State of Logistics 2013: Rail

Even with signs of apparent economic improvement at the mid-year mark of 2013, it’s fair to say that the freight transportation market is currently generating more questions than answers. But one constant amid the economic uncertainly over the past few years has been the staying power of the freight railroad industry.

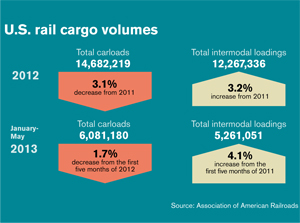

Much like a top athlete perfecting his craft, the railroad sector has stayed ahead of its competitors by focusing on the fundamentals. On the rails it’s been strong service and reliability, two basics that never go out of style. And because of this hyper-focus, the sector has seen domestic intermodal volumes return to pre-recession levels and carloads trending in the right direction, down only 2 percent on a year-to-date basis.

And as they have for years, the railroads are continuing to take their service capabilities and flip them into strong returns for Class I carriers. What’s more, this is happening at a time when the economy is still finding its groove, and coal, which represents about 40 percent of total rail carloadings, continues to see its volumes decline.

Helping to ease the loss of coal volumes is the emergence of crude oil by rail. Consider this: The AAR recently reported that U.S. Class I railroads originated a record 97,135 carloads of crude oil in the first quarter of 2013, up 20 percent from the 81,122 carloads in fourth quarter of 2012 and 166 percent higher than the 36,544 carloads originated in the first quarter of 2012.

And while the Class I rails have remained focused on service and reliability, they also continue make massive capital investments into their own networks and infrastructure to expand, upgrade, and enhance the U.S. freight rail network in the form of new equipment, safety, rolling stock, terminal expansion, and asset utilization. The AAR recently reported that the seven North American-based Class I railroads plan to invest an estimated $24.5 billion in 2013, with $13 billion of that allocated towards upgrading or enhancing rail capacity.

AAR President and CEO Ed Hamberger said that its’ not entirely surprising that the cumulative capital expenditure figure of the Class I railroads continues to be so high on an annual basis. “Our industry’s leaders and investors know that ‘deferred maintenance’ is not a winning strategy, so these vital capital expenditures and maintenance investments will continue, particularly given railroads are growing market share to move even more freight in the future.”

But in order to be able to make these investments, railroads need to maintain their current pricing leverage, which has been firmly intact for the last 10 years. This is where things get prickly with rail shippers—many of whom maintain that they’re not getting what they pay for in terms of service and value as annual rates rise about 5 percent year over year.

While there has been much made by shipper groups about re-regulating the industry, addressing the lack of railroad antitrust, fuel surcharges applied by the rails, and reciprocal switching, these efforts have largely stalled out in Washington.

“The mysterious thing is that you hear how rail prices have risen, yet the railroads that are earning their cost of capital are barely earning it,” says Stifel Nicolaus Analyst John Larkin. “People forget that it is such a major capital intensive industry, with new locomotives $200 million each or more. Ties are not cheap, nor is keeping right-of-ways in safe condition to allow for the passage of trains at a reasonable velocity. It is a very expensive proposition.”

Article Topics

Rail & Intermodal News & Resources

U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR Norfolk Southern shareholders sign off on 10 board of directors nominees Potential Canadian rail strike could damage the country’s economy U.S. rail carload and intermodal volumes are mixed in April, reports AAR Q1 intermodal volumes are up for second straight quarter, reports IANA 2024 State of Freight Forwarders: What’s next is happening now STB announces adoption of final reciprocal switching rules More Rail & IntermodalLatest in Logistics

Key benefits of being an Amazon Business customer with Business Prime USPS cites continued progress in fiscal second quarter earnings despite recording another net loss U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR New Ryder analysis takes a close look at obstacles in converting to electric vehicles Norfolk Southern shareholders sign off on 10 board of directors nominees Between a Rock and a Hard Place Inflation and economic worries are among top supply chain concerns for SMBs More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources