Risk Management: Investment in tech takes off

The supply chain took center stage during the pandemic, and now 64% of shippers are evaluating or implementing supply chain risk event monitoring tools and 73% are doing the same with supply chain visibility and multi-tier mapping applications.

Companies that built their business models around reducing costs and running “lean” are rethinking their approaches and focusing more on managing risk and building long-term resilience. For help, these companies are turning to technology to gain better visibility into their supply chains; identify and respond to risks before they even occur; and create stronger, more sustainable global networks that can endure mild shocks and respond quickly to more significant ones.

As they work to build more resilient supply chains, companies need accurate data and modern visibility platforms that support good decision-making. In absence of these tools, supply chain risk management is handled on a one-off, reactive basis—something that the pandemic proved does not work in today’s uncertain business environment.

Koray Köse, senior director, analyst of supply chain research and advisory for Gartner, Inc., says 83% of organizations want better supply chain visibility and 64% want to be able to extract more accurate, reliable data from those networks. He says many larger organizations (i.e., those with $1 billion or more in annual revenues) have already checked these two boxes, but adds that supply chain visibility drops off significantly as the tier level of suppliers increases.

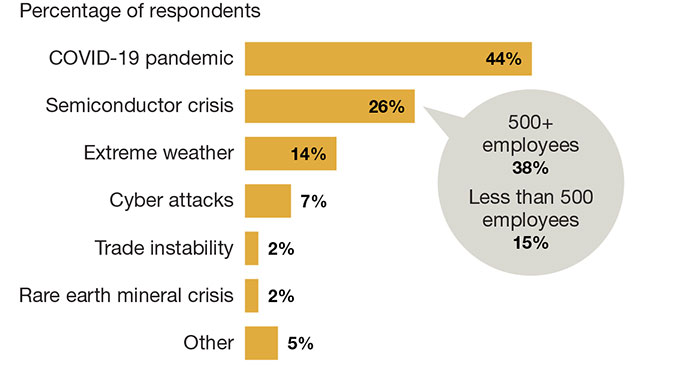

Most significant disruptive events experienced in past two years

For example, Köse’s recent research shows that more than 80% of companies have good visibility into the activities and status of their Tier 1 suppliers, but that percentage drops to 36% for Tier 2, 21% for Tier 3 and 19% for Tier 4. To fill in those visibility gaps, obtain more accurate data and avoid risk, he says companies are using compliance and auditing; supplier financial assessments; and supplier performance scorecards.

When it comes to supply chain risk event monitoring and supply chain visibility tools, Köse says 20% of companies are currently using the former and 11% rely on the latter. However, the pandemic, the semiconductor shortage and other recent events are driving more organizations to invest in and use these tools.

In fact, 64% of firms are currently evaluating or implementing supply chain risk event monitoring tools and 73% are doing the same with supply chain visibility and multi-tier mapping (for obtaining better visibility over Tier 2, 3 and 4 suppliers) applications.

“We’re seeing a lot of companies trying to gain more visibility into their overall supply chains right now and using supplier risk data as an effective overall risk management tool,” says Köse. “When organizations realized that they didn’t have visibility, it basically created a frenzy of technology investments, and specifically supply chain visibility, multi-tier mapping and risk event monitoring.”

Smaller enterprises are decidedly less proactive about recognizing and addressing risk before it happens. This not only impacts them, but it can also bring a much larger customer to its knees—and particularly if that customer’s supply chain visibility ends at the Tier 1 supplier level. “Smaller companies are dealing with issues as they come up, which can create significant misalignment in the supply chain, where every large enterprise relies on smaller suppliers,” Köse explains.

According to Köse, even if your own company is proactive and if your supply chain is operating in reactive mode, you really don’t have much leeway to improve your risk management. “Smaller enterprises may be managed less rigidly if your business volume is lower with those suppliers,” he adds. “The problem is that those Tier 3 or 4 suppliers can bring down the entire supply chain. Suddenly you have a problem at hand.”

Supply chains take center stage

The connected nature of our global societies and technologies has made supply chain risk management more complex than ever. Any crisis management approach that only considers a single aspect of the broader system may overlook a possible chain of events that has to be considered. From the pandemic to the labor shortage to the rapidly-changing global trade regulations, organizations must be continuously thinking, analyzing, assessing and planning for

all possibilities.

These realities have put the supply chain in the spotlight and made good risk management more important than ever. “Supply chains have taken center stage amidst all of the changes and disruptions that have taken place over the last two years,” says Shruti Gupta, senior manager and industrials senior analyst at RSM US LLP. “Now, organizations are building out capabilities to address all of these changes.”

The problem can’t be solved overnight, according to Gupta, but overcoming it does rank fairly high on most companies’ agendas right now. Manufacturers are particularly interested in investing in tools and applications that help them develop more resilient, shock-proof supply chains.

Disruptive demand management is one area these firms are most interested in, knowing that demand signals and traditional forecasting methodologies couldn’t “stand up to the task” during the pandemic.

“Companies are thinking, looking and exploring about how to better forecast and how to incorporate many more variables and data forecasting methodologies into their approaches,” says Gupta. So, where in the past a manufacturer would have its own, internal data to come up with a 3-month or 6-month demand projection, the same company is now incorporating outside, third-party data and short-term data variables into the mix. The goal is to build more robust algorithms and forecasting models that generate more accurate and reliable demand signals.

“Once you know your demand variability, you can

apply it across various product categories and

establish metrics like order quantity, safety stock

levels, lot sizes and so forth…Each of these metrics

can be customized to every part, which is critical

because just one single part (e.g., a semiconductor)

can stop the entire supply chain.”

Technology is of course playing a significant role in these developments. Along with the risk management and visibility software itself, advanced technologies like artificial intelligence (AI) and machine learning (ML) help companies create comprehensive, accurate models. Those models can be used to better forecast demand signals and predict the variability in demand.

“Once you know your demand variability, you can apply it across various product categories and establish metrics like order quantity, safety stock levels, lot sizes and so forth,” Gupta explains. “Each of these metrics can be customized to every part, which is critical because just one single part (e.g., a semiconductor) can stop the entire supply chain.”

Moving the needle

As she surveys the current business landscape, Gupta says those companies that are making investments are in a “better position to move faster” while those that stick to more manual risk management approaches may be struggling to catch up.

The pandemic moved the needle when it sent ripples of disruption through worldwide supply chains on an extended basis, but Gupta says there’s still more work to be done in this area.

“Many small- to mid-sized companies haven’t kept up with the technology investments and are still using aging legacy systems and distributed, disconnected solutions,” Gupta points out. “When you have those types of systems in place, it’s difficult to make the necessary progress. Thanks to the pandemic, however, more companies are saying: ‘Okay, now we need to start investing in the technology.’ So, we’re starting to see that happening.”

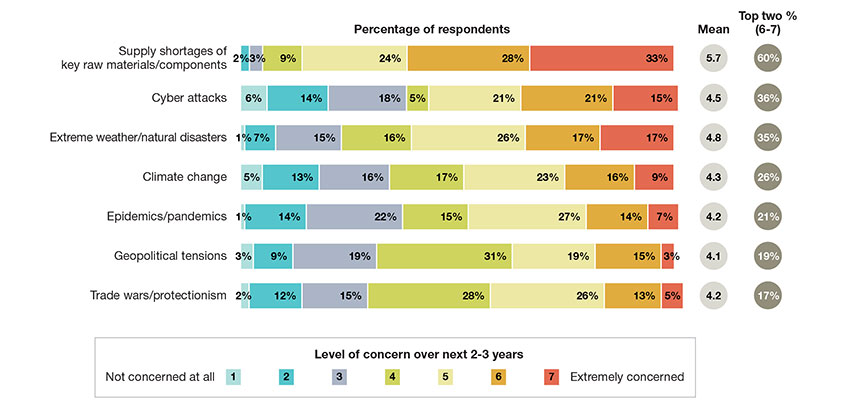

Supply shortages of key raw materials or components is the risk/disruption of most concern to companies over the next 2-3 years

For example, Gupta says supply chain control towers that capture data across the entire network and gather it in one location for easy information-sharing are gaining in popularity. Once in place, these platforms also give companies predictive and prescriptive capabilities that they need for pivoting and dealing with disruption.

Gupta is also seeing more companies embrace regional supply chain models and says that while just in time (JIT) inventory management models aren’t exactly “dead,” she does see more companies increasing their inventory buffers to deal with the

current uncertainty.

From his vantage point as director of Rider University’s Global Supply Chain Management Program, former supply chain practitioner Tan Miller says companies have taken a greater interest in software that provides high levels of supply chain visibility.

“If you can’t see the risks, it’s a heck of a lot harder to prevent them or prepare for them,” says Miller. “Supply chain technology is improving every year in terms of how much visibility it provides across the supply chain.”

This takes time and resources, but Miller says companies see the value in adding new capabilities to their existing enterprise resource planning (ERP) planning and other solutions that open up the doors to better visibility and, subsequently, improved risk management.

“There’s been a recognition that this type of investment can’t be put off,” says Miller, who sees risk management as an ongoing effort, and not a “one and done” event. “I expect companies will continue learning more over time and putting

a bigger effort into preventive

risk management.”

Opportunity abounds

“When organizations realized that they didn’t

have visibility, it basically created a frenzy

of technology investments, and specifically

supply chain visibility, multi-tier mapping and

risk event monitoring.”

Köse estimates that by 2025, half of all enterprises will have a dedicated supply chain risk management function that’s both supported and funded by the overall organization. The other 50% of companies will be lacking in this area, and that presents a real opportunity for software vendors that are continually honing and improving their solutions to meet their customers’ needs.

Referring back to the high percentage of firms that are currently evaluating or implementing supply chain risk event monitoring, supply chain visibility and multi-tier mapping applications, Köse says software vendors focused on risk management are well positioned to help companies either build new solutions from scratch or replace those that aren’t working.

“Within two years, companies are going to realize that the tools they implemented aren’t really solving their problems and aren’t creating visibility into their supply chains,” says Köse. “For vendors, the opportunity will be split pretty evenly between companies that are seeking new tools to replace the ones that they invested in and those customers that are still looking to implement the right solution.”

Article Topics

E-commerce News & Resources

UPS reports first quarter earnings declines Solving the last-mile delivery issue in New York City UPS is set to take over USPS air cargo contract from FedEx UPS presents updated financial goals and strategic targets at its investor day FedEx fiscal third quarter earnings see gains amid ongoing volume declines National Retail Federation 2024 retail sales forecast calls for growth Will recent talks between FedEx and Amazon lead to a reunion? More E-commerceLatest in Logistics

DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings declines LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources