Quarterly Air Cargo Update: Confidence on a Steady Climb

While the continued growth of air cargo demand is consistent with an improvement in world trade, analysts now contend that the pressure is on the market to improve its value proposition by accelerating process modernization and enhancing customer service.

Signs that the fortunes for air cargo providers have really been reversed were evident when The International Air Transport Association (IATA) released data for global air cargo markets last month. Indeed, the latest data shows that demand grew 12.7% in May 2017 compared to the same period a year ago.

That number was up from the 8.7% annual growth recorded in April 2017 and is more than three times higher than the five-year average growth rate of 3.8%. Furthermore, cargo capacity grew by 5.2% year-over-year in May 2017.

The continued growth of air cargo demand is consistent with an improvement in world trade. This, in turn, corresponds with new global export orders remaining close to a six-year high this past spring.

However, there are some signs that the cyclical growth period may have reached its apex. The global inventory-to-sales ratio, for example, has started rising. This indicates that the period when companies look to re-stock inventories quickly—a period that often gives air cargo a boost—has ended. Irrespective of these developments, the outlook for air cargo is optimistic, with demand expected to grow at a robust rate of 8% during the third quarter of 2017.

“May was another good month for air cargo,” says Alexandre de Juniac, IATA’s director general and CEO. “Demand growth accelerated, bolstered by strong export orders, and outpaced capacity growth, which should be positive for yields; however, the industry can’t afford to rest on its laurels.”

Lest logistics managers become too complacent about this growth, de Juniac cautions a measured approach to bookings for the rest of the year. “With indications that the cyclical growth period may have peaked, the onus is on the industry to improve its value proposition by accelerating process modernization and enhancing customer-centricity,” he adds.

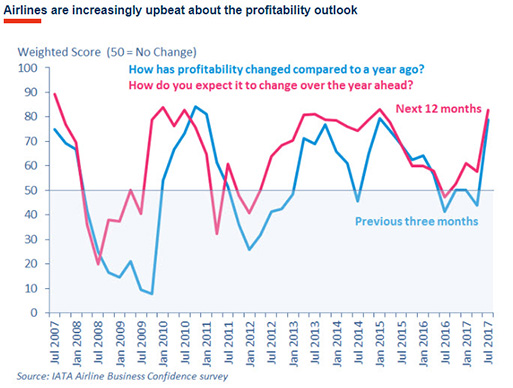

Data says confidence is high

While IATA statistics trail the current situation by several months, they nevertheless offer a window into the confidence of the air cargo industry, note analysts for Transport Intelligence (Ti), a London-based think tank. According to the consultancy’s “Logistics Confidence Index,” airfreight expectations jumped higher in June.

“Growing cross-border e-commerce demand is one reason that airfreight growth is on the up,” observes John Manners-Bell, CEO of Ti. “Though interestingly, it appears to not have stimulated large increases in express air cargo. It is suggested that this is because most e-commerce finds the regular speed of air cargo sufficient, and e-commerce is not just a matter of flying small individual parcels across the world.”

“Growing cross-border e-commerce demand is one reason that airfreight growth is on the up,” observes John Manners-Bell, CEO of Ti. “Though interestingly, it appears to not have stimulated large increases in express air cargo. It is suggested that this is because most e-commerce finds the regular speed of air cargo sufficient, and e-commerce is not just a matter of flying small individual parcels across the world.”

In addition, increasing consumer demand in general—electronics in particular—may be another factor, driven by higher purchasing power, especially in Asian markets.

IATA’s Air Freight Index registered a month-on-month rise of 3.1 points to 56.9 for June 2017. While this score reflected a year-on-year improvement of 6.5 points, it stood 2.7 points below the June 2015 total.

The Air Freight Logistics Situation Index, also compiled by IATA, noted a month-on-month improvement of 1.5 points to 55.0, growth that was lead by the U.S. to Europe lane, which rose by 3.1 points to 51.3. Nonetheless, both the Asia to Europe (up 1.6 points to 59.0) and Europe to United States (up 1.4 points to 51.1) lanes grew enough to offset the Europe to Asia lane, which declined 0.3 points to 56.9.

The performance of IATA’s Air Freight Logistics Expectations Index can perhaps be described as a “June boom,” add analysts. Cargo volume figures released by the Association of Asia Pacific Airlines (AAPA) confirm these observations, suggesting that business conditions continued to improve across Asian economies, in turn lending support to international trade activity.

“The broad-based expansion in global economic activity, coupled with renewed demand on selected routes, particularly between Europe and Asia, has contributed to growth in long-haul markets in recent months,” says Andrew Herdman, director general of the AAPA. Within the same period, Asian airlines recorded a solid 9.5% increase in air cargo demand, supported by a pick-up in export orders across the region’s economies.

“For the next 20 years, the Airbus’ ‘Global Market Forecast’ predicts a 4.4% global annual air traffic growth, despite some downward revision of future economic growth by a number of forecasters in several regions of the world,” says Leahy.And over the long term, it may only get better, says John Leahy, chief operating officer for Airbus. He maintains that air traffic continues to prove its resilience to slow economic growth by outperforming global GDP, demonstrating the world’s appreciation of the benefits aviation brings.

Raising rates

While air cargo volumes have increased, margins remain depressed for many air cargo middlemen, says Brandon Fried, executive director of the AirForwarders Association (AfA).

“Most of our members are looking forward to opportunities in which profitability may improve,” says Fried. “One influencing factor to consider is the growth of capacity we’ve seen over the past couple of years, keeping pricing at lower levels. This increase in space is attributable to the large amount of new and efficient wide-body aircraft, each with generous belly space flying the popular trade lanes.”

Another significant factor inhibiting this growth, says Friedman, is that in many cases there may be lower shipper pricing agreements that no longer reflect today’s market conditions. “Once these contracts expire, prices and margin should improve overall,” he adds. “However, new transport pricing agreements alone will not assure increased profitability, and this is why forwarders must be searching for more operational efficiencies that only technology can provide. People still play a crucial role in our business, but technology will help them work smarter, says Fried.”

Indeed, air cargo rates are seeing upward momentum, according to the “2017 Market Update” report recently issued by San Francisco-based freight forwarding and Customs brokerage services provider Flexport.

Looking at the global air cargo market, the report stressed that there is no “slack season” for air cargo this year, especially from Asia to North America—a trade lane that is now the strongest it has been in the last seven years. “A generational shift is coming to the air cargo industry,” says Flexport founder and CEO Ryan Petersen, who notes that airlines are poised to bring freight consolidation in-house.

“By optimizing for weight and volume at the plane level through dynamic real-time pricing, air cargo carriers will increase both their per-plane cargo yields and profit margins,” say Petersen. He observes that up until recently, air cargo consolidation has been dominated by specialists and middlemen with a simple business model—buy space from airlines and sell it at a markup to shippers.

“Today, the consolidators can improve margins by consolidating multiple shipper’s cargo in a single order, charging shippers with dense cargo by weight, and those with voluminous cargo by size,” says Petersen. The result of this volumetric mixing is called “free margin,” which he maintains are the two favorite words of every master consolidator.

“By embracing master consolidators and the third-party consolidation market, airlines have outsourced their risk, but they’ve also outsourced their margins,” adds Petersen. “The advent of real-time dynamic pricing for airfreight sold through digital marketplaces will allow airlines to aggregate cargo at the plane-level instead of the pallet-level.”

Michael Bentley, a partner at the management consulting firm Revenue Analytics, agrees with both Fried and Petersen that air cargo shippers can profit by this disruption. “We’re now entering a new era of optimization,” he says. “Logistics managers have not had this much room to operate for quite some time, and many of them will return to air cargo options as part of a sustainable strategy.”

Infrastructure advances

Working together with any sustainable strategy is air cargo infrastructure, add other industry analysts. Seth Lehman, senior director with Fitch Ratings, says that despite “a lack of clarity” around the Trump administration’s plans for beefing up infrastructure spending, the current state of air cargo airports looks healthy.

“Large-hub airports are still the strongest performers in the aggregate, though smaller regional airports are now showing stronger performance as well,” says Lehman.

In its midyear outlook report, Fitch also notes that growth in passenger traffic at U.S. airports remains solid, though it will level off somewhat in the coming months.

“By and large, U.S. airports have not seen broad growth in their cargo operations, with mail and freight cargo volatility and uneven performance,” says Lehman. “However, since the recession period of 2009 to 2010, Miami’s overall cargo has grown approximately 30%, while smaller Richmond Capital Region airport in Virginia has grown by a robust 48%.”

The biggest story of the season, however, revolves around Amazon Prime’s investment in its own infrastructure. In an unprecedented move, the behemoth retailer and visionary logistics provider has recently invested in a new centralized air hub at the Cincinnati/Northern Kentucky Airport (CVG), promising to meet growing demand from Amazon Prime members.

Last year, Amazon entered into agreements with two carriers to lease 40 dedicated cargo airplanes to support Prime members with fast, free shipping. Today, 16 of those planes are in service for Amazon customers with more planes rolling out over time. Amazon’s Prime Air hub at CVG will support Amazon’s dedicated fleet of Prime Air cargo planes by loading, unloading and sorting packages.

And how does the air cargo “establishment” feel about all this? “Forwarders may regard Amazon’s air fleet acquisition as a market threat or opportunity,” says AfA’s Fried. “But rest assured, their flights have become an intriguing curiosity within the logistics industry.”

Fried adds that it’s too early to determine how Amazon will address the traditional air fleet challenges of light dimensional loads, directional imbalances and use of high-cost transportation to ship relatively low-value commodities. “As an opportunity, perhaps forwarders can provide some relief to Amazon through partnering to fill space on some of those flights,” he concludes.

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources