Top 50 US and Global Third Party Logistics 2020

Today's marketplace is not for the faint at heart. Leading industry analysts maintain that in the current volatile business environment, an increasing number of logistics service providers are being forced to take dramatic action to generate positive impact rapidly—or risk going out of business.

While compiling its annual list of Top 50 third-party logistics (3PL) players, Armstrong & Associates (A&A) always seeks to find a few leading trends that indicate where the market is heading on both the provider and shipper sides around the world.

After working on the lists and the supporting report, Evan Armstrong, president of the consultancy, suggests to shippers that quick, tactical solutions should not be relied upon at this moment in time. Indeed, he maintains that 2020 will remain a year of “strategic crisis” for logistics managers aiming for a sustainable business plan with their 3PL partners.

“With the current uncertain business environment, an increasing number of logistics providers are being forced to take dramatic action to generate positive impact quickly—or risk going out of business,” says Armstrong, adding that, during the first phase of a strategic crisis, a business is no longer able to compete effectively.

Armstong & Associates Top 50 U.S. 3PLs

|

2019 Rank | Third-party Logistics Provider (3PL) | 2019 Gross Logistics Revenue |

1 | 15,309 | |

2 | 10,287 | |

3 | 9,302 | |

4 | 8,788 | |

5 | 8,175 | |

6 | 7,060 | |

7 | 4,364 | |

8 | 3,969 | |

9 | 3,668 | |

10 | 3,600 | |

11 | 3,394 | |

12 | 3,225 | |

13 | 3,100 | |

14 | 3,000 | |

15 | 2,650 | |

16 | 2,600 | |

17 | 2,540 | |

18 | 2,310 | |

19 | 2,300 | |

20 | 2,210 | |

21 | 2,185 | |

22 | 2,178 | |

23 | 2,173 | |

24 | 2,130 | |

25 | 1,950 | |

26 | 1,775 | |

27 | 1,750 | |

28 | 1,675 | |

29 | 1,552 | |

30 | 1,532 | |

31 | 1,524 | |

32 | 1,440 | |

33 | 1,395 | |

34 | 1,260 | |

35 | 1,203 | |

36 | 1,200 | |

37 | 1,082 | |

38 | 1,018 | |

39 | 1,010 | |

40 | 1,002 | |

41 | 916 | |

42 | 876 | |

43 | 875 | |

44 | 855 | |

45 | 835 | |

46 | 829 | |

47 | 813 | |

48 | 805 | |

49 | 800 | |

50 | 797 |

Armstrong & Associates Top 50 Global 3PLs (as of May 14, 2020)

|

2019 Rank | Third-party Logistics Provider (3PL) | 2019 Gross Logistics Revenue |

1 | DHL Supply Chain & Global Forwarding | 27,302 |

2 | Kuehne + Nagel | 25,875 |

3 | 19,953 | |

4 | DB Schenker | 19,349 |

5 | C.H. Robinson | 15,309 |

6 | 14,355 | |

7 | 10,549 | |

8 | 10,287 | |

9 | UPS Supply Chain Solutions | 9,302 |

10 | J.B. Hunt (JBI, DCS & ICS) | 8,788 |

11 | Expeditors | 8,175 |

12 | 7,173 | |

13 | CEVA Logistics | 7,124 |

14 | 6,472 | |

15 | 6,408 | |

16 | 6,379 | |

17 | 6,335 | |

18 | 5,965 | |

19 | 5,365 | |

20 | 5,274 | |

21 | 5,180 | |

22 | 5,067 | |

23 | 4,410 | |

24 | Agility | 4,122 |

25 | Ryder Supply Chain Solutions | 3,969 |

26 | Hub Group | 3,668 |

27 | Coyote Logistics | 3,600 |

28 | Imperial Logistics | 3,507 |

29 | Total Quality Logistics | 3,394 |

30 | Burris Logistics | 3,100 |

31 | Transplace | 3,000 |

32 | Hellmann Worldwide Logistics | 2,974 |

33 | Schneider Logistics & Dedicated | 2,650 |

34 | Sankyu | 2,613 |

35 | Penske Logistics | 2,600 |

36 | FedEx Logistics | 2,310 |

37 | MODE Transportation | 2,300 |

38 | Transportation Insight | 2,210 |

39 | Echo Global Logistics | 2,185 |

40 | Landstar | 2,173 |

41 | NFI | 2,130 |

42 | Mainfreight | 2,038 |

43 | Groupe CAT | 1,925 |

43 | Fiege Logistik | 1,925 |

44 | Americold | 1,775 |

45 | Ingram Micro Commerce & Lifecycle Services | 1,750 |

46 | ID Logistics Group | 1,737 |

47 | Worldwide Express/Unishippers | 1,675 |

48 | APL Logistics | 1,630 |

49 | BDP International | 1,552 |

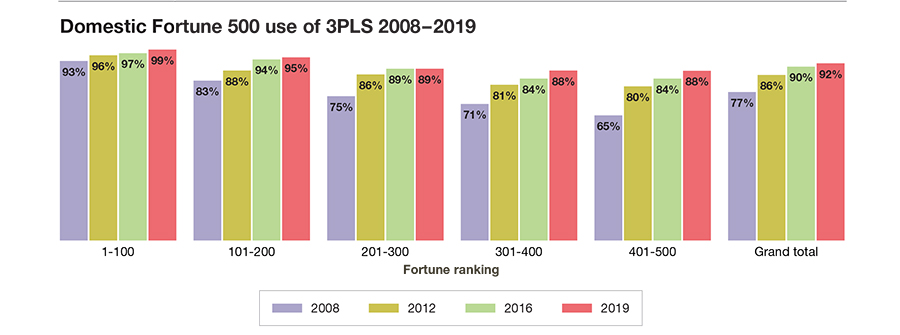

In the new A&A report, “Increasingly Strategic: Trends in 3PL/Customer Relationships,” Armstrong and his analysts observe a shift from initial 3PL sales strategies emphasizing relationships with large Fortune 500 accounts. Most 3PLs, in fact, are now also pursuing smaller accounts, which offer the potential for more strategic relationships with better profit margins.

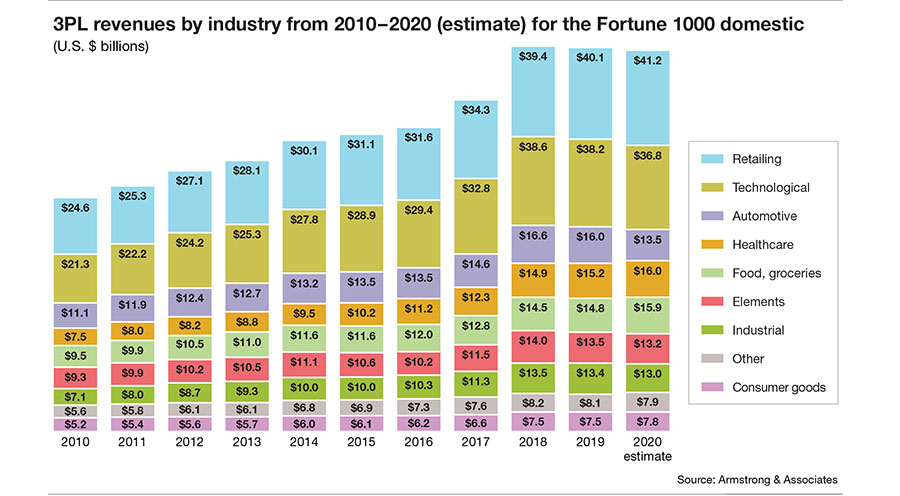

However, trends do indicate continued awareness of the benefits of using 3PLs among Fortune 101 to 1,000 companies, and according to Armstrong, this growth should hold over the foreseeable future. The overall U.S. 3PL market growth was 15.8% in 2018, the highest it has been since 2010, followed by a decline of -0.3% in 2019. Taking the last decade into consideration, 3PLs have developed business at an average of two to three times the rate of growth in the U.S. economy.

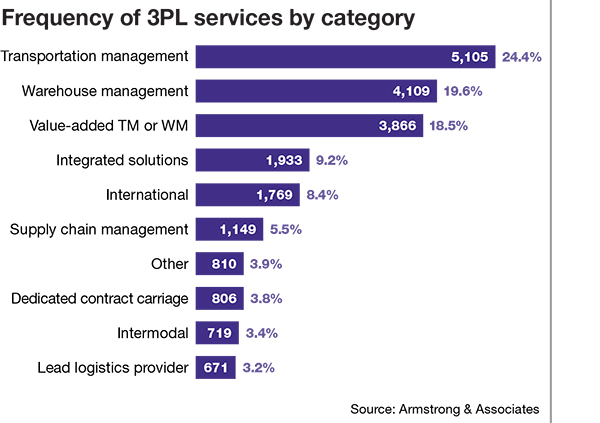

“Transportation management continues to rank first among all regions around the globe,” observes Armstrong. “Third-party providers in the Asia-Pacific region provide customers with a significant proportion of international services, while the Europe, Middle East and Africa-based 3PLs provide a greater proportion of warehousing, value-added, and integrated solutions. Meanwhile, North American services are typically transportation management, warehousing, and value-added services.” (See sidebar.)

Trade tensions and pandemic

Cathy Morrow Roberson, founder and head analyst for Logistics Trends & Insights LLC, a boutique market research firm that specializes in global supply chains, says that she would be surprised to hear of any major 3PL not affected by the trade tensions between the United States and China over the course of 2019.

“Freight forwarding and intermodal volumes, on average, declined last year,” says Morrow Roberson, “and those 3PLs that didn’t have a balanced portfolio of services probably were more negatively affected.”

Regarding COVID-19, she says that so far it looks like much of the demand for goods is coming from larger shippers as many small- to medium-sized businesses struggle to reopen.

“As manufacturing slowly recovers, there will be some pick up in 3PL activity, such as warehousing and distribution,” says Morrow Roberson. “Growth in e-commerce logistics will also continue as consumers, accustomed to ordering while confined to homes, will continue to order items online. However, the COVID-19 impact will hit 3PLs’ profits for at least the first half of the year, if not longer.”

Morrow Roberson also notes that tight air cargo capacity has resulted in some modal changes. For example, rail between Asia and Europe. DHL has added additional rail containers to meet demand for this solution. “Some providers are also utilizing trucking between Asia and Europe,” she says. “Multimodal options such as sea/air are also being used more as well as ocean for goods that usually move by air.”

Armstrong digs deeper into reserach

Armstrong & Associates provides shippers with a number of key takeaways on the state of the industry in its new report “Increasingly Strategic: Trends in 3PL/Customer Relationships.” In this exclusive interview, Evan Armstrong expands upon its findings.

Logistics Management (LM): What were the main surprises to surface in your research this year?

Evan Armstrong: We’re actually surprised by the limited impact COVID-19 has had on 3PL operations staffing. It seems to have disrupted China from a staffing perspective much more than we are seeing in the United States.

LM: Were any particular 3PLs hurt by the trade tensions between the United States and China in 2019?

Armstrong: The U.S. economy is tightly interconnected with China, and so are its supply chains. The import tariffs have been a continued drag on international trade, the growth of 3PLs and other U.S. businesses as well as the overall U.S. economy. The only bright spot for 3PLs has been on the import compliance side of international transportation management (ITM) operations where there has been increased demand for expertise.

LM: While it’s probably too early to tell, what impact will COVID-19 have on global and domestic 3PLs?

Armstrong: Domestically, the first quarter of 2020 was okay for 3PLs after a soft 2019 that saw overall U.S. gross revenues decline slightly. The first quarter saw some extra demand and resultant revenue increases within the food and grocery, consumer, Internet retailing, and technological vertical industries as products were hoarded by consumers and computers and office equipment were purchased to adhere to stay-at-home rules. The second quarter has seen about a 15% drop in domestic transportation management (DTM), and 3PL segment gross revenues as volumes have dropped off across all modes.

LM: Have you seen any major shifts in modal decisions by global 3PLs? More ocean, less air, for example?

Armstrong: The focus is still on meeting product demand using the most economical mode, but strong spikes in consumer B2C business and healthcare related spending drove procurement

toward airfreight.

LM: Finally, when will the barriers to entry finally come down to permit new players to enter the “Top 50” marketplace?

Armstrong: To break into the Top 50 requires a well thought out strategy to drive organic business growth as well as inorganic growth through merger and acquisition. It’s important to know your strengths in terms of value proposition, service offering, customer satisfaction, vertical industry expertise, and execute an operational model that builds upon your strengths and fills gaps to overcome weaknesses.

Organizational alignment to focus on customer needs and optimizing service performance is critical to grow organically. If you’re a customer of a 3PL and it isn’t consistently communicating its value to you in terms of performance or cost savings, then it may be time to look for other options. As they say, every 3PL’s best customer is another 3PL’s best prospect.

- Patrick Burnson

For domestic players, she feels that while cross-border activities continue, there may be more considerations for onshoring. “As we move past COVID-19 particularly, the pharmaceutical and healthcare supply chain may be reconfigured to meet demands made by U.S. shippers,” Morrow Roberson adds.

Meanwhile, cold chain will continue to be a vibrant 3PL niche for similar commodities, says Morrow Roberson. “This sector is a strong one for acquisitions in which Kuehne + Nagel and Panalpina [acquired by DSV] are playing leading roles,” she says. “Air cargo demand for fresh produce, meats, vegetables and flowers has been on the rise in recent years due to a growing middle class in China as well as growing demand in other Asian countries, the Middle East and elsewhere.”

Morrow Roberson concludes by noting that the ability for air cargo to move perishable goods from one place to another quickly is a key driver of this cargo growth, and in some cases, it’s replacing profitable electronics volumes that peaked by 2010 for air cargo providers.

“In addition, those 3PLs with a strong pharma/healthcare emphasis such as UPS and DHL also will see cold chain services grow,” says Morrow Roberson.

The impact of e-commerce

While stay-at-home orders imposed by government leaders may have challenged many logistics managers, one prominent player in the marketplace has found a way prosper within the “new normal” mandate.

El Segundo, Calif.-based 3PL Central is a warehouse management systems (WMS) leader that recently shared data indicating unprecedented growth in order volume from 3PLs supporting e-commerce since the lockdown. Analyzing proprietary data from its customer base, the provider has seen an 81% increase in order volume over the same time last year and the highest order volumes per 3PL ever—on par with Black Friday in 2019.

As it processes in excess of one million orders per week, 3PL Central shippers may indeed offer a relevant barometer for the growth of the 3PL warehousing market. Out of the top 100 shippers, the average growth rate per 3PL exceeds 61%, with more than 80% experiencing growth. Of the total 3PLs using its WMS, 45% have experienced growth.

Acute areas of growth include those 3PLs fulfilling e-commerce orders for essential goods and nutraceuticals. However, those 3PLs focusing purely on B2B fulfillment of non-essential items have been the hardest hit.

David Miller, general manager of platform services at 3PL Central, says many industry players are dealing with disruption in a positive way. “We’re seeing 3PLs pick up a lot of business from Amazon fulfillment centers as that inventory is being displaced,” he says. “Amazon is prioritizing household items, opening up a lot of demand and opportunity for other third-party warehouses to fill additional consumer demand.”

According to Miller, top providers are also discovering how essential their businesses are. Obviously med-tech and food/cold storage has been an imperative part of the essential supply chain, but other items such as electronics and communication equipment, literature and learning supplies, arts and crafts have all become critical for continued education.

“We’ve identified four trends across the top 3PLs we work with, including driving warehouse space efficiency to accommodate more inventory on hand,” says Miller. “The 3PLs responding to this increased demand have to act quickly to support unprecedented volumes or risk losing customers in this critical time.”

Miller believes that there will also be a resurgence of manufacturing in the United States and continued reduction of Chinese manufacturing. “This will lead to reduced ocean freight for years to come, and potentially increase the needs of domestic intermodal transportation,” he says. “In fact, a lot of ocean capacity is tied up due to closed ports, and ocean rates are starting to spike in certain lanes.”

Miller believes that there will also be a resurgence of manufacturing in the United States and continued reduction of Chinese manufacturing. “This will lead to reduced ocean freight for years to come, and potentially increase the needs of domestic intermodal transportation,” he says. “In fact, a lot of ocean capacity is tied up due to closed ports, and ocean rates are starting to spike in certain lanes.”

Finally, he sees freight recovery happening in the air sector faster than personal travel.

“This demand should put more planes back in the air at more competitive freight rates—compared to ocean—than before. I expect to see all of these sectors recover in the long term, but for 3PLs, the next couple of years will be…interesting.”

Article Topics

3PL News & Resources

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making XPO opens up three new services acquired through auction of Yellow’s properties and assets FTR’s Trucking Conditions Index weakens, due to fuel price gains LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 TD Cowen/AFS Freight presents mixed readings for parcel, LTL, and truckload revenues and rates More 3PLLatest in Logistics

LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics Investor expectations continue to influence supply chain decision-making The Next Big Steps in Supply Chain Digitalization Warehouse/DC Automation & Technology: Time to gain a competitive advantage The Ultimate WMS Checklist: Find the Perfect Fit Under-21 driver pilot program a bust with fleets as FMCSA seeks changes Diesel back over $4 a gallon; Mideast tensions, other worries cited More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources