Railroad shipping: AAR reports intermodal growth leads volume gains for week ending June 19

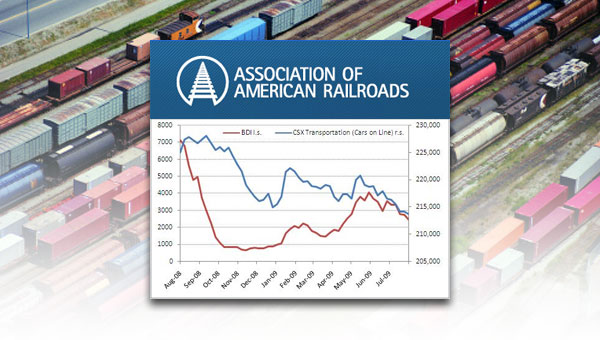

Spurred by strong intermodal growth, weekly railroad volumes remain well ahead of 2009 levels for the week ending June 19, according to the Association of American Railroads.

Weekly carload volumes—at 284,913—were up 9.2 percent year-over-year and down ten percent from 2008. This tally fell short of the week ending June 12 at 288,973 and beat the week ending June 5, which hit 270,251 carloads, but had the Memorial Day holiday factored into its totals. The week ending April 24, which hit 294,218 carloads, is the highest weekly carload level since December 2008, according to the AAR.

In October 2009, the AAR began reporting weekly rail traffic with year-over-year comparisons for the previous two years, due to the fact that the economic downturn was in full effect at this time a year ago, and global trade was bottoming and economic activity was below current levels.

Carload volume in the East was up 12.2 percent year-over-year and down 15.8 percent compared to 2008. And out West carloads were up 7.2 percent year-over-year and down 5.6 percent compared to 2008.

Intermodal volumes were the standout for the most recent week and are indicative of the strong growth momentum the mode has seen in recent weeks.

Intermodal container and trailer volumes—at 227,985 trailers and containers—were up 21.2 percent year-over-year and down 0.2 percent from 2008. This output represents the best weekly performance since the 45th week of 2008. The week ending June 12 hit 223,075 trailers and containers, the week ending June 5 hit 191,758

Intermodal container volume was up 23.2 percent year-over-year and up 8.8 percent compared to 2008. Intermodal trailer volume was up 10.5 percent year-over-year and down 32.8 percent compared to 2008.

As LM has reported, recent railroad volume growth has the potential to pave the way for a strong performance throughout the rest of 2010, according to industry analysts.

Factors cited by analysts include increased industrial production growth in the form of manufacturing and new orders indices, as well as gradual consumer spending, among other factors, as drivers for these gains. But even though volumes are slowly recovering, they are still well below previous peak levels.

And while current volumes remain below 2008 levels, the gap is clearly narrowing especially in recent weeks.

On a year-to-date basis, total U.S. carload volumes at 6,767,470 carloads are up 7.2 percent year-over-year and down 13.4 percent compared to 2008. Trailers or containers at 4,976,377 are up 11.7 percent year-over-year and down 7.3 percent compared to 2008.

Of the 19 carload commodities tracked by the AAR, 15 were up year-over-year. Metals were up 78.2 percent, and metallic ores were up 108.9 percent. Showing declines were farm products excluding grain -12.7 percent and food and kindred products at -5.5 percent, among others.

Weekly rail volume was estimated at 31.5 billion ton-miles, a 10.4 percent year-over-year increase. And total volume year-to-date at 744.3 billion ton-miles was up 8.3 percent year-over-year.

Article Topics

Rail & Intermodal News & Resources

U.S. rail carload and intermodal volumes are mixed in April, reports AAR Q1 intermodal volumes are up for second straight quarter, reports IANA 2024 State of Freight Forwarders: What’s next is happening now STB announces adoption of final reciprocal switching rules Norfolk Southern-Ancora Holdings proxy battle accelerates Intermodal growth volume remains intact in March, reports IANA Shipment and expenditure decreases trend down, notes Cass Freight Index More Rail & IntermodalLatest in Logistics

April Services PMI contracts after 15 months of growth, reports ISM 2023 industrial big-box leasing activity heads down but remains on a steady path, notes CBRE report U.S. rail carload and intermodal volumes are mixed in April, reports AAR Q1 U.S. Bank Freight Payment Index sees shipment and spending declines S&P Global Market Intelligence’s Rogers assesses 2024 import landscape Pitt Ohio exec warns Congress to go slow on truck electrification mandates Q1 intermodal volumes are up for second straight quarter, reports IANA More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources