State of Reverse Logistics: Leveraging “the loop” is key to profits in this year

With the ongoing growth of e-commerce, the volume of returned inventory continues to rise for logistics managers in a variety of industry sectors. Finding warehousing space for this flood of goods will be a major challenge, say analysts.

Industry analysts note that mounting returns pressures have been reshaping the global reverse logistics landscape, as shippers now must find the right amount of space at the right time to secure a sweet spot in the circular economy.

But arguably, it’s U.S. retailers who’ve felt the greatest impact through the pandemic year. Long overlooked by many global logistics managers, reverse logistics has now emerged as a premium differentiator.

Indeed, some social critics maintain that the “reverse loop mission” has been challenged, and perhaps even compromised by the frenzy of consumerism and entitlement. Members of the mission are now re-calibrating for a more sustainable industry with its values put back in place. Meanwhile, there’s a warehousing space crisis.

“The compression in the warehouse and industrial real estate sectors reflects the ongoing demands created by e-commerce,” says Tony Sciarrotta, executive director of the Reverse Logistics Association (RLA). “And this trend will only become more intense.”

According to Sciarrotta, most U.S. retailers have yet to “come up to speed” in matching strides already made by manufacturers like Nike and Patagonia—companies that repurpose their products for consumption in a seamless cycle. “The ugly alternative is seeing Amazon and Walmart telling consumers to simply not return their goods,” he adds. “This might look great on paper for a while, but it clearly not sustainable.”

Dr. Dale Rogers, ON Semiconductor professor of business at Arizona State University, agrees, noting that the COVID-19 pandemic has left the reverse logistics space more fragmented than ever. “With the rise of e-commerce and the ‘Amazonification’ of retail, consumers expect a wide variety of ever-changing product options, with new merchandise available every time they visit a website or a retail store,” he says.

That means manufacturers are creating new products at a record pace, with more options to choose. And to create this “unlimited shelf” of products, with new product a constant, retailers are carrying more inventory than they may know what to do with.

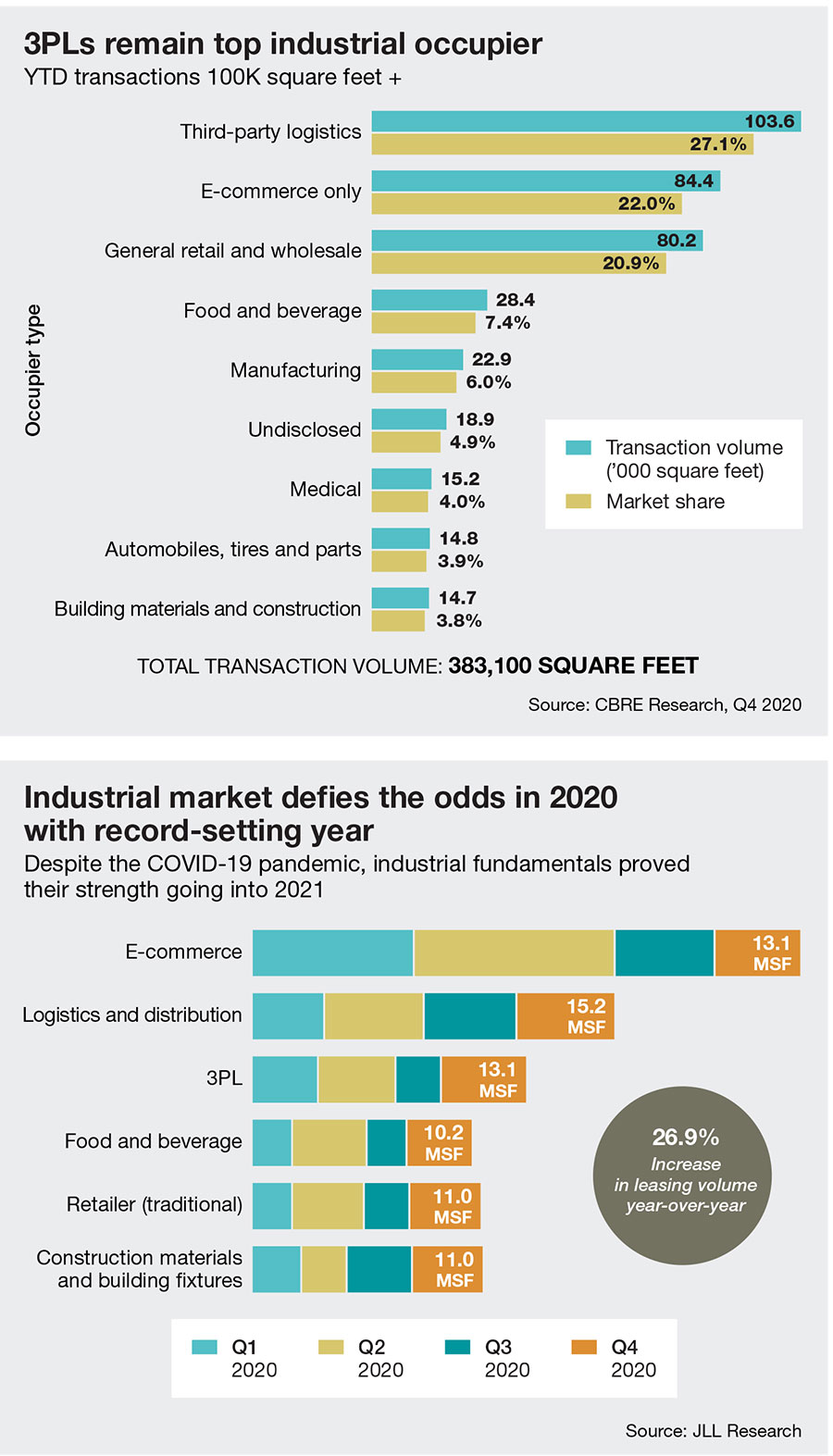

In its recent industrial market snapshot report, JLL notes that the nation’s manufacturers and retailers defied the odds in 2020 with a record-setting year—and the booming reverse logistics sector had much to do with it. Despite the COVID-19 pandemic, industrial fundamentals proved their strength going into 2021 and are fully prepared for heightened consumer demand.

JLL researchers found that occupation demand for industrial space remained remarkably resilient over 2020, with total leasing volume hitting 524.2 million square feet, a 26.9% increase from 2019. Indeed, net absorption continues to climb, surpassing the 250-million-square-foot threshold and exceeding 2019 totals by 47.6 million square feet.

Furthermore, though demand was widespread across all industries this year, e-commerce dominated the leasing market in 2020, representing over 16% of total leasing in 2020.

“A staggering 327.2 million square feet of new supply was added to the industrial market this year,” says Kris Bjorson, JLL’s executive brokerage director for industrial services for retail/e-commerce distribution. “With continued demand from e-commerce and logistics and distribution users on the rise, the pipeline shows no signs of slowing down.”

According to Bjorson, most JLL analysts were hedging their bets that this “roller-coaster” might slow down with the pandemic. Instead, there was exponential sector growth. “Logistics managers are now being charged with creating a variety of mechanisms to deal with new challenges,” he says. “For many retailers, it’s all about reducing the touch points for returns, which may mean more curbside activity.”

This means that JLL clients are looking for more parking and utility infrastructure for new buildings—and a longer lead-time for capital investment. “Up until last year, we believed the reverse loop could be addressed in a three-year to five-year timeframe,” says Bjorson. “Now it’s more like 10 years to strike the appropriate balance between labor and automation within four walls.”

Bjorson notes that the human resources needed for this reverse transformation is also changing. “When we make our site selection trips, we’re dealing with many more educated managers,” he says. “For reverse logistics to work well, these people have to be strategic thinkers, not just tactical cogs. There are bound to be more Black Friday episodes in the future, and that requires critical thinking and a vision for velocity.”

Sustainability questioned

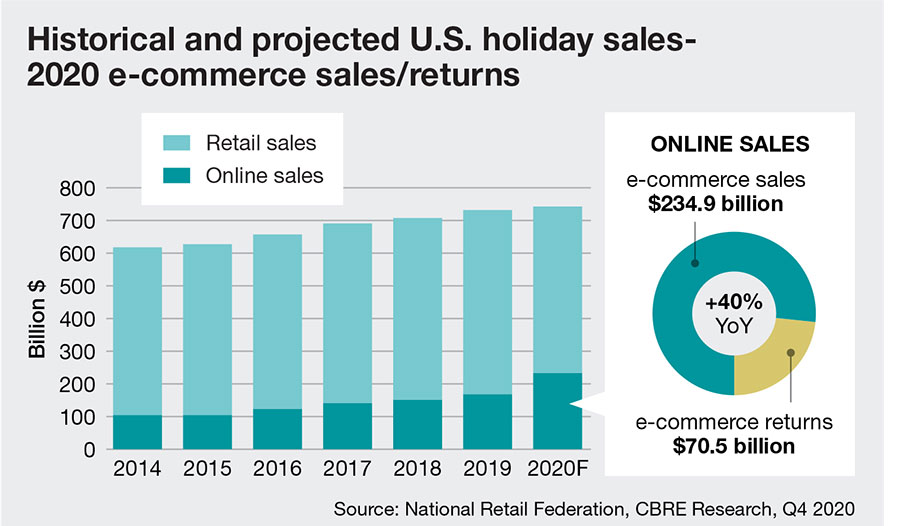

When the Los Angeles-based industrial real estate developer CBRE released its report “Reverse Logistics Stress Test: Holiday E-commerce Spike Will Lead to Record Returns” last December, many unanswered questioned remained about supply chain sustainability.

Matt Walaszek, director of industrial and logistics research for CBRE, said at that time that there would a heightened sense of attention being paid to the overload of goods ordered online this holiday season, due, in large part, to the COVID-19 pandemic. As a consequence, more “Class B” space would be leftover for the purpose of reverse logistics.

Walaszek further observed that the industrial logistics real estate space is continuing to experience tight market fundamentals, with vacancy rates at 4.7%, a number he says speaks to the need for more industrial space stock.

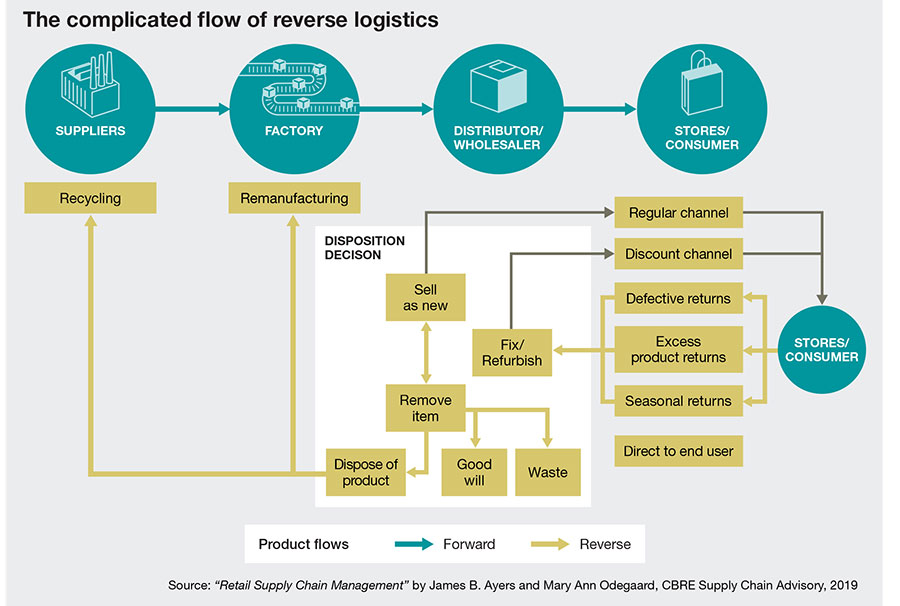

“But there have been some valuable lessons learned since the holiday rush,” says Walaszek. “For example, there are software providers like Optoro and Narvar offering a more efficient returns experience by leveraging consumer-use data, product and packaging design as well as operational data to better understand why an item was returned and integrated into the returns process.”

According to Walaszek, this prompts the operator on how to handle the return based upon the item’s condition. “Retailers may utilize these platforms to handle the complicated world of reverse logistics, protect their bottom line and minimize product depreciation,” he says. “They’re also attempting to balance consumer demand with sustainability while providing a seamless returns experience to protect their brand and customer loyalty.”

Walaszek also notes that many retailers do indeed contract with 3PL providers (XPO, Geodis, FedEx, UPS, NFI and many others) for their returns management to free up premium space for forward logistics. “This is a viable option for retailers that have a thin supply chain network and allows them to focus on other aspects of their business,” he says. “Third parties are capable of a wide array of services, and returns management falls within their purview,” he adds.

Building goodwill

According to Gina Anderson, vice president of solutions and growth of supply chain optimization at global services provider GEODIS, says beyond managing the high demand of last-mile delivery timelines, retailers also need to consider how they will build goodwill with customers during the reverse logistics process.

“Much like the contactless delivery solutions provided for shoppers like buy online pickup in store [BOPIS] and curbside pickup, retailers must also leverage innovative solutions to bridge the gap of the returns process,” says Anderson. “Returns are a critical part of a good reverse logistics network. So, why not elevate the customer experience when re-evaluating your reverse logistics program?”

Zac Rogers, Ph.D., an assistant professor of supply chain management at Colorado State University, agrees that other valuable takeaways have surfaced as a consequence of holiday shopping during the pandemic. “When Amazon talks, all others listen,” he observes. “Omni-channel distribution seemed like a radical idea two years ago, and now everyone is onboard with it. Consumer buying behavior patterns have been shaped by the pandemic, but we don’t see any of these reverse logistics strategies changing.”

Rogers concludes by noting that both city and suburban areas remain under pressure for more warehouse space, but better utilization of micro-fulfillment and “nano-warehousing” will take a lot of pressure off logisticians seeking to add smaller, flex-node operations to their reverse logistics network.

“We see this as a very healthy trend for small businesses and start-ups,” says Rogers. “It’s time for many ‘zombie’ companies to get out of the way.”

Article Topics

E-commerce News & Resources

UPS reports first quarter earnings decline Solving the last-mile delivery issue in New York City UPS is set to take over USPS air cargo contract from FedEx UPS presents updated financial goals and strategic targets at its investor day FedEx fiscal third quarter earnings see gains amid ongoing volume declines National Retail Federation 2024 retail sales forecast calls for growth Will recent talks between FedEx and Amazon lead to a reunion? More E-commerceLatest in Logistics

GXO’s acquisition of Wincanton is a done deal Q1 sees a solid finish with strong U.S.-bound import growth, reports S&P Global Market Intelligence Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources