Supply Chain Management (SCM) applications keep the supply chain humming

Interest in supply chain management (SCM) software accelerates as more companies replace their legacy systems and look for new ways to offset ongoing supply chain challenges.

When the global pandemic exposed an inordinate number of supply chain vulnerabilities—some of which the companies themselves were unaware of—more companies began turning to technology for help to close those gaps.

Anyone who wasn’t already using supply chain management (SCM) solutions, or whose systems were antiquated and no longer doing their jobs properly, looked for new ways to apply the technology to their pain points.

Fast-forward to 2024 and SCM continues to be a frontrunner in the software space, where companies use transportation management systems (TMS) to run their shipping networks; warehouse management systems (WMS) to manage shipping, receiving and fulfillment; and inventory planning solutions to minimize stockouts and overstocks.

Essential to the efficiency and productivity of the modern logistics and supply chain operations, SCM also helps companies coordinate shipping cut-off times, optimize routes, track shipments in real-time, improve service levels and scale up to meet demand during peak season.

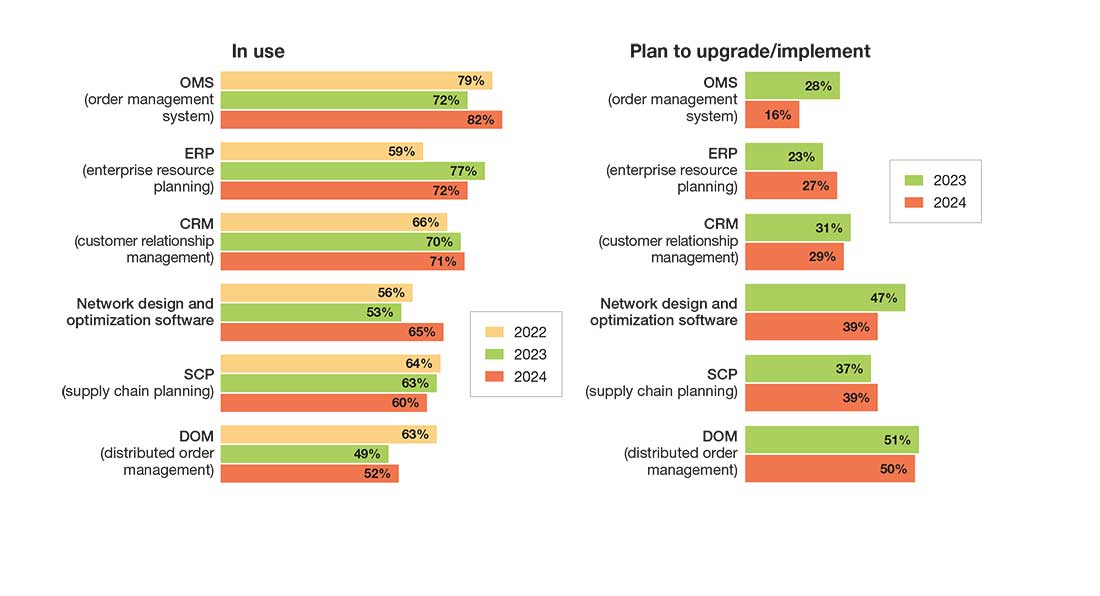

Some of the most popular SCM applications currently being used by warehouses and DCs include order management systems (OMS), enterprise resource planning (ERP), customer relationship management (CRM), supply chain planning, and network design and optimization software, according to Peerless Media’s 2024 Technology Study.

According to the study, 50% of companies plan to invest in new distributed order management (DOM) solutions within the next two years. Some of the other applications that companies plan to add to their SCM portfolios in 2024 or 2025 include network design and optimization software (29% say they’ll be evaluating these solutions), supply chain planning (39%), CRM (39%), ERP (27%) and OMS (16%).

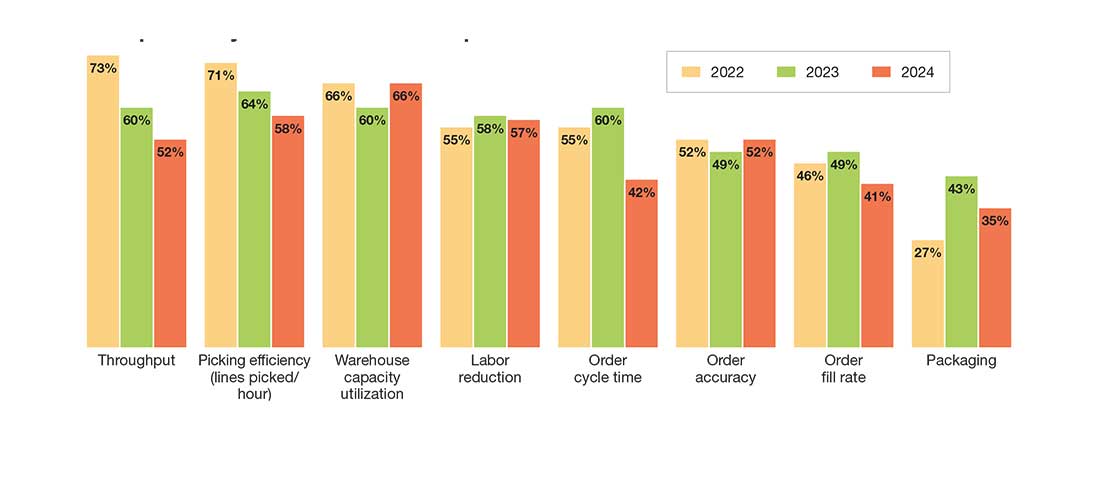

During the next 2 years, what areas are you looking to improve in your warehouse/DC operations?

With these new systems in place, companies want to be able to improve throughput, picking efficiency and warehouse capacity utilization. Other core goals they’d like SCM to help them achieve on a 2-year timeline include reducing reliance on labor, accelerating order cycle times and improving order accuracy.

Tracking CSCO priorities

Chief supply chain officers (CSCOs) and logistics managers have a lot on their plates right now. Labor shortages, geopolitical events, rising business costs, a dynamic transportation environment and changes in consumer preferences are all keeping these professionals up at night. These aren’t new challenges, of course; most of them spilled over from 2023 and right into the new year.

Citing a recent internal survey, Christian Titze, research VP at Gartner, says CSCOs are most concerned with achieving profitable growth, preparing for possible disruptions, managing digital transformation and developing effective workforce strategies. Others are concerned about their organizations’ sustainability initiatives and how to best leverage the power of generative artificial intelligence (AI).

Titze says at least one technology solution can be paired up with every one of these core challenges. For example, companies that infuse more automation into their supply chain operations can improve their chances of growing more profitably and reach their digital transformation goals. Similarly, organizations can use more AI to identify and manage disruptions and hit their digital transformation targets.

Right now, Titze says that he’s also seeing a major focus on supply chain data governance—or the policies and technologies that ensure the security of data across its lifecycle. “Data is the fuel for everything supply chain-related, so it’s really garbage in/garbage out,” he explains. “When you use AI to enhance and cleanse that data, you get ‘cleaner’ databases and more meaningful key performance indicators (KPIs).”

Breaking away from legacy SCM systems

Depending on how long a company has been in business, its legacy systems may have been in place for 10 to 20 years or more. These on-premises systems require much internal IT support, often command hefty annual licensing fees and lack the modern “bells and whistles” that more current systems offer. And because they were built during a time when software systems operated independently of one another, these unintegrated systems can’t readily share data with other applications.

As he surveys the logistics environment in 2024, Howard Turner, director, supply chain systems at St. Onge Company, says that this may be the year that more companies ditch their legacy SCM solutions in favor of more modern options. Specific to warehouse management, Turner has worked with multiple different companies in the last 12 months that are planning to upgrade their WMS systems—many of which were implemented 20+ years ago.

What supply chain management software solutions are presently in use in your organization and which will you be upgrading or implementing during the next 24 months?

Turner says upgrade cycles like this one happen every so often, and that the industry is “at the top of the cycle” right now. “A lot of companies are at the point where they’re looking to upgrade their ERPs, WMS and other business systems,” he says. Because companies are generally leery of upgrading or replacing major SCM applications at the same time, they pick warehousing first.

“It basically comes down to a ‘what comes first’ decision for companies,” Turner explains. “And what we’ve found is, for companies where their warehouse service is their core offering—think of a 3PL—it just makes sense to address WMS first.” For other non-3PL companies, he adds, it often makes more sense to replace an aging ERP first and then either use a new WMS that comes built into that ERP, or add a new warehouse system that can be integrated with the enterprise system.

Supply chains under pressure

Norm Saenz, St. Onge partner and managing director, says new SCM investments are largely being driven by new pressures to improve service levels, meet the demands of e-commerce distribution and manage inventory more effectively—all while maintaining high levels of productivity. All of this has to take place within the context of the logistics and transportation labor shortage, which is yet another driver of the SCM upgrade trend.

Saenz is seeing these scenarios take shape in St. Onge’s customer base this year. “We just started working with a company that has a legacy system that’s been in place for 30+ years,” he says. “The company is now opening its mind to testing the market, defining the functionalities that [it wants] and really getting out there to see what’s available on the market.”

The cost and availability of software is also pushing more companies to follow this path. Add the cloud to the list of compelling reasons why organizations think it’s time to replace their aging, on-premises software systems.

Put simply, the days when you had to put in huge servers to support your new software system are long gone. “People are getting more comfortable with the cloud,” says Saenz, “which is becoming a larger market that offers more options, competitive pricing and implementations that are easier than they were decades ago.”

Kevin Beasley, CIO at VAI, a developer of mid-market ERP solutions, says that companies are also “extremely interested” in software that comes with pre-integrations (those already in place) or easy integrations between various applications.

“We’re constantly integrating to various different systems,” says Beasley, who is also seeing big demand for predictive analytics and reporting that helps companies more readily address issues, leverage opportunities and ward

off problems.

“Companies also want software that helps them better control shipping [activity] and cut the related costs,” Beasley explains. “Backhauling has been used for years, for example, but lately there’s been a lot more focus on using it from an efficiency standpoint.” In most situations, that focus is being driven by a combination of the persistent labor shortage and rapid advancements in technology.

“Years ago, shipping software couldn’t do predictive analysis; it was a human being making decisions about how to deal with disruptions like what’s happening now in the Red Sea. Now, companies are using software’s predictive capabilities to identify issues in various parts of the world and then [make better decisions] based on that data.” - says Beasley

More platforms, please

As they shop around for net-new or replacement SCM solutions to run their supply chains, more of them are leaning toward platforms that can manage multiple different activities. Some of these applications may have multiple different native capabilities developed by a single vendor, and others use application programming interfaces (APIs) to effectively “tie in” outside applications into a core software ecosystem.

These end-to-end platforms offer advantages like reduced data silos, more seamless data flow across applications/functionalities, faster information retrieval and more automated workflows. They also support good collaboration across departments and provide a holistic view of the end-to-end global supply chain.

The fact that more companies are exploring platform options and automation in general doesn’t surprise Ann Marie Jonkman, senior director, global industry strategies at Blue Yonder. She says logistics services providers (LSPs) are particularly interested in using more automation that helps address the skilled labor shortage and the inevitable wage increases that come along with it.

“These companies are accountable to their shareholders and internal boards, and they need ways to either control those costs or do more with less,” says Jonkman. “Companies are calling upon automation to help with these and other issues.”

E-commerce retailers can also benefit from a platform SCM approach that eliminates data silos and gets everyone working from the same playbook, so to speak. The online seller that’s using paper, email and other manual processes internally, for example, and relies on a 3PL to ship its orders, is likely dealing with a lot of visibility gaps and disparate systems that manage the various aspects of its supply chain.

“We’re encouraging e-commerce companies, 3PLs and LSPs to get on a standardized platform and connect their solutions in the cloud using APIs (as needed),” says Jonkman. “That way, they can have one standard ‘brain’ that does the thinking, handles the process improvements and pushes out answers and/or suggestions.”

What’s next?

Looking ahead, Turner expects more interest in warehouse execution systems (WES)—solutions that orchestrate and optimize receiving, put-away, replenishment, picking, packing and shipping—as companies look for software that supports automated material handling equipment (e.g., robots, goods-to-person systems, etc.).

The company that’s designing a new fulfillment center, for example, will likely install multiple different pieces of automation in that DC or warehouse, including autonomous mobile robots (AMRs) for picking and automated storage and retrieval systems (ASRSs) for storage and fulfillment. In most cases, the equipment is manufactured by different vendors and can’t effectively operate in tandem with, or share data with, one another.

Turner sees WES as a good way for companies to fill these gaps and expects more vendors to catch onto this opportunity. “We’ve been working with companies that ideally would like to have a WES that can serve as the ‘orchestra conductor,’” he adds, “and effectively control the various pieces of automation that they’re using in their warehouses.”

Article Topics

Blue Yonder News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder announces acquisition of flexis AG Supply Chain Management (SCM) applications keep the supply chain humming Solving the Problem of Profitable CPG Distribution Drive Greater Supply Chain Resilience by Bringing Data to your Fingertips Fast Tracking ROI: Agile Logistics through Automation, AI, and Optimization Angove is named as Blue Yonder’s new CEO More Blue YonderLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources