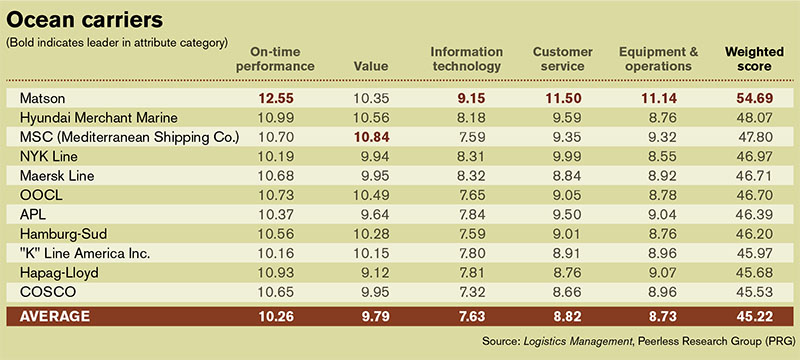

As shippers wait to see what new alliances are formed, we can rest assured that the 11 ocean carriers walking away with Quest for Quality gold in 2016 will be setting their sites on keeping service levels at an all-time high. In fact, we saw the weighted average in the category jump a full two points this year, signaling that LM readers witnessed a significant increase in service.

Pulling in with top weighted score this year we find Matson Navigation with an impressive 54.69. Matson lead the way in On-time Performance (12.55), Information Technology (9.15), Customer Service (11.50), and Equipment & Operations (11.14). Putting up top marks in Value this year is MSC with a 10.84.

2016 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL | OCEAN CARRIERS | PORTS | 3PL | AIR CARRIERS and FREIGHT FORWARDERS |  home page |

Article Topics

Ocean Freight News & Resources

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications Expensive, lengthy delays expected before Port of Baltimore can re-open to vessels following Key Bridge collapse More Ocean FreightLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources