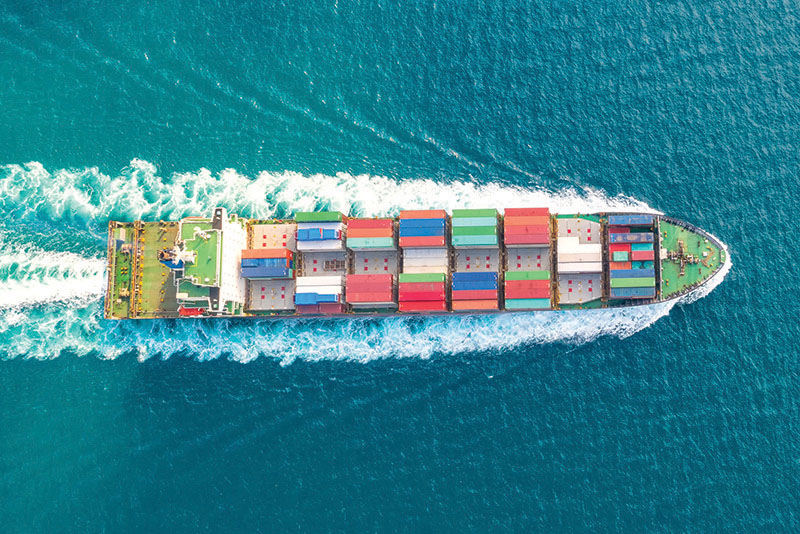

Ocean Freight: From famine to feast

It’s important to take note of the rapid adaptation by ocean carriers to the elastic demand in international freight in 2020. The owners and operators went from famine to feast in a few months.

It’s important to take note of the rapid adaptation by ocean carriers to the elastic demand in international freight in 2020. The owners and operators went from famine to feast in a few months.

Predictions of an end to global trade due to the pandemic and trade barriers were literally blown out of the water, with huge surges in demand for goods for consumers and large resellers. As of this month, western ports in North America are congested with cargo sitting on ships at anchor waiting for a berth to unload.

At the beginning of the year, there was a sharp decrease in demand for shipping services since retailers hesitated to restock their shelves as the pandemic spread. The remarkable thing was how quickly cooperating competitors in freight markets reduced ocean shipping capacity to match these dwindling demands to keep rates higher than expected.

When demand skyrocketed in the second half of the year, rates not only stabilized, but they also quickly increased while capacity seemed to recover less quickly. Good fortune or good co-opetition? As we are seeing in other modes of air, rail, pipeline and LTL freight, the consolidation of the market toward a few big players has brought discipline and a trend of ever-higher prices for transportation.

One could argue that the coordination between competitors is the root of the problem. Certainly, we can assume that it will not be favorable to shippers. However, there are several technology trends that do help shippers as well as operators. These developments will keep downward pressure on costs across the supply chain.

First is the development of optimization software that can handle the complexity of intermodal freight moving internationally. Like the airline industry, ocean operators and their forwarder customers are adopting third-party systems that can monitor rates in the market, forecast capacity in lanes and set pricing to maximize net revenue rather than just volume. Getting maximum pay for each cubic meter and keeping vessels moving are assisted by artificial intelligence (AI) that uses big data to help big operators.

On the shipper side, forecasting and AI-assisted inventory control tools are reducing lag-time in responding to changes in demand. Increased sales of an item or style logged in at cash registers in the Midwestern U.S. will trigger demand signals in China and the Southeast Asian production sites.

Shippers are increasingly able to feel comfortable with lead times and with landed costs as they expand their markets. Years like 2020 are an exception in that demand was chaotic, but despite this, leading carriers flexed their capacity to protect their businesses and retain customers.

The third element is the capacity-sharing agreements. Cooperating competitors removed sailings from the market schedule and the companies shared the remaining capacity. These “blank sailings” reduced shipper choices and supported price stabilization.

As an example, Maersk reports that over half of the bookings in key markets were spot rates, thus not subject to shipper-negotiated annual prices. The spot market, when controlled by few operators, historically results in upward trends in pricing.

The emergence and popularity of application programming interfaces (APIs) has enabled the AI applications to gather real-time detailed information on demand and supply. It can connect applications that weren’t originally coded or built to communicate with each other. The result is better decision making with far fewer errors in billing.

Operators argue that prices can’t be allowed to fall below basic operating costs. They contend that cooperation and space sharing protect the industry from steep losses that resulted in bankruptcies in the recent past.

With the new clean fuel costs, we were bound to see prices rise in 2020 anyway. The operators are seeing the fruit of using 21st Century technology to manage their business. Shippers do need to keep an eye on the technology as well as the coordination between competitors.

Article Topics

Ocean Freight News & Resources

Port Tracker report is bullish on import growth over the balance of 2024 Maryland DOT: $1.9 billion and up to four years to rebuild bridge sunk near Baltimore port 2024 State of Freight Forwarders: What’s next is happening now Baltimore bridge recovery efforts continue with opening of new channel Q1 sees a solid finish with strong U.S.-bound import growth, reports S&P Global Market Intelligence Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum More Ocean FreightLatest in Logistics

Automate and Accelerate: Replacing Pick-to-Light with the Next Generation of Automation STB Chairman Martin J. Oberman retires Get Your Warehouse Receiving Audit Checklist Now! LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity Last-Mile Evolution: Embracing 5 Trends for Success Optimizing Parcel Packing to Cut Costs A buying guide to outsourcing transportation management More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources