Managing air cargo costs

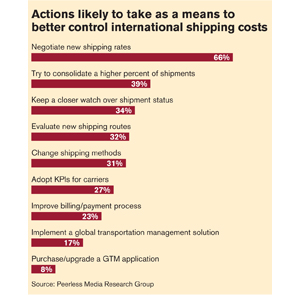

Although the fluctuation of jet fuel surcharges and the supply/demand balance of air cargo capacity are elements that air shippers can’t control, there are several steps they can take to better manage the related, volatile costs.

Article Topics

Latest in Logistics

Varying opinions on the tracks regarding STB’s adopted reciprocal switching rule National diesel average falls for the fourth consecutive week, reports EIA New Descartes’ study examines consumer preferences, changes, and shifts in e-commerce home delivery preferences Potential Canadian rail strike could damage the country’s economy C.H. Robinson highlights progress of its AI-focused offerings with a focus on automating shipping processes UPS announces CFO Newman to leave company, effective June 1 Preliminary April North American Class 8 net orders are mixed More LogisticsSubscribe to Logistics Management Magazine

Not a subscriber? Sign up today!

Subscribe today. It's FREE.

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

May 2, 2024 · As the days of slow, invisible supply chains that “worked behind the scenes” continue to fade in the rearview mirror, companies are improving their demand forecasting, gaining real-time visibility across their networks and streamlining their operations—and its software that makes that all possible.

Latest Resources

Warehouse/DC Automation & Technology: Time to gain a competitive advantage

In our latest Special Digital Issue, Logistics Management has curated several feature stories that neatly encapsulate the rise of the automated systems and related technologies that are revolutionizing how warehouse and DC operations work.

The Ultimate WMS Checklist: Find the Perfect Fit

Reverse Logistics: Best Practices for Efficient Distribution Center Returns

More resources