Global Logistics: New perspectives on global transportation risk

Most enterprises have logistics and transportation risk management protocols that can address localized disruptions. Global supply chain risks, however, can have cascading and unintended consequences that no one organization can mitigate. Here are recommendations for managing the vulnerabilities.

Thanks to globalization, lean processes, and the geographical concentration of production, among other factors, supply chain and transport networks are more efficient than ever before. This increasing sophistication and complexity, however, is accompanied by increasing risk.

Major disruptions in the past five years—including the global financial crisis, the Yemen parcel bomb scare, flooding in Thailand, and the Japanese earthquake and tsunami—have illustrated the vulnerabilities of finely tuned, closely interconnected supply chain and transport networks.

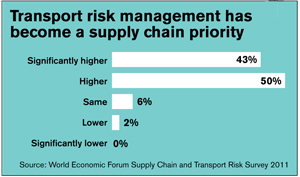

Although risks have increased, there are concerns about the ability of organizations to address this new risk profile. As the recent World Economic Forum (WEF)/Accenture report, New Models for Addressing Supply Chain and Transport Risk, points out, most enterprises have logistics and transportation risk management protocols that can address localized disruptions. Greater supply chain risks outside the control of individual organizations, however, can have cascading and unintended consequences that no one organization can mitigate.

While it’s important to be able to anticipate specific disruptions, it’s even more important to build in dynamic systems and processes that can quickly and effectively respond to changing logistics and transportation circumstances. The goal is not to predict what will happen, or when, but to be prepared and able to respond in an informed, planned manner.

The report identified a number of recent supply chain and transport concerns that have increased organizations’ risk profile, creating the need for more dynamic supply chains.

Information/communication disruptions: Growing reliance on online systems and the sophistication of cyber attacks place ever-greater stress on supply chain and transportation networks. In transport, for example, the increased reliance upon, and use of, electronic data for real-time risk assessment—including electronic manifests for cargo—have proven effective in facilitating the movement of freight. At the same time, however, they have put more pressure on governments and businesses to maintain robust and secure information and communications networks.

- Infrastructure failure: Critical infrastructure, from roads to power stations, is under pressure due to lack of investment and planning for future resiliency. In the U.S. alone, the American Society of Civil Engineers estimated that the cost of repairing national infrastructure at $2.2 trillion over the next five years. The disruption or failure of critical infrastructure nodes could have a severe impact on global transportation networks, and needs attention and investment.

Reliance on oil: The WEF expert group identified reliance on oil as the single greatest vulnerability to supply chain and transportation networks. An immediate change in oil availability as the result of external disruptions such as civil unrest or terrorist attacks (or closure of the Straits of Hormuz) could have an extensive global impact on transport networks in particular.

This vulnerability is itself a subset of a broader, long-term challenge of addressing oil reliance. A more dynamic supply chain might respond by varying sourcing options based on a reassessment of a company’s global manufacturing footprint that moves production closer to target markets and reduces shipping costs.

- Legislation and regulation: When the Icelandic volcano erupted in 2010, the reactive response of European transport ministries and civil aviation authorities resulted in uncertainty and delays in restarting air traffic. There was a failure to recognize in advance the potential threat presented by such ash clouds, along with inflexible aviation protocols and the absence of any pre-existing agreement on safe ash levels. Similarly, well-intentioned government initiatives such as air cargo screening can impede the efficient flow of transport networks.

While there are significant new risks arising on these and other fronts, organizations also have new opportunities to improve their supply chain and transportation risk management. The first step identified in the report was the development of the trusted networks for effective collaboration.

Trusted networks spanning business and government

Effective identification and management of systemic risk across the supply chain and transport network requires a high level of collaboration among businesses, professional groups, governments, regulators, suppliers, customers, and even competitors. These trusted relationships are crucial to pre-disruption preparation and post-disruption rapid response.

In the research underpinning the report, considerable enthusiasm was identified for developing greater collaboration between business and government at the global level to address risk. The nature of global disruptions means that there are too many economic, security, and political issues to take a siloed or compartmentalized approach to risk management.

Aligning priorities and agreeing on focus areas among these different stakeholder groups, however, will be a gradual process.

There are also opportunities for greater understanding and coordination at the industry and/or regional level. Initiatives such as the Supply Chain Risk Leadership Council, which comprises manufacturing and services supply chain firms, bring teams together to develop and share supply chain risk and transport best practices. The World Economic Forum’s own Risk Response Network (RRN), launched in 2011, supports the development of trusted networks by tapping into a diverse, high-level group of domain experts.

Sharing data and information

Access to accurate and reliable information can provide a clearer global picture of supply chain and transportation networks’ vulnerabilities and support the coordination of back-up plans in the event of a disruption. Identifying reoccurring risks at the industry level can also help businesses and governments focus efforts on increasing network resilience.

There are, however, serious questions about the availability of shared data, based on research included in the WEF/Accenture report. In fact, nearly two-thirds or 63 percent of those surveyed for that research said that the management of shared data and information was being handled ineffectively.

Two specific actions were suggested by the group: First, establish reliable dashboards for macro-level flows and disruptions through key infrastructure; and, second, increase the flow of information across end-to-end networks to improve transparency at all tiers of the supply chain.

While limited tools and software exist that can be used to support extensive data and information sharing, a new class of software products is being developed, both internally by companies and by external providers, to deal with risk. These products are designed to help identify high-probability and high-impact risks and prepare for potential disruptions. They also create an alert system for disruptions where early detection is likely to help organize and prioritize the response.

Furthermore, the report also noted that the importance of being able to quantify and measure supply chain and transportation network risk exposure was flagged by individuals who participated in a WEF workshop and was referenced in the report. Without those metrics, companies struggle to quantify their risk exposure or to compare providers. A recognized set of supply chain and transport risk quantification metrics needs to be developed to help businesses and governments obtain an accurate understanding of risk to networks, better prioritize risk management activities, and align the incentives, exposure, and risk appetite.

Ideally, these risk metrics should be consistent within and across organizations to enable comparisons.

Scenario planning

While scenario planning is used effectively at the operational level, it also has the potential to play an integral role in reducing systemic risk across networks. Conducting scenario planning on a regular basis ensures that external risks and network vulnerabilities are continually reviewed and that the associated mitigation controls are effectively updated.

If possible, scenario planning should be scaled to the level of different stakeholders to enhance understanding of external environments while contributing to the anticipation of actions by network partners and improved joint preparation of continuity plans. Scenario planning at the regional and/or sector level can enable areas of conflict and lack of coordination to be identified, clarify the roles and responsibilities of public and private actors in the face of major global disruption, and increase the speed and effectiveness of response.

The trusted networks mentioned earlier can increase the scope and effectiveness of scenario planning, driving effective risk management and investment in contingency solutions while helping to shape global legislation and regulation.

The Forum expert group emphasized the requirement for significant interaction between business and government to drive improvement in the risk management methods identified.

Among possible courses of action, global transportation companies can urge the formation of working groups led by regional trade ministries driving action in regional hubs.

Another important initiative is the creation of disruption-level evaluation frameworks. This represents agreement on standardized classification of the impact of a disruption, which would then inform the response of the public and private sectors during and after an event.

5 recommendations

The report concluded with five recommendations:

governments should improve international and interagency compatibility of resilience standards and programs;

businesses should more explicitly assess supply chain and transport risks as part of procurement, management, and governance processes;

government and business should work together to develop trusted networks of suppliers, customers, and competitors focused on risk management;

governments and businesses should improve network risk visibility through two-way information sharing and collaborative development of standardized risk assessment and quantification tools; and

- both governments and businesses should improve pre- and post-event communication on systemic disruptions, balancing security and facilitation to bring a more balanced public and private sector discussion.

Due to the increasing complexity and interconnectedness of global supply chains—and the emergence of new and potentially highly disruptive types of risk—risk management for supply chain and transportation networks could benefit from cooperation across public and private sectors.

In addition, companies should expand their approach to risk management and make it a strategic priority across their ecosystems of businesses, suppliers, and partners. They should develop more dynamic supply chains that are efficient as well as resilient and able to rapidly respond when supply, demand, and cost-to-serve shocks occur whether they are triggered by a natural disaster, political unrest, or other circumstances.

Jonathan Wright is an executive director in Accenture Management Consulting, with an operations focus. Daniella Datskovska is an executive in the risk management practice at Accenture, a global management consulting, technology services and outsourcing company.

Article Topics

Global Logistics News & Resources

2024 Global Logistics Outlook: Crisis mode lingers The reconfiguration of global supply chains Hidden risks in global supply chains Global Logistics 2023: Supply chains under pressure Roadrunner rolls out new direct lanes and transit time improvements U.S. rail carload and intermodal volumes are mixed, for week ending March 12, reports AAR State of Global Logistics: Time for a reality check More Global LogisticsLatest in Logistics

STB Chairman Martin J. Oberman retires Get Your Warehouse Receiving Audit Checklist Now! LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity Last-Mile Evolution: Embracing 5 Trends for Success Optimizing Parcel Packing to Cut Costs A buying guide to outsourcing transportation management How site selection can help recruit top talent More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources