State of Logistics in 2019: What’s Next?

Tight capacity, high rates, rapid e-commerce growth and a booming economy fueled an 11.45% rise in U.S. logistics costs over the course of 2018. However, new freight management innovations abound, and now nimbleness and efficiency are keys to good service as we roll through 2019.

Experiencing the most challenging year in over a generation, shippers managed to adapt to a quickly changing transportation landscape through innovation, increased technology adoption and improved partnerships in a year of rapidly rising rates and constricted capacity.

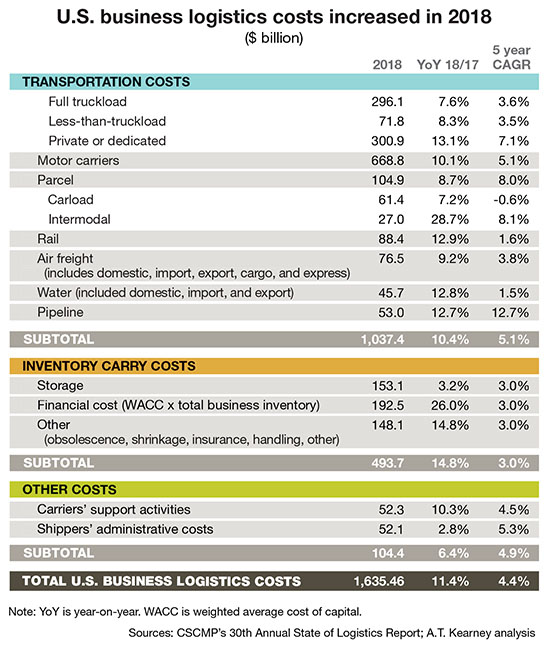

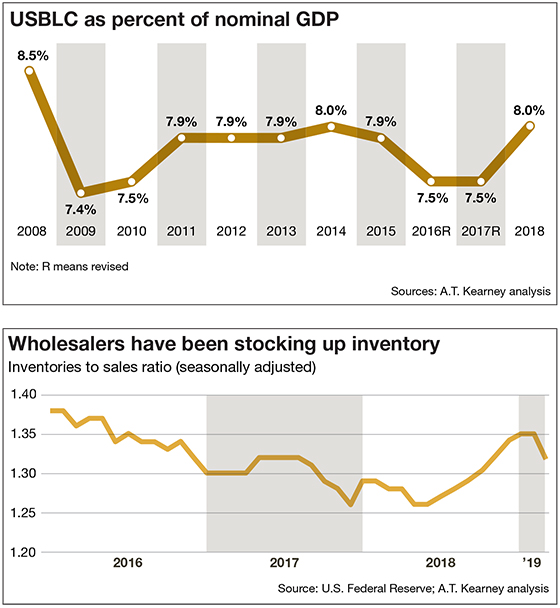

Riding a booming economy, U.S. business logistics costs (USBLC) rose 11.45% to reach $1.64 trillion—or 8% of 2018’s $20.5 trillion gross domestic product (GDP). That’s according to the “30th Annual State of Logistics Report” recently released at the National Press Club in Washington, D.C. The report, authored by A.T. Kearney, was sponsored by the Council of Supply Chain Management Professionals (CSCMP) and presented by Penske Logistics.

That 8% cost of logistics as a segment of GDP was the most since 2014. However, to put that figure in historical perspective, logistics as a share of GDP was about 18% in 1979, the last year prior to trucking deregulation.

As to be expected, freight transportation costs ate up the biggest share of USBLC, hitting $1.037 trillion last year. “There is no other way to put it: 2018 was among the most challenging of years for shippers,” say the authors of the report. “Tight capacity led to significant, and, in some cases, multiple rate increases in order to continue to secure capacity. Shippers struggled to control spend.”

In addition, the report says, logistics professionals were “forced to adjust their business models to maintain capacity” and control costs. They did this in two ways: implementing dedicated fleets to assure service and adjusting internal operations to become “shippers of choice” in this new era.

According to the report, overall supply chain costs are rising due to several factors:

- retooling of supply chains to account for more e-commerce sales, as online purchasing increased by 14.2% last year to reach 9.9% of all retail sales. The need for smaller, more costly warehouses has spiked;

- “extremely high” utilization of existing truck fleets limits available freight capacity, driving up rates;

- increasing government regulations on driver hours-of-service (HOS) causing smaller trucking firms to cease operations, consolidate or be acquired by larger transport companies; and

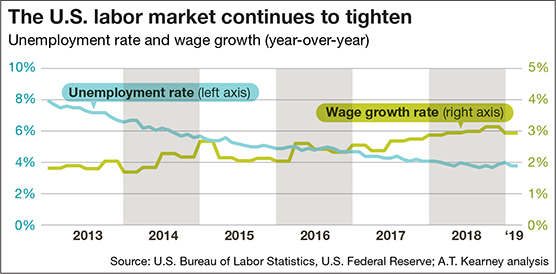

- a tight U.S. labor market and higher wages for truck drivers and warehouse workers, as attracting and retaining labor in general remains challenging for transportation and logistics companies.

However, the report cites several innovations that are driving state-of-the-art supply chains toward improvement:

- Silicon Valley has devoted time, energy and resources to automation and robotics with inventions like automated trucks and automated warehouses;

- vehicle electrification will lead the way to a more sustainable transportation network;

- the upgrade to a 5G communications network is on the horizon, which will improve logistics operation execution, planning and management as well as high-security encryption.

Let’s take a deeper dive inside the latest State of Logistics to examine exactly what’s happening on the nation’s docks, railways and highways.

What’s behind the rise in rates?

Entitled “Cresting the Hill,” the report states that the strong seller’s market that carried over from 2017 well into 2018 began to weaken in the second half of last year as capacity started to catch up with demand and the quarter-on-quarter pace of GDP.

Citing President Donald Trump’s trade and tariff disputes, the report notes that U.S. inventory buildups began during the second half of 2018. There were also “dramatically rising costs” for drivers and warehousing staff at that time, but the report states that logistics providers managed to complete last year with “generally excellent” results while maintaining cautious optimism for 2019.

Conversely, shippers hoped for redress after what for most was the worst year in memory in terms of cost and capacity availability, the report says. Shippers in attendance for the report’s release generally agreed with that assessment.

Ken Braunbach, vice president of inbound transportation for Walmart, says that reviewing 2018 “was like watching a bad movie again.” However, he says that the driver shortage continues vexing shippers and carriers alike, adding that the average age of a driver in Walmart’s private fleet is 57. “If the economy improves, the shortage could become even more acute.”

Derek Leathers, president and CEO of Werner Enterprises, said that the 2019 supply chain is much different now compared to even a few years ago. “People want everything, including toilet paper, to be delivered next day,” he says. “Yes, supply chain costs went up in 2018, but it’s a much more robust supply chain than just a few years ago.”

Derek Leathers, president and CEO of Werner Enterprises, said that the 2019 supply chain is much different now compared to even a few years ago. “People want everything, including toilet paper, to be delivered next day,” he says. “Yes, supply chain costs went up in 2018, but it’s a much more robust supply chain than just a few years ago.”

At the halfway point of 2019, signs of a slowdown and talk of recession are “abundant,” but mid-year federal interest rate cuts and other forms of economic stimulus may be on the way, the report predicts. Key indicators suggest that the economic momentum that lifted GDP 2.9% last year will wane with “swollen retail and wholesale inventories” being depleted and corporations turn cautious in the short term, according to the International Money Fund (IMF) and other sources.

GDP growth is expected to be 2.3% this year, according to the IMF and A.T. Kearney projections. The next two years will see sharply lower growth, they predicted, at 1.9% and 1.8% respectively in 2020 and 2021.

Michael Zimmerman, A.T. Kearney principal and the report’s author, says that neither shippers nor carriers seemed content with business as usual. “The U.S. economy is flashing warning signs,” Zimmerman says.

Noting quarterly GDP growth turned in a robust 3.1% growth rate in the first quarter, Zimmerman says that there’s temptation to be more optimistic than economic signs would indicate. “Cautious carriers have been making concessions and have cut back on capacity plans,” he says. “At the crest of this hill, we see both hope and evidence of a better road being taken.”

Leading shippers looking to control logistics costs have moved in the direction of constructive engagement and innovation more than ever before over the last year. The report notes that carriers have been pleased with the new collaboration while opening up to start-ups and new technologies for novel solutions to transportation challenges.

Jill Donoghue, vice president of supply chain for Bumble Bee Seafoods and a member of the panel in Washington, says that after 2018, shippers and carriers “are truly coming together to collaborate” and to ensure profitability for both camps.

With demand slowing after the capacity crunch of 2018, shippers like Donoghue say that they’re seeing demand pressure moderating this year. “Despite this apparent short-term temptation to be opportunistic in rate negotiations,” the report warns, “the goal for shippers should be to actively manage and nurture relationships with carriers.”

According to Zimmerman, this means “co-developing long term goals while in the short term doing carrier friendly duties such as communicating delays in advance, honoring load commitments and pick-up windows, and aiding carriers in their pursuit of asset utilization.”

Mode by mode

A closer look at the 2018 numbers shows rising costs across all USBLC components: transportation, inventory-carrying costs and other expenses. Inventory led the way with a 13.2% overall cost increase on a 4.6% rise in year-over-year inventories as trade-tension buildups met declining demand.

While transportation costs fared better with a 10.4% increase, certain modes saw big jumps. Intermodal and private fleets jumped 28.7% and 13.1%, respectively, as shippers sought alternatives to common carriers, while the U.S. Postal Service powered up 9.7% as the big volume winner in last-mile deliveries.

Once again, gathering nearly 67% of this nation’s freight transport-spend, trucking was the engine driving the nation’s $1 trillion freight machinery. Trucking—full truckload (TL), private carriage and less-than-truckload (LTL)—accounted for nearly two-thirds of the freight spend. And after several lean years, the trucking industry has succeeded in gaining rate increases that carriers say are necessary to cover their additional costs in labor, equipment and fuel.

Werner Enterprises’ Leathers says that 2018 was a “once in a lifetime” rate situation for truckers. But he says that average fleet profit margins remained in the single digits. “We still have a very tight margin environment for trucking,” he adds.

Truckload carriers posted a 7.6% rise in revenue to $296.1 billion, while LTL carrier revenue rose 8.3% to $71.8 billion. Private trucking, including dedicated carriage, enjoyed the biggest jump, posting a 13.15% rise in revenue to just over $300 billion. All told, motor carrier revenue jumped 10.15% to $668.8 billion.

Parcel carriers enjoyed an 8.7% jump in revenue to $104.9 billion, while intermodal carriers had the biggest jump in revenue, a healthy 28.7% rise to $27 billion. The entire rail industry had a 12.9% rise in revenue to $88.4 billion, with airfreight revenue also jumping 12.9% to $76.5 billion.

Steven Bobb, executive vice president of BNSF Railway and a member of the panel discussion in Washington, says that what jumped out at him was rail carrier efficiency—with operating ratios in the mid-60s—allowing such profitability. “You have to be cost-effective to compete and allow your customers to compete,” he says. “Being cost effective allows for investments that allow your rail network to be sustainable.”

In addition to moving to dedicated fleets and working to be become a “shipper of choice,” the report says that shippers are also placing more emphasis on understanding total cost of ownership. “They’re evaluating not only contractual freight costs, but also exposure to spot market rates and accessorial charges,” states the report. “Large shippers have noted that they have had success in mitigating irregular operations and out-of-plan shipments by raising base rates, thereby minimizing their exposure to spot rates.”

Donoghue of Bumble Bee Seafoods adds that becoming a “shipper of choice” is essential to the ongoing success of their logistics operations. “Last year we paid extra money to get our freight hauled,” she says. “This year we’re working with carriers on quarterly pricing and adjusting pricing throughout the year to smooth out demand peaks and valleys.”

However, this strategy is not without some downside, states the report, and becomes less advantageous as spot rates fall and capacity increases—a warning to shippers not to try and outsmart themselves.

Tight capacity, high rates, rapid e-commerce growth and a booming economy fueled an 11.45% rise in U.S. logistics costs over the course of 2018. However, new freight management innovations abound, and now nimbleness and efficiency are keys to good service as we roll through 2019.

Read this years State of Logistics Updates for each major segment of the Logistics market.

- Less-than-truckload (LTL): Rates up as carrier costs “go through the roof”

- Truckload (TL): Grappling with excess capacity, lagging rates

- Rail/Intermodal: Volumes trending down

- Ocean Cargo: Carrier alliances and slow steaming bear scrutiny

- Air Cargo: Capacity outpaces demand as carriers regroup

- Third Party Logistics (3PL): More M&A on the horizon

Article Topics

Motor Freight News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates Preliminary March North America Class 8 net orders see declines National diesel average heads down for first time in three weeks, reports EIA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ More Motor FreightLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources