Tackling the complexities of world trade

Global trade management platforms are helping shippers streamline their cross-border logistics and business processes in an unpredictable global trading environment.

As the software that helps shippers navigate the complexities of international trade, global trade management (GTM) supports the movement of goods as they flow through the world’s supply chains. An effective compliance tool, GTM also helps companies reduce their supply chain risk while avoiding fines,

penalties and shipment delays.

Still managed manually by many shippers, global trade management addresses the processes related to global logistics, customs and regulatory compliance, and trade financing. As the world’s supply chains grow to include more trading partners, destinations and shipments, the complexity of managing those global networks increases exponentially.

Using GTM, shippers can automate some or all of these responsibilities. The software helps them manage the flow of information, money and goods in their global trade supply chains, and also handles fine details like multiple languages, time zones, currencies and transportation modes. Combined, these capabilities help companies tackle global trade challenges and streamline their end-to-end supply chains.

Key global challenges

Coming into 2021, many cross-border shippers found themselves dealing with obstacles similar to those that they faced in 2020.

The global pandemic still had its grips on much of the world, and issues surrounding the U.S. presidential election and Brexit were still of key concern for many. And while global trade wars have always had a place in the global trading environment, concerns over increased economic nationalism and newer/higher tariffs have been elevated over the last few years.

Steve Banker, VP, supply chain management at ARC Advisory Group, sees economic nationalism and its impacts on the free trade system—versus the global pandemic—as two of the biggest issues global shippers are dealing with right now. “We’ve entered an era of economic nationalism and tariffs are changing all the time,” he explains. “In this situation, if you’re making global shipments and you want to classify the goods correctly, you need a global trade compliance system.”

Banker says most companies either handle compliance on their own, using GTM, or let their freight forwarders or external trade compliance experts do it for them. ARC doesn’t track statistics on which choice is most popular among shippers, but Banker says he expects that GTM adoption will continue to increase slowly year over year. He adds that larger organizations are moving to handle global trade management in-house versus outsourcing it to a third party.

“This is in part because some of the solution providers in the market offer TMS and GTM in one application and one code base,” Banker explains. “So that makes it easy to get onboard, realize a return on investment (ROI) with TMS, and then move to the next step: GTM.” In other words, shippers don’t have to make the decision to add GTM to their supply chain technology portfolios or not; it’s just bundled right into their existing platforms.

Offered by companies like Descartes, Amber Road (now a part of E2open), Oracle, Infor Nexus, SAP, and Blue Yonder, the GTM platforms that shippers rely on continue to evolve right along with the trading environments that they were designed to manage.

In assessing the market positioning of these providers, Banker says their industry rankings have remained fairly constant over the last few years. “The companies that are at the head of the chart pretty much stay at the head of the chart,” he points out. “Year in and year out, we don’t see many changes in who is leading the GTM market.”

2021 trade trends

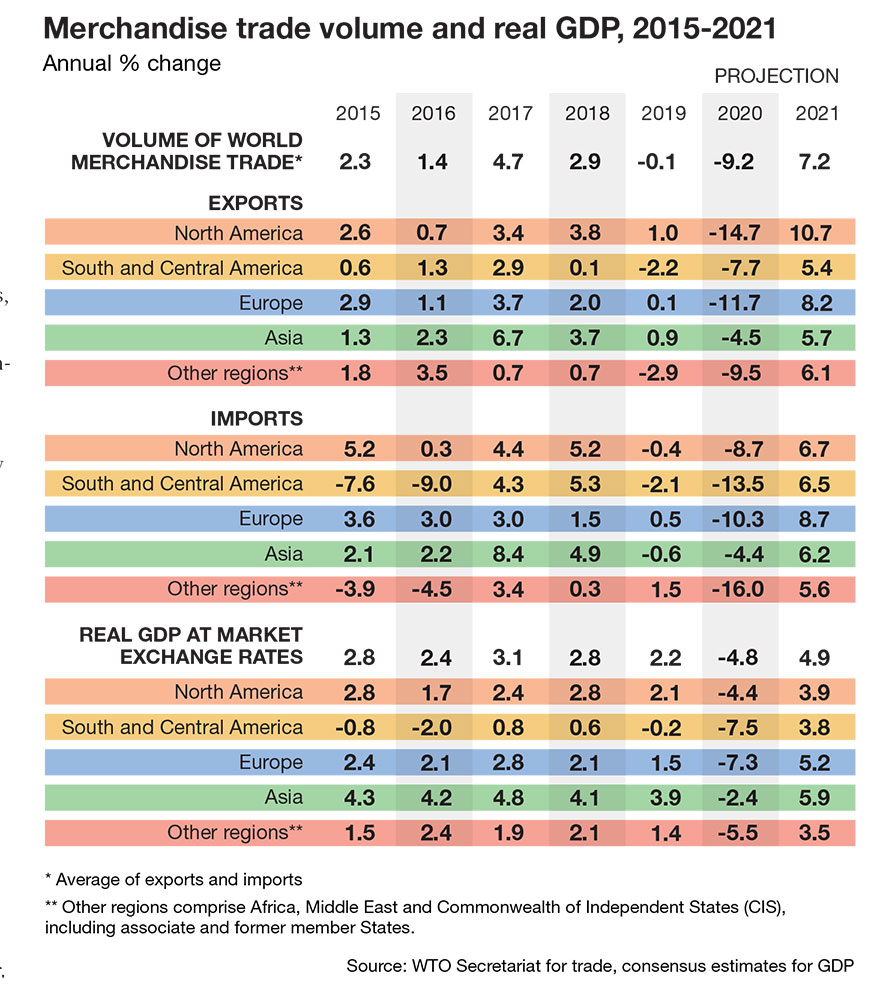

As we move further into 2021, the World Trade Organization is projecting a 7.2% increase in global trade this year. This represents a turnaround from the 9.2% decline in the volume of world merchandise trade that took place in 2020. Based on these WTO predictions, it’s safe to say that cross-border trade will continue on its path to recovery over the next few months.

This will present both opportunities and challenges for international shippers. “World trade will continue to bear the scars of the tit-for-tat trade war, and the effects of subsidies introduced during the pandemic risk dampening the recovery,” ING predicts. “But in spite of the challenges and risks, cautious optimism for 2021 is warranted as economies are set to recover and trade policy may be done through talks, rather than tariffs.”

Some of those talks took place in 2020, and resulted in new free-trade agreements for key trading partners. In a 2021 Trade Update, for example, Logistics Management reported that with the United States-Mexico-Canada Agreement (USMCA) now resolved, much hemispheric trade will continue to take place on a duty-free basis.

“Indeed, much of the new agreement has been to standardize and modernize customs procedures throughout our continent to facilitate the free flow of goods,” Patrick Burnson writes, adding that U.S. shippers are now closely tracking ongoing regulatory issues with China and Southeast Asia, as well as the impacts of Brexit.

Getting out of manual mode

Reflecting on 2020, Joe Vernon, practice leader, supply chain analytics at Capgemini, says globalization came front-and-center as supply chains worldwide were disrupted by the pandemic.

Companies that relied heavily on Chinese manufacturing for their products and/or raw materials, for example, had to scramble to find alternate sources of supply. “China has done a good job of mitigating COVID, but for any company that relied on it—and particularly those in the electronics sector—there were some definite disruptions to contend with,” Vernon recalls, “as factories went offline and/or reduced capacity.”

As a result, global trade management as a whole (not just the software itself) became less fluid and “less guaranteed,” says Vernon. As companies sought out secondary sources of supply to fill those gaps, the process of managing global trade became more “old-school, get it done, find new sources, and make things happen,” he explains. Those companies with GTM already in place had an advantage, mainly due to the connected networks, automation and supply chain visibility that such platforms provide.

“Companies that had invested in systems driven by GTM were probably at an advantage when COVID broke out, affecting international supplies and shipping capacities globally,” says Vernon. “They were probably pretty well positioned.” At the other end of the spectrum were the multitude of companies that still handled global trade management manually, and that rely on warehouse employees to fill out customs, compliance and other forms by hand—and for every export shipment.

“Global trade management is an area that has to be more agile and flexible, and getting there requires data and systems,” says Vernon, citing a McKinsey statistic that a new supply chain disruption comes along every 3.7 years in today’s business environment. And while these disruptions may not all be as monumental as a global pandemic or Brexit, each one does pose new challenges that GTM can help solve and/or circumvent.

“To deal effectively with these interruptions, companies have to get out of manual mode,” says Vernon, “and away from paper-driven approaches and non-systems-driven processes.”

Going beyond compliance

To shippers that are eager to either maintain their smooth-running cross-border supply chains or improve them for 2021, GTM is one of several supply chain applications that can help them achieve those goals.

In most cases, Banker says companies invest in GTM as a way to “comply with loss”—in other words, they’re trying to avoid the fees, penalties, fines and delays that surface when shipment documentation is inaccurate, misfiled or missing.

Knowing that this doesn’t always present a viable financial case for a GTM investment, Banker says some software providers are adding capabilities that help companies select alternate sources of supply in different target countries.

“Some of the GTM solutions incorporate an engine that companies can use if they, say, want to start sourcing a specific component from Columbia instead of China,” Banker explains. “Using the platform, shippers can get a quick answer as to what the total landed cost—inclusive of tariffs—will be, should they decide to make that change.”

This, in turn, transforms GTM into a tool for strategic procurement, and provides a bigger ROI that goes beyond fine avoidance. Banker sees this as a future selling point for GTM that could expand as the global trading environment continues to morph and evolve. “The more economic nationalism that we see emerging, and the more the word gets out that these compliance engines allow companies to expand their sourcing into new countries and roll everything up into a total landed cost,” he concludes, “it will be a true driver of ROI for GTM, and more [compelling] than compliance alone.”

Article Topics

Global Trade News & Resources

UPS reports first quarter earnings decline Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report EU Update 2024: Crises lead to growth Examining the impact of the Taiwan earthquake on global supply chain operations Descartes announces acquisition of OCR Services Inc. More Global TradeLatest in Logistics

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week UPS reports first quarter earnings decline LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources