Ocean Carriers Trends 2024: Unprecedented uncertainty

Ocean shipping is again at the mercy of environmental and geopolitical events—and the pessimists are winning over the optimists on the high seas.

As shippers look to the new year, they find that the shipping boom of 2020-2022 is over and the ocean carrier industry is rapidly sliding into severe over-supply, compounded by low traffic growth and further reductions in container freight rates on most routes.

On top of this, container shipping is facing numerous disruptions caused by issues ranging from labor problems at U.S. seaports to water shortages in the Panama Canal. However, the greatest issue surmounting these going into December were terrorist attacks on ships in the Red Sea.

“In October and November, we had a very clear message about what was going to happen with the industry,” says Stefan Verberckmoes, an analyst at Alphaliner. “We focused on the overcapacity that was going to result by the number of ship deliveries in 2024 and 2025 and warned that the market would not be able to absorb it.”

But now, because of restrictions with the Panama Canal and the conflict in Gaza, the picture has become completely diluted. As a result, 2023 ended with a sudden shift in focus prompted by attacks by Yemen-based Houthi missiles on vessels transiting the Red Sea. In mid-December, Maersk and Hapag Lloyd suspended Suez services and rerouted ships from the Far East and India around South Africa. Other major ocean lines immediately followed suit.

“But then there was the question of what to do with all the cargo destined for Jeddah and Djibouti,” Verberckmoes says.

The severe drought in Panama in August also led to a 200-ship pile up of vessels on both sides of the Panama Canal. Crossings had to be limited to 32 ships a day versus the usual 36, and those allowed passage had to carry less tonnage to reduce their draught from 50 feet to 44 feet. Some neopanamax vessels, with draughts of 60 feet, were diverted around South America or circumnavigate the globe to the Suez Canal.

Clear trends

With the world situation creating a demand for vessels, the problem of overcapacity could be resolved, albeit perhaps temporarily.

However, Peter Tirschwell, vice president for supply chains at S&P Global Market Intelligence and chairman of the TPM ocean container supply chain conference, notes how shipper-carrier relationships took a hit during the pandemic when capacity dried up and rates spiked to unprecedented levels, yielding the carriers all-time record profits.

“Trust was undermined and will take time to be restored, which will be difficult when many shippers want to recoup costs by driving rates down and carrier service will be unreliable and unpredictable due to measures taken to manage capacity,” says Tirschwell.

“Meanwhile, the cost of the detour around the Cape is enormous,” adds Verberckmoes. “It’s causing carriers to raise rates.”

The export rates for China, for example, are up again. “Carriers have experienced a full normalization of rates versus 2019, which, when combined with structural cost increases, means they are barely in profit making territory,” says Tirschwell.

As ships ordered during the pandemic are delivered, the industry is being forced to engage in active capacity management—including blank sailings, spontaneously added port calls, diverting backhauls around Africa, and slow steaming. “Slower steaming not only helps ocean carriers meet Carbon Industry Indicator [CII] criteria, it absorbs extra capacity,” says Verberckmoes. “Carriers are employing more ships to slow down.”

But, as ships are taking the big detour around the Cape of Good Hope, many are having to speed up again to make up time. “Adding one extra ship to a service to reduce speed adds an extra three days per direction on a round voyage,” Verberckmoes explains. “But going around the Cape adds seven to 10 days to the voyage.”

From a shipper’s perspective, this increases unpredictability and reduces service reliability.

“In fact, while profits, rates, and port congestion have all normalized to pre-COVID levels, the one measure that has not recovered is schedule reliability,” says Tirschwell. “With carriers’ needing to absorb additional capacity continuously over the next two to five years, active use of capacity management, and the negative impact it has on shippers’ supply chains, should be expected as the norm.”

Downbeat note

The challenges going into 2024 are many. Besides the situation in the Red Sea, Philip Damas, managing director and head of Drewry Supply Chain Advisors, anticipates the top trends in 2024 will be the untimely delivery of about 400 new containerships in 2024, exacerbating over-supply; enhanced risks of extra costs, delays and sailing cancellations in shipping; and sourcing continuing to rely less on China and more on other regions.

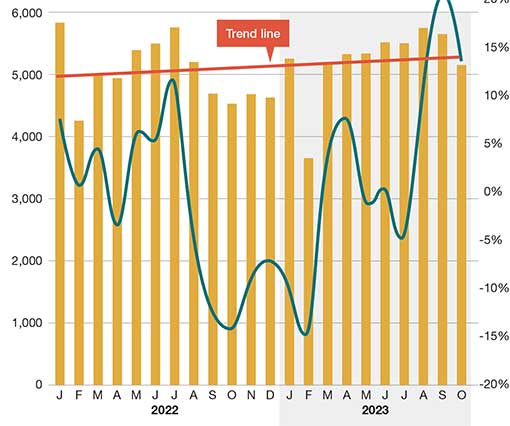

Top 8 Chinese ports: Export container traffic

Carriers are starting to scrap older, more polluting ships. They’re “idling” surplus ships, and they’re trying to reschedule the delivery of ships that they ordered during the recent shipping boom. And, according to Damas, they’re increasing the number of cancelled sailings.

“These are the various tools that carriers have to try and mitigate shipping over-capacity and the decline in their financial results,” says Damas. “But they face a huge wave of new capacity due to be delivered in 2024.”

Drewry forecasts container shipping’s weakest ever supply-demand balance in 2024 and the highest ever amount of ship capacity addition—2.9 million of new capacity. In the meantime, Damas foresees that, on most routes, it will be a buyer’s market. “With some exceptions, shippers will find it easy to secure capacity and lower freight rates,” he says. “My colleagues who run annual contract bids for shippers are finding that ocean carriers are very competitive, this year. So, at Drewry, we expect that contract rates in 2024 will fall again, but not as much as they did in 2023.”

Enhanced risks of extra costs, delays

Shipping is always subject to disruptions, but 2024 has a greater share of risks than previous years: risk of attacks in the Red Sea on commercial ships affecting the Suez Canal transits; risk of continuing water shortages in Panama affecting the Panama Canal transits; risk of port labor issues around the summer of 2024 by the ILA port union; and risk of unilateral cancelation of sailings by carriers.

Ocean carriers are adept at diverting ships and re-routing cargoes to get products to their destinations, but often can’t avoid delays and extra costs. “Already, some carriers have announced Panama Canal surcharges effective from January 1,” says Damas.

“In October and November, we had a very clear message about what was going to happen with the industry…We focused on the overcapacity that was going to result by the number of ship deliveries in 2024 and 2025 and warned that the market would not be able to absorb it.”

Many shippers are talking to their carriers to mitigate the risk of port delays when and if the ILA conflict happens.

“Routing via the U.S. West Coast will be more common,” says Damas, adding that shippers who saw their supply chains being undermined by lack of reliable shipping—or lack of shipping capacity—in 2021-2022 have been working on making their supply chains more resilient by their leadership.

“As carriers are again keen to work more flexibly with major retailers and manufacturers, we advise shippers to revise their contract terms with carriers to stabilize service quality levels and to define plans to address contingencies,” adds Damas.

China takes back seat

While China will remain a giant for manufacturing, for the first time in 30 years, China has lost its position as a high-growth shipping market (See chart).

“Based on data gathered by Drewry port experts in China, exports from China are flattening or growing imperceptibly,” says Damas. Ocean carriers are still heavily invested in China and China-based routes, but are now starting more shipping services on the higher-growth routes to and from India, Vietnam, Mexico, Africa, and South America.

Decarbonization issues

Among one of the major trends making and impact on ocean shipping today are new environmental regulations across the globe, particularly Europe.

A big emerging concern is decarbonization, and specifically how carriers can share with shippers the economic burden of transition to what are still much more expensive zero-carbon fuels—whether methanol, ammonia, or biofuels.

“Pioneering shippers such as Nestle, IKEA, H&M, and Europris have shown themselves willing to pay above-market rates for zero-carbon shipping, but they’re the minority, and it’s not clear how quickly more shippers will step up in the absence of regulation,” says Peter Tirschwell, vice president for supply chains at S&P Global Market Intelligence.

According to Tirschwell, the carriers are becoming increasingly vocal about the need for the International Maritime Organization (IMO) to set a carbon price sufficiently high to narrow cost differential as demand and supply scale up. “This is a topic that’s already a divisive debate among IMO member states,” he says.

The introduction on January 1, 2024, of the European Union’s “Emissions Trading Scheme” (ETS) on all routes to, from and within Europe is resulting in ocean carriers investing in low-carbon emitting ships and introducing ETS surcharges to re-coup the new European carbon taxes.

“Concerning the Carbon Intensity Indicator ratings of all ships by the IMO, carriers will be told in early 2024 whether their ships are efficient or inefficient concerning the emission of carbon and may have to take actions, such as reducing the vessel speed, for ships that score poorly,” says Philip Damas, managing director and head of Drewry Supply Chain Advisors.

Carriers are currently negotiating new ETS surcharges with many shippers.

“It’s not clear how the carriers’ proposed charges were calculated, how often the surcharges will be updated and whether they will be charged separately or as part of the base rate,” says Damas. “Drewry believes that it’s important that shippers should set the correct baseline for this new cost by obtaining independent cost calculations from a consultant to verify and standardize the proposed surcharges.”

The ETS surcharges could make the checking and auditing of carrier invoices more cumbersome.

It has become clear that shippers are setting up or improving their logistics networks in the new regions and production hubs. Facing weak demand in the United States and Europe, retailers and manufacturers are also looking for new markets or for new sources to de-risk their supply chains.

“Dealing with global ocean carriers, through a central procurement team at head office, can assist shippers to adjust to changing, international shipment and distribution networks,” adds Damas

Article Topics

Alphaliner News & Resources

Top 30 U.S. Ports: U.S. Seaports Persevere Ocean Carriers Trends 2024: Unprecedented uncertainty Top 30 Ocean Carriers: Riding high on wave of profits Ocean Cargo: Post-pandemic strategies take hold Quarterly Transportation Market Update: State of Ocean Cargo Anticipating a Sea of Change Ocean Cargo Update: Reversal of Fortune for Rates?Latest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources