Top 20 Lift Truck Suppliers in 2019: Market reaches new heights

Focused on enhancing productivity, gaining efficiencies and improving labor utilization in the warehouse and DC, companies buoy the lift truck market by continuing to invest in both electric and internal combustion vehicles.

After hitting a new high in 2017, the North American lift truck market outdid itself once again last year by collectively selling more than one-quarter million new units. According to the Industrial Truck Association (ITA), this represented a 2.8% increase over 2017, with steady growth seen across most lift truck classes.

The ITA says year-end lift truck sales totaled 260,180, with electric and internal combustion truck sales growing at similar rates (showing annual increases of 2.8% and 2.7%, respectively). Overall, electric products accounted for approximately 64% of last year’s market, with the industrial lift truck market contributing more than $25 billion annually to the U.S. GDP, the association reports. Canada and Mexico remain the two largest export countries for U.S. forklift manufacturers.

Along with their North American counterparts, lift truck makers from other areas of the world also posted impressive sales growth last year.

The largest manufacturers all maintained their rankings in 2018…

- Toyota

- KION

- Jungheinrich

- Mitsubishi

- Crown Equipment

Each of the companies in the Top 5 saw an increase of more than 5% over last year’s numbers. Today’s leaders, especially Toyota and KION, continue to expand their reach beyond industrial trucks and into the broader market for supply chain services.

Scott Johnson, ITA’s chairman of the board of directors and vice president of marketing and sales for Clark Material Handling Company (No. 10 on this year’s list), credits a “very healthy” industry with supporting growth across most asset classes and manufacturers. “As an industry, we’re the benefactors of several years of continuous growth that has enabled manufacturers to invest in their facilities and manufacturing processes,” he says. “Today, everyone is really turning out world-class products.”

ITA’s lift truck classes

The Industrial Truck Association (ITA, indtrk.org) has defined seven classes of lift trucks, or forklifts, which are defined by the type of engine, work environment, operator position and equipment characteristics.

Lift truck classes include:

- Class 1: electric motor trucks with cushion or pneumatic tires

- Class 2: electric motor narrow aisle trucks with solid tires

- Class 3: electric hand trucks or hand/rider trucks with solid tires

- Class 4: internal combustion engine sit down rider forklifts with cushion tires, suitable for indoor use on hard surfaces

- Class 5: internal combustion engine sit down rider forklifts with pneumatic tires, suitable for outdoor use on rough surfaces

- Class 6: electric or internal combustion engine powered, rider units with the ability to tow (rather than lift) at least 1,000 pounds

- Class 7: almost exclusively powered by diesel engines with pneumatic tires, these units are suitable for rough terrain and used outdoors.

Since primarily classes one through five are used in materials handling applications inside the four walls, Modern has only specified those on our supplier table.

Top 20 Industrial Lift Truck Suppliers

| 2018 Rank | Company | 2017 Rank | 2018 Revenue (in millions) | 2017 Revenue (in millions) | % Change 2017 - 2018 | World Headquarters |

|

| 1 | 13,292+ | 11,393 | 16.7% | Aichi, Japan | |

| 2 | 6633+ | 6306 | 5.2% | Wiesbaden, Germany | |

| 3 | 4363 | 4120 | 5.9% | Hamburg, Germany | |

| 4 | 4270 | 3833 | 11.4% | Kyoto, Japan | |

| 5 | 3480 | 3080 | 13% | New Bremen, Ohio | |

| 6 | 3174 | 2885 | 10% | Cleveland, Ohio | |

| 7 | 1414 | 1347 | 5% | Hefei, Anhui, China | |

| 8 | 1227 | 1077 | 13.9% | Hangzhou, China | |

| 10 | 790 | 781 | 1.2% | Seoul, South Korea | |

| 9 | 740+ | 670 | 10.4% | Seoul, South Korea | |

| 11 | 649 * | 649 | 0% | Tokyo, Japan | |

| 12 | 477 * | 477 | 0% | Ulsan, South Korea | |

| 13 | 343 * | 343 | 0% | Shanghai, China | |

| 14 | 294 | 236 | 24.6% | Hangzhou, China | |

| 15 | 293 | 259 | 13.1% | Monaghan, Ireland | |

| 16 | 218 | 197 | 10.7% | Ancenis Cedex, France | |

| 17 | 185 * | 185 | 0% | Hyvinkää, Finland | |

| 20 | 79 | 71 | 11.3% | Mumbai, India | |

| 18 | 72 | 79 | -8.9% | Fulda, Germany | |

| 19 | 69 * | 69 | 0% | Cravinhos, Brazil |

A real game-changer

The lift truck industry may be a mature one, but that doesn’t mean the manufacturers that operate in it are resting on their laurels. Knowing the constraints that end users are dealing with in today’s e-commerce/omni-channel distribution environment, these companies are continually seeking out new ways to help those users work smarter, better and safer.

“As a group of manufacturers, we continually find ways to improve how we make our trucks and the safety features that we put in those trucks,” says Johnson. “I’m very proud of my peers in that sense.”

As e-commerce continues to expand, Johnson says that forklift makers are seeing new demands for Class 3 trucks (motorized hand trucks) and other vehicles that support the high-speed/high-velocity warehousing environment. “E-commerce is a real factor in some of the things we’re doing now,” says Johnson, “and it’s really fueling strong industry sales.”

Cumulatively, Johnson says ITA is seeing very balanced performance across all lift truck classes, which also include electric rider trucks (Classes 1 and 2) and internal combustion powered trucks (Classes 4 and 5). He says that the market is increasingly embracing electric-powered vehicles—a phenomenon that’s expanding lift truck sales as a whole and also eroding some of the “traditional IC bandwidth.”

“When an electric truck’s performance characteristics are equal to or greater than those of an IC truck, it’s a real game-changer,” says Johnson. “The products have matured to a point where there is market acceptance, and where the consumer or end user has got it in his or her mind that it’s OK to use.”

That signifies a fairly dramatic shift away from the historical perception that a traditional inside/outside DC application requires either an IC or diesel truck. “That’s not the case today,” says Johnson. “There are electric trucks now that can handle tasks and perform in a way that’s equal to IC counterbalanced trucks. That’s really changed the dynamic of the marketplace.”

A safe operator is a trained operator

Putting on his ITA hat and looking around at the current marketplace, Johnson sees a number of lithium-ion, multi-shift, and zero emission electric lift truck options coming on the market right now. “Those are all attractive qualities for many of today’s buyers,” says Johnson, “including smaller mom-and-pop operations and large national accounts. That represents a fairly broad appeal.”

Johnson says that as the number of lift trucks in use continues to grow right along with the number of operators needed to run them, the ITA and its constituents are putting an even bigger emphasis on safety and training. At its 2019 National Forklift Safety Day in Washington, D.C., ITA members discussed how there are currently more than 4.5 million truck operations currently employed in more than 300 industries nationwide.

This is a testament to the impact that lift truck manufacturers and dealers have on the U.S. economy, says Johnson, and also the critical nature of operator training and safety in the context of the workplace.

“The phrase ‘a safe operator is a trained operator, and a trained operator is a safe operator,’ sounds simple enough, but we truly believe that,” says Johnson. “While we all compete very robustly in the marketplace, when it comes to engineering standards, safety and other industry-wide concerns, we can all come together to have positive, productive conversations and then come to a consensus about what’s best for the industry and for the operator.”

Facing key challenges

You can’t have steady growth over a 48-month period without at least some growing pains, and the lift truck industry has faced its share of challenges during that time. The sustained labor shortage and persistent nationwide unemployment rate of 3.6%, for example, makes it more difficult than ever to find, recruit and retain the labor needed to make the trucks. Equally as elusive are new dealers that want to take on new lift truck lines—a challenge that Johnson chalks up to ineffectual succession planning.

“As an industry, we struggle to bring in that new blood, or that next wave of leaders that’s willing to come in and take advantage of what really is a great business,” says Johnson. “That’s a persistent problem for us.”

This year, the political environment and its associated tariffs and trade wars haven’t been kind to any manufacturers that do business on a global scale. Calling the political environment “one of the biggest headwinds” for the lift truck industry right now, Johnson says the ITA is in favor of free and fair trade.

“Our unified message to our leadership in D.C. is that we don’t think tariffs are the way to go,” says Johnson. “We do think we need free and fair trade, and good trade partners, but tariffs—both inbound and outbound—are a challenge for our industry.”

Cautiously optimistic

Despite the challenges that may hold it back this year, the North American lift truck industry is in a good position to have broken yet another record by the time 2019’s numbers are tallied up. Acknowledging the difficulties that come with continually posting record years in sales, Johnson says a minor slowdown will still translate into plenty of orders for a robust industry.

“I continue to have cautious optimism,” says Johnson. “When I look at the momentum and the inertia that our industry has had for the last five to seven years, it’s been fantastic. Even if we have a slight pullback in 2019, it will still be a fantastic year.”

Growth by region

The Worldwide Industrial Truck Statistics (WITS) organization tracks quarterly and monthly statistics on lift truck sales and its report is compiled by six trade groups based in North America, Brazil, Japan, Korea, Europe and China.

According to the 2018 WITS figures, global orders increased by 10.25% and world shipments by 11.68%. Additional highlights of the 2018 WITS figures include:

- The Americas region improved slightly from 2017’s high, with 328,610 orders, and showed a 4.12% increase.

- The Oceania region showed the largest increase in orders (19.69%) and shipments (24.7%).

- Europe produced double-digit growth in orders (11.42%) and shipments (10.38%)

How the suppliers are ranked

To be eligible for Modern’s annual Top 20 lift truck suppliers ranking, companies must manufacture and sell lift trucks in at least one of the Industrial Truck Association’s seven truck classes: electric motor rider; electric motor hand trucks; internal combustion engine; pneumatic tire; electric and internal combustion engine tow tractors; and rough terrain lift trucks.

Rankings are based on worldwide revenue from powered industrial trucks during each company’s most recent fiscal year. Revenue figures submitted in foreign currency are calculated using the Dec. 31, 2018 exchange rate.

Forklift Products and Accessories

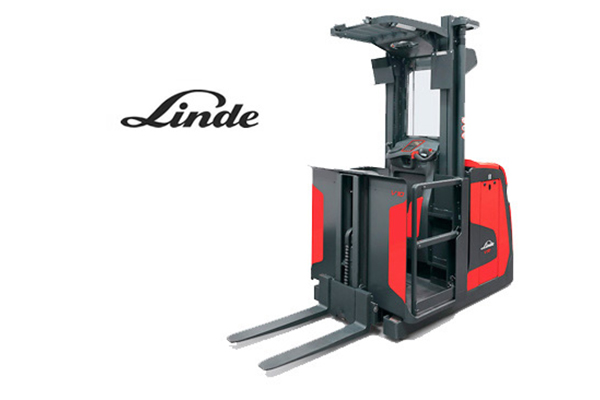

Linde Series 5021 V10 electric medium level orderpicker

Linde Series 5021 V10 electric medium level orderpicker

AC-powered medium level orderpicker.

Powerful Cart Tugger Tow Tractor

Powerful Cart Tugger Tow Tractor

Tow tractor offers electric tuggers for any application.

Joey Zero electric access vehicle

Joey Zero electric access vehicle

Compact orderpicker reaches heights of 118 inches.

MPC Series Orderpicker

MPC Series Orderpicker

Orderpicker offers dock-to-stock versatility, time savings.

R30XM series of narrow aisle orderpickers

R30XM series of narrow aisle orderpickers

Narrow aisle orderpicker increases stock-picking productivity.

OSX15 orderpicker

OSX15 orderpicker

Fully AC-powered orderpicker powered by 24- or 36-volt battery.

Article Topics

Lift Trucks News & Resources

Exploring Customized Forklift Solutions Toyota Material Handling | Products: 48v/80v Lift Truck - Video Toyota Material Handling Product Video: 3 Wheel Electric Forklift Cut costs and emissions with lithium-ion forklifts Reverse Logistics, Best Practices and Equipment for Returns Toyota Material Handling | Products: SEnS+ Video Lithium Transition: It’s all about the outcomes More Lift TrucksLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report XPO opens up three new services acquired through auction of Yellow’s properties and assets More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources