2017 State of Logistics: Less-than-truckload (LTL)

Revived sector benefits from proprietary networks, e-commerce boom

This is a supplement to the 2017 State of Logistics feature article.

The once beleaguered $35 billion LTL market is enjoying a revival thanks to its substantial investment in technology, difficult-to-replicate hub-and-spoke networks, the boom in e-commerce as well as other non-traditional growth areas.

Simply put, it’s about market share and pricing power. The top 25 LTL carriers still account for nearly 90% of market share. And with giants FedEx Freight and UPS Freight upping the ante with multi-million dollar investments in technology and operations improvements, the LTL sector continues to enjoy pricing power over shippers that the highly fragment truckload (TL) sector does not.

According to David Ross, veteran LTL analyst for Stifel Inc., 2017 will be “generally good” for LTL carriers, with results improving as the freight year progresses.

“The expectation remains for better times ahead in LTL due to the prospect of lower taxes, reduced regulation, increased capital spending and the administration’s stated focus on domestic jobs, infrastructure and manufacturing,” says Ross. “In theory, these should all work to drive earnings per share higher for LTL carriers—but in practice it may take a while.”

For some leading LTL carriers, it’s already happening. XPO Logistics, the nation’s 2nd-largest group of LTL carriers, earned a profit in the first quarter of a year for the first time since 2010. According to CEO Brad Jacobs, XPO, the former Con-way Inc., is benefitting from the boom in e-commerce, last-mile delivery capability, investment in technology and cross-selling among other XPO units.

For some leading LTL carriers, it’s already happening. XPO Logistics, the nation’s 2nd-largest group of LTL carriers, earned a profit in the first quarter of a year for the first time since 2010. According to CEO Brad Jacobs, XPO, the former Con-way Inc., is benefitting from the boom in e-commerce, last-mile delivery capability, investment in technology and cross-selling among other XPO units.

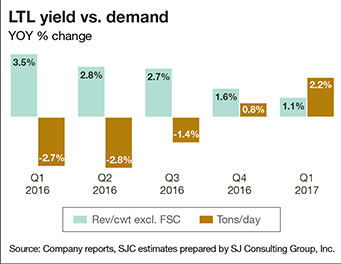

Dating back to last year, overall LTL demand is picking up, if only slightly. Fourth quarter daily tonnage and shipments at public LTL carriers rose about 1% on average, but at least both were positive for the first time since the fourth quarter of 2014. Low-single-digit growth rates are forecast for the rest of this year.

Stifel’s Ross says that the key to 2018 growth is an improving manufacturing sector and reduced truckload supply, which might be sufficient enough to cause lighter-weight TL shipments to flow back into LTL networks.

Ross adds that LTL pricing should be higher for the rest of this year. In fact, revenue per hundredweight (yield–not pure price) rose on average 1.8% in the fourth quarter. He’s currently forecasting 2% higher rates this year.

Unlike the TL market, which recently saw a $6 billion merger between Knight and Swift Transportation, analysts are not expecting similar moves in LTL due to the fact that public LTL carriers already have their networks largely built out. Few analysts are expecting any mega-mergers in LTL. “There simply aren’t any benefits,” says Ross, who adds that smaller, “bolt-on acquisitions” could make more sense down the road.

However, Saia—the only public LTL without a national footprint—is moving down the organic expansion path. “Even if Saia buys someone to accelerate its growth into the Mid-Atlantic or Northeast, it probably won’t be a publiccarrier, as they’re all too big,” adds Ross.

Of course, all these LTL companies are chasing Old Dominion Freight Line (ODFL), which posted a sector-leading $195 million in net income last year while posting an 83.8 operating ratio, a mark that leads the LTL sector.

ODFL vice chairman and president David Congdon says that his company formula for success is simple: 99+% on-time service in regional, interregional and national market lanes at competitive rates with low claims. That’s easy to say, but difficult to do consistently in the highly competitive LTL market place.

Article Topics

Motor Freight News & Resources

Following USTR review, White House announces tariff increases on certain U.S.-bound imports from China LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity Last-Mile Evolution: Embracing 5 Trends for Success A buying guide to outsourcing transportation management Harness Network Design for Supply Chain Success New Ryder analysis takes a close look at obstacles in converting to electric vehicles Between a Rock and a Hard Place More Motor FreightLatest in Logistics

Following USTR review, White House announces tariff increases on certain U.S.-bound imports from China Insider Q&A: Improving Freight Transportation: Anticipate scenarios, mitigate disruption, think long-term Inflation continues to have a wide-ranging impact on supply chains, notes Blue Yonder survey National diesel average decreases for the fifth consecutive week, reports EIA New Union Pacific service connects Southern California and Chicago Automate and Accelerate: Replacing Pick-to-Light with the Next Generation of Automation STB Chairman Martin J. Oberman retires More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources