Ocean Carriers Top 30: Tough year on the high seas

Will the historic downfall of one major carrier provide a lesson for other Tier 1 competitors? As maritime analysts share their insights and forecasts of the ocean carrier market for 2017, they contend that this could be the year of reckoning for some.

Latest Logistics News

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore More Ocean FreightThe poor handling of Hanjin Shipping's collapse has done irreparable damage to the Korean carrier’s reputation, and it’s improbable that the carrier can be revived, say industry analysts.

According to the Paris-based consultancy Alphaliner, even the Seoul district court’s approval for rehabilitation granted last month will not be enough to rescue Hanjin. Furthermore, a merger with Hyundai Merchant Marine (HMM), or any potential “white knight,” can also be ruled out, given its financially encumbered status.

With HMM, backed by the Korean Development Bank (KDB), now looking at the acquisition of Hanjin’s “profitable” assets, a liquidation of Hanjin Shipping appears to be the most likely outcome. “It’s clear that the rapid disintegration of the company sent shock waves across the liner market,” says Alphaliner analyst Ashe Marson.

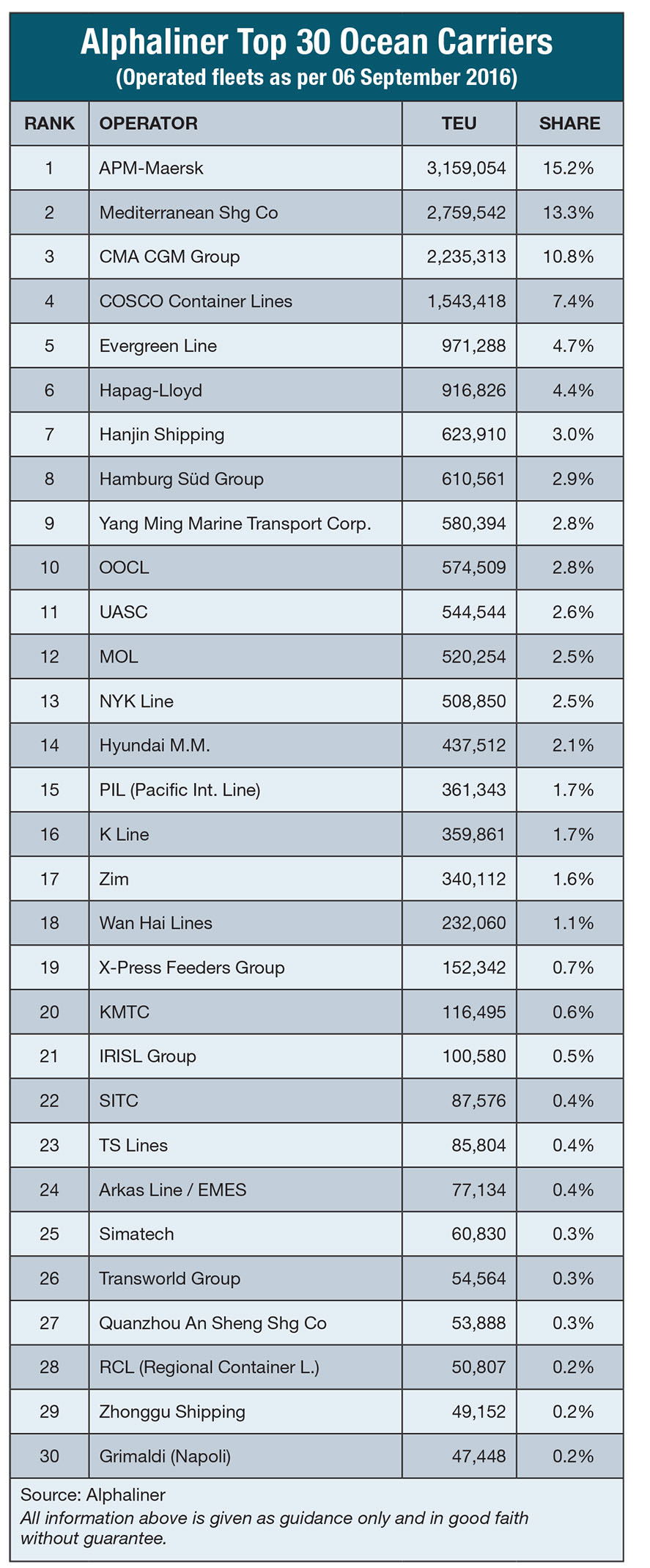

In the wake of the news, carriers and shippers are scrambling to take contingency measures to fill the void left by Hanjin Shipping, which held a global market share of just under 3%.

According to Alphaliner, the carrier’s departure is expected to be felt the most on the trans-Pacific and Asia-Europe routes, where the shipping line had capacity shares of 6.7% and 4.9%, respectively.

“Responsibility for the fallout must be jointly borne by Hanjin Shipping’s creditors and by the Hanjin Group, who continued to wrangle over sharing the cost of a financial restructuring until the very last minute, and who were unprepared to deal with the consequences of the insolvency proceedings,” adds Marson.

Alliance fallout

Arguably, shippers that use the CKYHE Alliance are feeling the most significant effect from the colossal failure. The group now consists of remaining partners Cosco Container Lines, “K” Line, Yang Ming Line, and Evergreen Line.

While the CKYHE Alliance will cease to operate in 2017 as a result of consolidation in the container shipping industry, Hanjin’s abrupt collapse leaves its members scurrying for solutions during peak season. Further complicating this situation are the rumors that “K” Line may soon be acquired by an investment fund before the year is out.

Evergreen Line, meanwhile, has added new functions to its on-line e-commerce system in response to the unexpected service disruption, which caused delay to its cargoes previously loaded on the Korean carrier’s vessels. Evergreen’s new functions enable shippers to update the status of their cargoes and Hanjin’s vessel positions, including information about anchorage at or sailing to a particular port.

“Besides, Evergreen has developed detailed service plans within its own network as a substitute to cover the affected services operated by Hanjin,” says Nicola Good, an analyst with IHS Global Insight.

Meanwhile, spot container freight rates on the major routes from Asia soared by up to 42% last month following the collapse of Hanjin Shipping, according to data from the World Container Index (WCI). “Unpredictable freight rates are not a new phenomenon in the container industry, however a major upheaval of supply like this is likely to cause extreme short-term price volatility,” says Richard Heath, general manager of WCI. “Shippers should expect increasing freight costs and tight allocation for several weeks at least.”

Writing on the wall

The news of Hanjin’s demise did not come as a surprise to all, however. Indeed, many industry experts had been predicting a major carrier failure for some time now.

Sanne Manders, a chief analyst with Boston Consulting Group before joining the forwarding firm Flexport, says that his company had told shippers to stop booking on Hanjin months before its collapse. “The writing was on the wall, so we were able to soften the impact,” he says. “Hanjin’s monthly reports on profits showed that the carrier was unsustainable, so we counseled our shippers to find alternatives outside of the CKYHE Alliance.”

Manders adds that as a consequence, alliance members will pay closer attention to the financial health of their partners while concentrating on specific trade lane deployments for their own vessel strings. According to Andrew Lubin, an international business professor at Rosemont College, the global implications should be a major concern for logistics managers. “Hanjin Shipping’s receivership and bankruptcy filing suddenly exposed how fragile the world of shipping alliances and just-in-time supply chain management is these days,” he says.

Global shipping giant Maersk “upped the ante” by being the first to launch new generations of mega-vessels, says Lubin, thereby starting a competitive frenzy for ever larger ships. “At the same time, a severe decline in ocean freight rates resulted in three years of losses estimated in the $16 billion range,” he says. “With the majority of the carriers—except Maersk and Hapag-Lloyd—not offering financial results, one must look at the forced Cosco-CSCL merger, the Zim restructuring, or the rapidly-arranged Hapag-UASC merger to understand the severity of the losses.”

Shippers aren’t entirely blameless for this situation, either, maintains Lubin. In fact, they may bear substantial responsibility. “Despite years of claiming reliability was more important than price, Maersk was forced to abandon their ‘daily Maersk’ service as the vessel’s utilization rates were at best anemic. Shippers have pursued the cheapest rate for far tool long.”

Policing carriers

For the time being, however, global shippers are earnestly seeking protection from regulatory watchdogs worldwide, such as the Federal Maritime Commission (FMC). According to FMC chairman Mario Cordero, the commission is keeping a vigilant eye on all of this, and assures shippers that it will not put up with any “illegal behavior.”

“We’ve established a protocol for communicating requests for assistance to the agency concerning developments related to the status of Hanjin Shipping,” adds Cordero. “Allegations of Shipping Act violations or requests for assistance related to retrieving or receiving cargo in transit are being taken seriously by the Commission.”

Over the long term, carriers may be policing themselves as well, says the Baltic International Maritime Council (BIMCO) in Copenhagen. According to Peter Sand, BIMCO’s chief analyst, contract orders for new-build vessels at shipyards around the world have taken a dramatic dive.

“The shipyards will become the next victim of the deteriorating conditions in container markets as 2016 looks to set the record for the lowest new-building contracts in more than 20 years,” says Sand.

Article Topics

Ocean Freight News & Resources

Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications Expensive, lengthy delays expected before Port of Baltimore can re-open to vessels following Key Bridge collapse More Ocean FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources