Outlook for Warehousing Market Remains Positive

With the e-commerce boom during the pandemic, there’s very little available warehouse/DC space—consequently, developers continue to build at a bullish pace.

Few industries have faced more challenges this year than what’s currently facing the supply chain. However, warehouse and distribution real estate markets have remained resilient, and, in fact, are now thriving.

While shelter-in-place orders challenged warehouse operations, particularly those in automotive parts and industrial supplies, distribution centers (DCs) handling goods for personal consumption have seen business escalate. “I’d be naïve to say that this isn’t tied to the economy and personal consumption, because it is,” says Steve Schnur, COO of Duke Realty, a specialist in e-commerce and distribution locations.

“What we’re hearing overall is that industrial and logistics real estate is performing significantly better than other real estate sectors given the severity of the pandemic,” says Nick Kittredge, president of the east region for Prologis. In fact, the industry was already seeing vacancy rates at a low 4.5% when the country began experiencing the impact of COVID-19 and shelter-in-place—a significant figure when you keep in mind that the historical average is 7.5% vacancy.

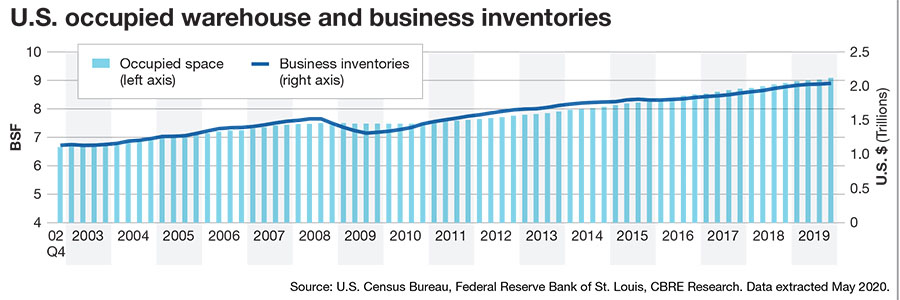

Bottom line: There’s very little available warehouse/DC space. As a result, developers remain bullish and continue to build new facilities given short- and long-term demand resulting in a need to stockpile more new square footage.

Bottom line: There’s very little available warehouse/DC space. As a result, developers remain bullish and continue to build new facilities given short- and long-term demand resulting in a need to stockpile more new square footage.

Market leaders

Commercial real estate firm CBRE reports that at the end of the first quarter of 2020, a record 315 million square feet (msf) of warehousing space was under construction around the United States. “This number dipped to 298 msf in April, as some projects were delayed because of quarantine,” says James Breeze, senior director and global head of industrial and logistics research at CBRE.

However, as the country reopened, so did construction sites, with projects under construction increasing to 313 msf in May, of which 104 msf (33.2%)

was already committed. The West Coast of the United States has the most warehousing space under construction at 93.4 msf, with the Inland Empire leading the pack with 29 msf under construction.

“The main reason that region leads is a significant increase in development in Phoenix, Las Vegas, Denver and Salt Lake City,” Breeze points out. “All of these markets have over 5 msf under construction.” CBRE finds that the Southeast has the second highest amount of warehouse space under construction at 68.1 msf, but the region also has the most pre-leasing, with 45% of that 68 msf already taken. “Because of solid pre-leasing, development will have little effect on vacancy rates in the coming quarters,” says Breeze, adding that the Northeast and South Central regions of the country have significantly less inventory than the West, Midwest, and Southeast regions.

“In terms of size range, we’re seeing higher demand for larger facilities compared with smaller light industrial facilities, but we were pleased with the activity in smaller light industrial in May,” says Kittredge, adding that Prologis finds Northern New Jersey markets posting overall vacancies less than 2%. “The situation is extremely tight in that region, and the same is currently true in the Toronto region.”

Given the economic hardships industries outside of distribution are facing, Kittredge suggests that there may be opportunities to sub-lease space where there was not before. “COVID-19 has created additional demand for some segments, but others will take a while to get back to where they were prior to the pandemic,” he says.

Possible new, hot markets once we get past the pandemic could be Houston and Florida. “Houston has had issues going into the pandemic because of its energy/oil-related economy,” says Schnur. “Florida’s situation will be short term. So much of its economy is tied to travel and tourism, which should bounce back once the pandemic subsides.”

However, many DCs in Florida serve small tenants with space that also includes office, showroom, and contractor space—much of which was closed during shelter-in-place. They’re not like large companies like Target, Walmart and Amazon that have big lines of credit and, therefore, can more easily weather the pandemic storm.

E-commerce surge

On a positive note, experts point to three factors driving DC development today: e-commerce, reverse logistics (returns), and inventory increases. Changing consumption patterns, particularly among seniors, are giving e-commerce a major boost, largely because people have been unable to circulate.

“Seniors typically shopped in stores, but during COVID-19 turned to e-commerce for their goods,” says Joel Bergstein, president of Lincoln Equities Group (LEG), a full-service real estate company. “They’ll probably continue to do so, having appreciated the convenience of receiving packages at their doorsteps.”

As a result of shelter-in-place, revenue at Amazon is up 27% for the first quarter of 2020; Walmart’s online sales skyrocketed by 74% for the quarter; and Target’s digital channel sales surged 141% during that same time. “These are crazy figures,” adds Schnur.

This multi-story 200,000 sq. ft. warehouse in the Bronx, NY owned by Prologis was recently leased by Amazon. Courtesy of Prologis.

This surge in online shopping has created an environment where proximity to consumers is increasingly important. “Our fundamental investment in having properties within striking distance to major population centers has been accentuated,” say Kittredge says.

Consequently, e-commerce providers and third-party logistics (3PLs) providers—including the likes of UPS, FedEx and USPS—are running overtime schedules to accommodate demand. Prior to COVID-19, Amazon had set a gold standard of next-day and even same-day deliveries to which many DCs were trying to adhere.

When shelter-in-place escalated in March, shortages of product and drivers pushed delivery times to days, even months. According to Duke Realty’s Schnur: “Amazon’s brand is ‘find anything you want and get it very quickly.’ That motto was lost during the pandemic, when consumers faced shortages and delivery times changed dramatically.”

Much was exacerbated by stoppages of cargo flows, especially coming from China. This has put pressure on the need for what has become deemed “safety stock” as opposed to running a warehouse in a just-in-time (JIT) scenario.

“I don’t think demand for e-commerce and last-mile deliveries will take inventories back to zero post-pandemic,” says Bergstein. “At some point, demand will require the development of more warehousing product. Amazon and others involved in e-commerce are already gobbling up space in the Northeast at a high rate.”

And overall, experts contend that there will be a return to onshore or nearshore manufacturing of many products, particularly pharmaceuticals. “I don’t think we want to be so dependent on China in the long term,” remarks Schnur.

Continued challenges

Industry experts note how shelter-in-place put big demands on home-delivered pharmaceuticals, groceries and meal kits. “Consumption patterns have changed because people are unable to circulate and purchase their basic daily needs,” says Kittredge of Prologis.

According to a recent Prologis report, e-fulfilment operations accounted for nearly 40% of new leasing in March and April. “I feel strongly that the trend in e-commerce shopping will remain and is driven by new adoption by people who, historically, didn’t buy online,” says Kittredge. Consequently, Prologis is constructing buildings that provide the highest degree of flexibility for customers to fully utilize space and automation.

For the near term, those in the industry see online grocery shopping and e-commerce overall being a market driver for warehousing and distribution space since existing physical retail infrastructure isn’t designed for online grocery delivery or e-commerce fulfillment. “It’s a mismatch, and we’re in the first inning of figuring this out,” Kittredge says.

The Prologis report found growth for refrigerated warehouses around 150,000 sq. ft. in size in both urban and suburban areas where deliveries are challenging. “Those can be juxtaposed in a market like the Meadowlands in Northern New Jersey or the Bronx in New York, or even the Lehigh Valley in Pennsylvania, 90 minutes away where you might see a regional DC anywhere from 500,000 msf to 1 msf in size,” Kittredge says.

Such DCs, Kittredge adds, will be designed to accommodate higher SKU volumes and automation to increase turnover. In other words, instead of sending an Instacart shopper to an existing grocery store to fulfill an online order, consumers will receive their shipments from a DC designed specifically for that purpose.

Market outlook

Overall, industry experts view long-term prospects for the DC/warehousing market as positive. Bergstein reveals that LEG is receiving requests from clients for projects around 3 msf in size. “We’re getting phone calls from brokers and users wanting to know how fast we can get buildings built,” he says.

And again, the primary reason for the long-term outlook is e-commerce. “Even before COVID we were expecting e-commerce as a percent of retail sales to rise steadily in the next decade, but with the pandemic, we believe that this will happen at a more robust pace,” says CBRE’s Breeze.

Consumers, especially those in urban and suburban areas have become accustomed to one-day, same-day and two-day delivery. “They don’t want to wait a week for their shipment,” states Bergstein.

Rendering of a Lincoln Equities Group (LEG) 195,000 square foot warehouse/DC facility in Hicksville, Long Island, NY. Built on 9 acres, the facility will serve as a last-mile DC to logistics and e-commerce retailers. Courtesy of Webb Malcomb.

Consequently, hyper-local fulfillment is emerging as a remedy, but now without its own set of challenges. While consumers want their goods fast, they don’t want last-mile DCs—which average 10,000- to 50,000-square-feet—in their neighborhoods. There are also issues regarding zoning and increased traffic. “The challenge,” says Bergstein, “is how close can DCs ultimately get to the end user?”

One solution is to utilize already existing retail stores that are vacant because store vacancies in New York City are especially at an all-time high. “These could serve as a DC or a hub center,” Bergstein suggests. “Here a truck could drop off larger packages, which, in turn, could be broken down and delivered to end users by bicycles with carriage behind.”

The fact there remains a lack of available facility space in many markets, especially infill markets. CBRE’s Breeze finds growing interest in facilities that have not yet hit the market, particularly spaces occupied by retailers who have filed for bankruptcy. “Many occupiers are calling landlords communicating their interest in occupying these spaces before they hit the market,” he says.

Article Topics

Warehouse News & Resources

The Ultimate WMS Checklist: Find the Perfect Fit 40th Annual Salary Survey: Salary and satisfaction up Data Capture: Bar coding’s new companions Salary Survey: Pay, satisfaction, youth on the rise Examining the impact of the Taiwan earthquake on global supply chain operations Reverse Logistics: Best Practices for Efficient Distribution Center Returns Exploring Customized Forklift Solutions More WarehouseLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources