U.S. Bank Freight Payment Index shows no immediate signs of recession

Freight shipment and spending levels were somewhat mixed in the third quarter, according to the most recent edition of the U.S. Bank Freight Payment Index, which was issued this week by Minneapolis-based U.S. Bank.

This report, which was initially launched in the third quarter of 2017, is comprised of data on freight shipping volumes and spend on both a national and regional basis. The report’s data is based on the actual transaction payment date, highest-volume domestic freight modes of truckload and less-than-truckload and is seasonally- and calendar-adjusted.

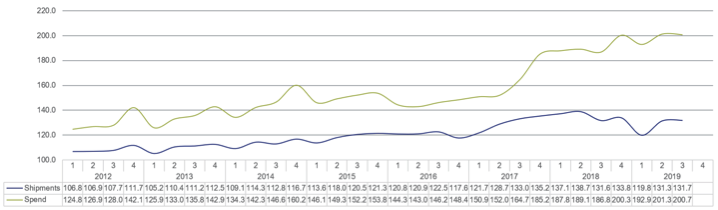

Its historical data goes back to 2010, with a base point of 100, and its index point for each subsequent quarter marks that quarter’s volume in relation to the preceding quarter. U.S. Bank Freight Payment processes more than $23 billion in global freight payments for U.S. Bank’s corporate and federal government clients.

The report’s National Shipment Index, at 131.7 (2011=110.1), was up 0.3% from the second quarter to the third quarter, which was well off the 9.7% gain from the first quarter to the second quarter, and was down 0.1% annually, marking the fifth consecutive annual shipment decline.

U.S. Bank noted in the report that shipments still remain at historically good levels, due, in large part, to solid consumer spending, with retail sales up from the second quarter to the third quarter that helped to support shipment growth from July to September.

“Accounting for a large portion of truck freight, retail sales are supported by a near 50-year low in the unemployment rate, elevated consumer confidence and record levels of inflation-adjusted personal disposable income,” the report said. “Retail sales are also particularly good for the dry van truckload segment. As for the macroeconomic drivers for freight last quarter, consumer spending continues to be the pillar. Retail sales are off the pace set in 2018, but the level of freight in this sector remains high. Conversely, new home construction activity is essentially moving laterally, albeit at high levels. Meanwhile, factory output decelerated as economic growth around the world slows and businesses moderate capital investment. A soft factory sector has impacted the LTL market, with large portions of LTL freight coming from manufacturers. Inventory levels throughout the supply chain remain elevated, but there is evidence that the trends are improving. In summary, the U.S. Bank National Shipment and Spend Indexes were at in the third quarter, as compared to the previous quarter.”

On the spending side, the report’s spending index, at 200.7, slipped 0.3% from the first quarter, the second sequential decline over the last three quarters, and rose 7.4% annually, topping the 6.4% annual gain from the first quarter to the second quarter.

With shipments up 0.1% annually while spending is up 7.4%, U.S. Bank said this suggests that capacity is coming more into balance, coupled with a large number of motor carriers shutting down in the first half of 2019, at a higher number than all of 2018, which it said is a trend that could continue moving forward.

U.S. Bank Freight Data Solutions Director Bobby Holland told LM with shipments up slightly and spending down slightly, on a sequential basis, the report’s data indicates that there are no immediate signs of a recession on the horizon.

Addressing the 7.4% annual gain on the spending side, Holland said that is a reflection of more freight being moved ahead of the holiday season, coupled with solid retail sales numbers.

“We are also seeing increases for housing completions, too,” he said. “Manufacturing is softening a bit, which is why some areas, like the Midwest, are down, and agriculture is taking a hit with tariffs, too. In our second quarter report, the data indicated that spending had spiked from the first quarter to the second quarter. It was not an indication that the economy was taking off but more of a rebalancing. And we think the third quarter data supports that, too, because…things are still at a fairly robust pace, especially when compared to last year, when things were at a very high level. Flattening out is not a bad thing, in that case, as we are now at a point where capacity and demand are not necessarily completely at equilibrium but are a lot closer than before. There is still a truck driver shortage and some related problems with capacity but is counterbalanced by normal drivers of freight that are themselves softening.”

As for the fourth quarter’s prospects, Holland said that while available data is minimal, retail is expected to be the main driver for shipments and spending, adding that the aforementioned capacity rebalancing is also mitigated by factors like potential winter weather issues, but are otherwise likely to be similar to the third quarter.

The US Bank Freight Payment report provided an overview of third quarter performance in five U.S. regions, including:

- Midwest: saw the weakest regional performance of the five as manufacturing output and agriculture export sectors lagged;

- Northeast: strong consumer spending and new home construction in Q3 made it the only region to show volume increases each quarter

- Southeast: shipment index rose on the heels of Atlantic storms in Q3, triggering the first year-over-year increase in four quarters;

- Southwest: despite a mostly flat index in Q3, spend activity remains at all-time high levels in the Southwest; and

- West: was one of just two regions to post quarterly and year-over-year gains in shipment volume

Article Topics

3PL News & Resources

Following USTR review, White House announces tariff increases on certain U.S.-bound imports from China Inflation continues to have a wide-ranging impact on supply chains, notes Blue Yonder survey New Union Pacific service connects Southern California and Chicago LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity USPS cites continued progress in fiscal second quarter earnings despite recording another net loss U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR New Ryder analysis takes a close look at obstacles in converting to electric vehicles More 3PLLatest in Logistics

Following USTR review, White House announces tariff increases on certain U.S.-bound imports from China Insider Q&A: Improving Freight Transportation: Anticipate scenarios, mitigate disruption, think long-term Inflation continues to have a wide-ranging impact on supply chains, notes Blue Yonder survey National diesel average decreases for the fifth consecutive week, reports EIA New Union Pacific service connects Southern California and Chicago Automate and Accelerate: Replacing Pick-to-Light with the Next Generation of Automation STB Chairman Martin J. Oberman retires More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources