2018 Air Cargo Roundtable: Carriers go all in

While it appears that air cargo providers are finally playing their cards right, shippers are eager to see if their carriers use more caution in the future—or decide to double down while their hands are hot.

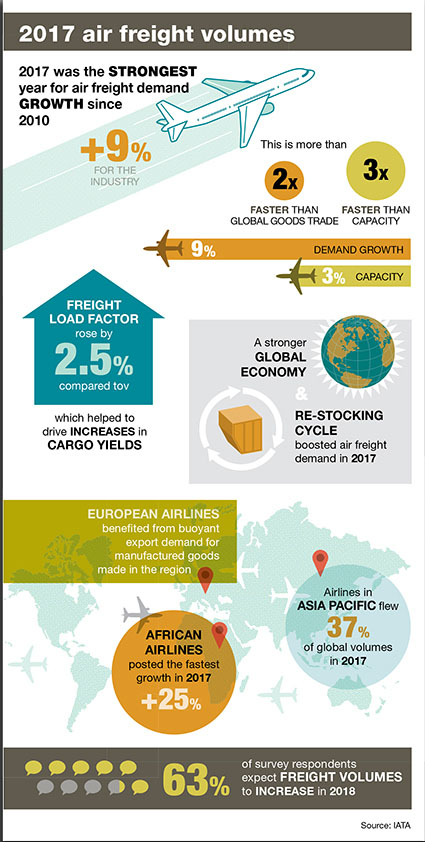

Air cargo providers had a very good year in 2017. The International Air Transport Association (IATA) reports that global airfreight markets grew by 9% last year, more than double the 3.6% annual growth recorded in 2016. Meanwhile, freight capacity rose by 3% in 2017, marking the slowest annual capacity growth seen since 2012. But when all the data is rolled up, demand growth outpaced capacity growth by a factor of three.

To help Logistics Management examine the choices and challenges lying ahead for air cargo shippers during this fruitful period for their providers, we’ve asked three prominent air cargo experts from diverse disciplines to respond to questions posed by global logistics managers concerning the current state of the industry in our annual “Air Cargo Roundtable.”

This year we’re joined by J. Bruce Chan, an air cargo institutional investment analyst with Stifel Capital Markets; Brandon Fried, president of the AirForwarders Association; and Skip Dokken, a consultant with London-based Drewry Supply Chain Advisors.

Logistics Management (LM): Let’s first address the elephant in the room. How will traditional air carriers compete with Amazon in the near future? Any long-term strategies that they can implement?

J. Bruce Chan: Competing with Amazon is essentially competing with insourcing. While we believe that, over time, Amazon is likely to expand its air network and may even offer for-hire air capacity to fill density, we think the opportunity to sell space to others is limited.

Brandon Fried: It’s an interesting question, but there’s a world of difference when managing flight schedules to meet your own internal needs as opposed to maintaining schedule integrity to meet the diverse needs of a large number of third-party shippers.

Skip Dokken: Indeed, traditional carriers have long been in the business of supply production and distribution facilities. The bulk of Amazon’s new flying effort will be in support of its direct-to-consumer business along the lines of FedEx, though they probably will get into supplying their own DCs wherever possible.

LM: We’re hearing a great deal about artificial intelligence (AI) these days. What will be its impact on air cargo operations?

Friedman: Artificial intelligence will begin to play a role sooner or later in air cargo operations. Hopefully the technology can be used to help airlines and forwarders better forecast the need for warehousing, temperature controlled facilities, improve tracking and provide better revenue management.

Chan: Technology leaders like UPS and FedEx are already exploring and even implementing AI, but its effects are more incremental. We believe AI is more likely to be seen first in areas like load planning, route optimization and customer service, with the result being more efficient use of personnel and, ultimately, better margins.

Dokken: That’s right, and it probably has already started…but not with a big bang. AI can bring significant improvement to areas like revenue management, as revenue managers will be able to upgrade algorithms and load plans at a much more rapid pace.

LM: Let’s talk about new market players. How high are the barriers to entry for air cargo providers?

Dokken: For carrying traditional airfreight with no-frills, all one needs is an agreement for a parked airplane. One could probably get some sweet deals on the planes, and that’s not a high barrier to entry. However, it doesn’t mean you’ll make money doing it after considering operating cost and market yields.

Friedman: That’s true, but at the same time, barriers to entry for new asset-based air cargo providers with plenty of capacity have never been higher. Also, today, investing in technology is essential, and that comes at a price.

Chan: Agreed. Technology solutions can allow new entrants to substitute innovation for capital and compete more effectively with incumbents while utilizing fewer assets. In addition, a wide range of available off-the-shelf software packages means that companies no longer have to spend considerable time and resources building proprietary systems from scratch. But we’ve long said that technology can make smart people smarter, but it won’t make foolish people smart.

LM: Traditional cargo airports also appear to be under extreme pressure. Do you see an unchartered ground for new developments?

Dokken: Airports are part of the neglected infrastructure that we’ve been hearing about recently. Some of this extreme pressure comes down to simply not providing enough services and facilities to carriers to properly handle their cargo.

Chan: Capacity constraints at airports could lead to re-routing, different inventory management strategies, alternative modal selection, and higher pricing. All of those things will require more resources, technology and sophistication being devoted to supply chain planning. The lack of these elements is likely to drive more outsourcing to third-party logistics providers.

Friedman: Clearly, the planners underestimated demand for cargo facilities and supporting infrastructure before the e-commerce mega-trend began, and this may be hurting the industry. Some forwarders are challenged in finding the necessary warehousing and distribution center facilities in meeting demand for the purpose. Of course, given that most cargo managed by forwarders moves on

passenger aircraft, the potential for new airport market entry is quite limited, but still possible.

Take Rickenbacker Airport in Columbus for example. The airport was a former military Air Force Base and is now primarily used for international freighter operations supporting retailers and forwarders who use the facility as a primary distribution point. From this location, retailers have 80% of the U.S. population located within 500 miles of its runway.

LM: Major airlines and consolidators must be pleased with the current limited available capacity. How will they try to keep the status quo?

Friedman: This is a delicate balance, as forwarders faced with heavy demand may also find themselves with capacity challenges. Given the amount of trade now moving on passenger aircraft, this is more a question of adapting to an ever-changing market.

Dokken: If we can keep the global economy booming, half the battle is won. That’s the demand side. For the supply side, we need to watch how much new capacity gets put into the market. A flood of capacity without a corresponding increase in demand has led to some lean times for providers and some unsustainable, rock-bottom freight rates for both providers and customers. The air cargo market had the same scenario not that long ago, but there has not been an exorbitant increase in capacity and freight rates have hardened on the back of tight capacity.

Chan: Air cargo capacity is historically scarce, with globally strong cyclical demand and secular growth in e-commerce squeezing from one side, while years of supply rationalization—particularly of main deck freighters—squeezes from the other. On the freighter side, it takes time to order and build or convert aircraft. And on the passenger side, air cargo is somewhat unique in that demand of freight does not dictate supply—rather, supply growth is driven by passenger demand. On top of that, pilots are hard to find. This means that the status quo is likely to persist whether the airlines and consolidators want it to or not.

LM: How will blockchain and bitcoin affect the industry? Is this just all buzz, or are there specific examples that signal a change?

Chan: While blockchain does have some practical applications for the industry, more so than bitcoin in our view, we do believe that it’s currently more hype than substance. The technology does have implications for faster and more precise payment and contract execution, less paper work, and generally signals a shift toward more automation, better information sharing, and greater personnel efficiency.

Friedman: When applied to shipment data, blockchain probably has a lot of merits, and I suspect it will catch on as cybersecurity is becoming so important in the logistical arena. Take the recent Maersk cybersecurity attack and its impact on the shipping line last year. Perhaps blockchain could be used to avoid a recurrence or attack on another entity in the transportation business. Regarding bitcoin as a medium for trade, I’m skeptical, as the currency appears extremely volatile with no regulatory structure and seemingly too much risk.

Dokken: I agree with Bruce and Brandon. Blockchain applications are still in a very early phase and lack standards, but watch this space as it will affect your business down the road. As for bitcoin, there are some very high-priced people in every financial capital around the world that are trying to figure this out.

LM: What must aircraft manufacturers do to accommodate new cargo demands? Will aircraft undergo any profound changes in their configurations?

Dokken: The manufacturers are constantly helping air cargo by bringing down the cost per ton-mile of their new models. This helps everyone in the supply chain, as these improvements reduce the need to go and ask for price increases.

Friedman: I’ll add that current aircraft configurations, especially for the passenger carriers, are likely to remain constant for the foreseeable future. In a market where cargo seems to be a byproduct of passenger operations, airlines tend to emphasize the needs of their passenger customers more so than freight.

LM: Let’s now consider the regulatory landscape. What new compliance hurdles will air cargo shippers be facing in the coming years?

Chan: Outside of political issues like Customs and trade compliance barriers, cybersecurity and data protection are front and center, especially given the recent Petya ransomware and NotPetya malware attacks.

Dokken: In this area, both shippers and service providers are at the mercy of politicians and bureaucrats who make or change the rules. And lately, there seems to be a lot more uncertainty about the world’s regulatory direction than in recent history—see Brexit, NAFTA, tariff changes and pending sanctions that are mounting.

Friedman: Security will always be a primary issue, and at this juncture, regulatory harmonization among major trading partners would help streamline processes and reduce cycle times. Terrorists are smart and will exploit loopholes, so countries need to work in concert to mitigate the threat. When it comes to defending against aviation terrorism, borders should be little more than lines on a map, and all countries need to be working together to keep air cargo and aviation safe.

LM: The United States is still missing a scheduled, all-cargo international airline able to take on the non-U.S. scheduled freighters. Do you see any changes on the horizon?

Dokken: Flying freighter aircraft is expensive, and if you’re fortunate enough to make a profit, the margins will not get you the best return for your investment. So, there probably isn’t much of a chance for a U.S. based all-cargo scheduled carrier starting up.

Friedman: At this point, there appears to be no significant new operators on the immediate horizon, but we are eternal optimists.

Article Topics

Air Freight News & Resources

UPS reports first quarter earnings decline 2024 Air Cargo Update: Cleared for take off Supply Chain Currents Part I: Is there a different way to move freight more effectively? Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes UPS fourth quarter earnings see more declines GRI Impact Analysis: Getting a Handle on Parcel Costs Averitt’s ‘State of the Supply Chain Survey’ presents an optimistic tone for 2024 More Air FreightLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources