Mission Foods’ wireless supply chain evolution

Over the past six years, the tortilla manufacturer has rolled out a combination of wireless technologies—from handhelds, to wireless networks, to RFID—to automate transactions, track assets, and manage labor and inventory in its distribution and warehouse operations. Here’s how they made it happen.

Latest Logistics News

Automatic Data Capture (ADC) at the edge Lift Trucks join the connected enterprise 2018 Warehouse / Distribution Center Survey: Labor crunch driving automation Warehouse Management Systems (WMS) / Inventory Management Technology: 6 Trends for the Modern Age ERP Suppliers’ Changing Role More Warehouse and DCIt’s official: You’re not the only one addicted to your Blackberry. Most everyone in your supply chain is.

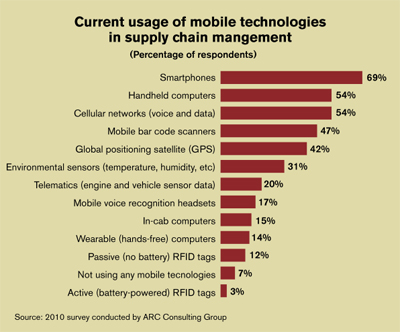

According to a 2010 survey conducted by the ARC Advisory Group, respondents picked the smartphone (Blackberry and iPhone) as the most used mobile or wireless technology being applied in supply chain management (SCM) today, at 69 percent. It even surpassed the veritable workhorse of the logistics industry—the handheld computer, at 54 percent.

“A person uses a smartphone to stay connected to his business and to link in to his office,” says Steve Banker, ARC’s service director of SCM. “But on the warehouse floor I don’t see it replacing the standard handheld scanner anytime soon. The handhelds are more robust, don’t break easily, and scan much more efficiently.”

Pete Doyle, strategic account manager for Intermec Technologies and provider of rugged handheld computers, agrees with Banker’s assessment. “Having WIFI, GPS, cellular, and Bluetooth connectivity—and still being able to drop the device from eight feet to concrete, that’s been a big game changer for us. And we’ve had it even before the smartphones had it.”

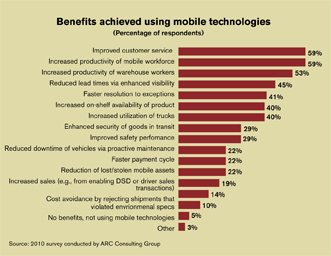

No matter which wireless technology you’re putting to use in your warehouse/DC operations, going wireless and freeing yourself from paper—while achieving real-time visibility on your trucks and inventory—are the clear beneficial attributes that are making wireless technology the hot topic it is today.

Tortilla manufacturer Mission Foods is a terrific example of what can be done through a comprehensive wireless system. The company employed a combination of wireless technologies—from handheld computers, to wireless networks, to RFID—to automate transactions, track assets, and manage labor and inventory in its distribution operation. Let’s take a closer look at how this innovative manufacturer made it happen.

Mission’s mission

Mission’s mission

With 16 plants and 50 distribution centers (DCs), Irving, Texas-based Mission Foods is one of the largest manufacturers of tortillas, chips, salsa, and taco shells in the U.S. Mission’s mission is simple: To deliver fresh, shelf-stable tortilla products to every customer, every time, on time.

Mission’s supply chain operation accomplishes this by following a direct-store-delivery (DSD) model using independent operators to quickly move products to market. It has a network of about 2,000 independent distributors who transport Mission’s products over 2,300 routes. They pick up these products from Mission’s facilities and deliver them directly to supermarkets and retail stores.

Since the late 1980s, Mission Foods had been using batch computers for its DSD routes, while relying heavily on paper and corrugated for picking and packing items. But by 2005, following years of dramatic developments in wireless networks, data capture, and mobile computers, Eduardo Valdes, vice president of management information systems, knew it was high time to leverage these technologies and transform Mission’s distribution process.

Under his watch, Mission Foods began making the move towards wireless technology in three critical areas: its DSD operation; in the tracking of returnable plastic containers; and within the four walls of the warehouse.

Three wireless radios in one

Like worker bees in a colony, Mission’s independent distributors are tasked with delivering the company’s products to stores and producing invoices requiring a customer’s signature before moving on to the next store.

“In the past, we’d have to wait for the distributors to establish a modem connection to download invoices and get an update, or we’d wait for them to come to the office,” says Valdes. Hard copies of invoices that were dropped off had to be manually scanned for electronic processing—not a small task when you’re dealing with about 30,000 documents a day nationwide.

In 2005, having worked with Intermec since 1996, Valdes and his team went back to its solution provider to see if it had a handheld computer that could simultaneously support three forms of wireless communication: wide area wireless connectivity to transmit invoice and delivery data in real time from distributors in the field to Mission’s SAP systems; a wireless LAN 802.11b-standard connection for use within its facilities; and Bluetooth connectivity to print signed paper invoices at a customer site from a portable printer.

According to Valdes, the provider’s handhelds clearly fit the bill; and in 2006, these mobile devices were rolled out to Mission’s independent distributors who could now generate invoices for customers on the spot.

In this system, the capture of a customer’s signature on the handheld automatically triggers a wireless transmission that sends the invoice data to Mission Foods over AT&T’s wide range area network. If out of network coverage, the system will automatically retry to send the data. If any transactions haven’t been transmitted when the distributor returns to the DC, the DC’s wireless LAN is used to send the data from the handheld.

Although the biggest benefit to Mission Foods might be the real-time exchange of accurate transactions, electronically capturing signatures on invoices has also eliminated the need to scan and process 30,000 documents. More importantly, independent distributors don’t take as much of the customer’s time to complete deliveries, elevating service levels on delivery routes.

Container tracking with RFID

Container tracking with RFID

After offering independent distributors these new handhelds, Valdes and his team switched gears in late 2008 to focus on the containers used to transport products to stores. The company, in response to sustainability initiatives, had been gradually replacing its corrugated boxes with returnable plastic containers (RPCs).

With these containers costing $8 each, the company’s ability to be “green” relied heavily upon distributors returning RPCs after product delivery—easier said than done. Nearly 100 percent of the RPCs were being replaced each year at a loss of $3 million.

While keeping track of containers leaving may have been easy, tracking them coming back proved difficult. “Most distributors would drop the empties outside the warehouse, but facilities lacked the manpower to check-in and count the trays that were returning,” says Valdes. He needed a system that wouldn’t create extra work for warehouse personnel, follow the natural picking and shipping process, and still track who was returning the containers.

Valdes and Intermec set up a “proof of concept” in Mission’s 150,000 square-foot Dallas facility to determine whether using RFID to track containers would be feasible.

“We put a fairly expensive RFID tag on a thousand containers so we knew it would read, and then we successfully tracked them with this handheld coming and going,” recalls Intermec’s Doyle. Engineers then tested the readability of less expensive tags on containers filled with Mission’s products until finally recommending an inexpensive, but reliable weather-resistant, polyester label with an RFID tag built into it. Placing RFID reader portals on each dock door would have been cost-prohibitive, so Mission’s team located a minimal number of portals along the workers’ most travelled paths.

To facilitate tagging each container, Mission printed the containers’ RFID labels in-house before sending them to the RPC manufacturer for application to the containers before they arrive at Mission’s facilities. Before loading onto the independent distributor’s truck, a worker prints and attaches an RFID paper tag on the pallet indicating which independent distributor gets the pallet along with the number of containers associated with the pallet.

Lift truck drivers then transport product through an outbound portal that automatically records both the pallet and container codes. Upon the independent distributor’s return, the trays are processed through an inbound portal near the docks where lift trucks must drive before unloading the empty containers in the warehouse. Because every reader has a unique IP address, Mission knows where the containers were read and if they were leaving or coming back to the facility.

The only issue, according to Valdes, is the inadvertent reading of stray tags from product stored within the vicinity of the portal—a problem that’s common in many RFID applications. Valdes and his team installed filtering software that could identify these stray tags and eliminate them from tracking reports.

In July 2009, Dallas went live with three strategically placed portals. Soon after that, portals were installed in Houston and San Antonio in just one week. Mission Foods plans to continue rolling out this RFID system to all of its DCs and plants through 2012.

The system, including readers, tags, and software, cost about $100,000 for all three Texas facilities—which move a total of 20,000 containers per day. For 2010, these facilities saved a combined $700,000 by switching from corrugated, resulting in a return on investment of only a few months.

Taking wireless to the warehouse

Valdes and his team’s foray into wireless technology continues to evolve over time. In 2009, they decided to concentrate on Mission’s warehouses that still used paper pick lists to pick full cartons of product onto a pallet.

For years, this paper-based approach caused mispicks and inhibited automatic traceability for recalls. Many times, the oldest products weren’t picked first, resulting in some items going to scrap due to expired sell-by dates.

To address these issues the team chose another handheld computer capable of scanning barcodes up to 50 feet away. The handheld is equipped with a terminal emulator software that mimics the data entry terminal on Mission’s host system, essentially making the handheld a smaller version of the system.

With these wireless devices, a worker scans the pick location and the product to make sure he or she is picking the correct product and quantity. The handheld then directs the worker to the next pick location.

Using these wireless handheld scanners in the warehouse has allowed real-time tracking of inventory, labor productivity and delivery status, while seamlessly interfacing with Mission’s SAP systems. In late 2009, they went live with the first location, adding two more locations in 2010.

Article Topics

Warehouse and DC News & Resources

Automatic Data Capture (ADC) at the edge Lift Trucks join the connected enterprise 2018 Warehouse / Distribution Center Survey: Labor crunch driving automation Warehouse Management Systems (WMS) / Inventory Management Technology: 6 Trends for the Modern Age ERP Suppliers’ Changing Role 2016 Warehouse/DC Operations Survey: Ready to Confront Complexity Warehouse and DC Management: 4 ADC Trends More Warehouse and DCLatest in Logistics

Automate and Accelerate: Replacing Pick-to-Light with the Next Generation of Automation STB Chairman Martin J. Oberman retires Get Your Warehouse Receiving Audit Checklist Now! LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity Last-Mile Evolution: Embracing 5 Trends for Success Optimizing Parcel Packing to Cut Costs A buying guide to outsourcing transportation management More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources