Top 25 Freight Forwarders 2023: Bumps ahead for freight forwarders

The freight forwarding market continues to be negatively affected by the ripple effects of normalization in consumer behavior, as well as the global economic and manufacturing slowdown. Consequently, volumes handled by freight forwarders slowed down in the second half of 2022.

While all major forwarders benefited roughly equally from the market conditions in 2022, Armstrong & Associates, Inc. (A&A) finds in its 2022 ranking of the Top 25 Global Freight Forwarders by gross logistics revenue that 18 of these forwarders achieved revenue gains. (See chart: A&A’s Top 25 Global Freight Forwarders.)

Similarly, Transport Intelligence (Ti) finds in its research that 17 out of the Top 20 forwarders achieved revenue gains. It attributes this to soaring freight rates, particularly in the first half of the year.

“However, the exceptional market conditions of the past two years are long gone, and the markets are on a new trajectory,” says Viki Keckarovska, Ti research manager and freight forwarding team head. “While many forwarders saw record profits for the financial year 2022, fourth quarter numbers suggest that these results are more about the past than the present.”

Mergers and acquisitions

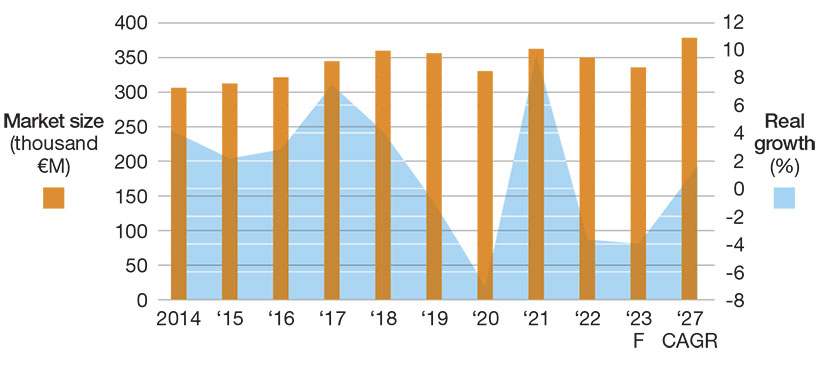

Global freight forwarder market, size and growth

Stepping into the No. 1 spot of A&A’s Top 50 Global 3PLs list for the first time in 2021, Kuehne + Nagel continued to hold its lead in 2022 not only by gross revenue, but also by both air and ocean volumes handled.

Although K+N’s airfreight tonnage remained flat at 0.5% growth and ocean twenty-foot equivalent (TEUs) TEUs dropped 4.9%, A&A reports that it still managed double-digit growth in revenues at 14.8% with all business units contributing significantly.

A contributing factor for K+N is its recent acquisitions. In February 2021, K+N made its largest acquisition ever with the purchase of Apex Logistics International and has also been expanding its perishables logistics business. “The combined entities created the largest global 3PL and airfreight forwarder, surpassing DHL, with K+N remaining as the largest global ocean freight forwarder,” says Evan Armstrong, president of A&A.

Merger and acquisition activity contributed to CEVA Logistics holding its 7th-place rank on A&A’s Top 25 Global Freight Forwarders list this year, while Nippon Express and C.H. Robinson fell to 8th and 9th place. Last year, CEVA’s parent, CMA CGM’s, acquired most of Ingram Micro’s Commerce & Lifecycle Services activities (CLS) for $3 billion, and French automotive specialist, GEFCO.

“In May 2023, CMA CGM announced its intent to purchase France-based Bolloré Logistics, which currently ranks 12th on our Top 25 Global Freight Forwarders list,” notes Armstrong. “The deal would be CMA CGM Group’s largest since its founding in 1978.”

Top 25 Global Freight Forwarders

(*Ranked by 2022 Gross Logistics Revenue and Freight Forwarding Volumes)

| A&A Rank | Provider | Headquarters | Gross Revenue (US$ M) | Ocean TEUs | Air Metric Tons |

| 1 | Kuehne + Nagel | Switzerland | 46,864 | 4,386,000 | 2,232,000 |

| 2 | DHL Supply Chain | Germany | 45,590 | 3,294,000 | 1,902,000 |

| 3 | DSV | Denmark | 34,883 | 2,665,147 | 1,557,972 |

| 4 | DB Schenker | Germany | 30,392 | 1,909,000 | 1,326,000 |

| 5 | Sinotrans | China | 16,405 | 3,890,000 | 781,000 |

| 6 | Expeditors | United States | 17,071 | 942,500 | 869,000 |

| 7 | CEVA Logistics | France | 18,700 | 1,300,000** | 520,000 |

| 8 | NIPPON EXPRESS | Japan | 19,932 | 756,741 | 867,038 |

| 9 | C.H. Robinson | United States | 23,874 | 1,425,000 | 285,000 |

| 10 | Kerry Logistics | Hong Kong | 10,483 | 1,176,370 | 515,419 |

| 11 | GEODIS | France | 12,624 | 1,146,100 | 293,984 |

| 12 | Bolloré Logistics | France | 7,466 | 793,000 | 708,000 |

| 13 | Kintetsu World Express | Japan | 8,710 | 697,828 | 688,823 |

| 13 | Hellmann Worldwide Logistics | Germany | 5,504 | 977,500 | 652,100 |

| 14 | UPS Supply Chain Solutions | United States | 14,294 | 575,000 | 864,000 |

| 15 | LX Pantos | South Korea | 8,243 | 1,527,000 | 123,000 |

| 16 | Yusen Logistics | Japan | 6,886 | 668,000 | 325,000 |

| 17 | CTS International Logistics | China | 3,274 | 805,651 | 373,139 |

| 17 | Maersk Logistics | Denmark | 14,423 | 658,000 | 211,484 |

| 18 | DACHSER | Germany | 8,918 | 575,600** | 236,865 |

| 19 | LOGISTEED | Japan | 6,053 | 455,000 | 176,000 |

| 20 | Savino Del Bene | Italy | 4,955 | 685,000 | 87,000 |

| 21 | Worldwide Logistics Group | China | 2,002 | 862,742 | 132,845 |

| 21 | Logwin | Luxembourg | 2,488 | 659,000 | 167,000 |

| 22 | Toll Group | Australia | 6,300 | 523,300 | 117,400 |

*Revenues and volumes are company reported or Armstrong & Associates, Inc. estimates. Revenues cover all four 3PL Segments (DTM, ITM, DCC and VAWD) and have been converted to US$ using the annual average exchange rate. Freight forwarders are ranked using a combined overall average based on their individual rankings for gross revenue, ocean TEUs and air metric tons.

**Includes LCL shipments.

Copyright © 2023 Armstrong & Associates, Inc.

Falling ocean and airfreight rates

John Murnane, senior partner at McKinsey & Company, sees the forwarding industry as one in a state of rebalancing. “Capacity, constrained from 2020 to 2022, has recovered,” he says. “But demand has been sluggish.”

This combination of stronger supply and weaker demand has caused the historically high rates experienced during the last couple of years to drop quickly. The first and second quarters of 2023 particularly have seen significant changes in the trajectory of freight rates, says Murnane. He attributes this to the overall economic environment.

Meanwhile, while freight rates have fallen, forwarder costs have increased, and margins have eroded. “Demand has been slow throughout 2023,” adds Murnane.

Ti finds that the demand for ocean and airfreight services over the past two quarters has been muted, putting a downward pressure on rates. Overcapacity, particularly in ocean freight, has contributed significantly to the falling freight rates.

“For instance, ocean trade volume is ~4% lower in the first six months of 2023 compared to the first half of 2022,” says Murnane. “Current trade levels are close to 2019.”

A&A notes that compared to 2021, the international transportation management’s (ITM) 2022 gross revenue growth of 19.3% to $146 billion and net revenue growth of 19.7% to $42.6 billion seems underwhelming. Last year, the 3PL Market segment “realized an unheard of 74.9% gross revenue gain and 44.6% net revenue increase from pandemic-driven demand from shippers focused on replenishing inventories to meet strong consumer demand,” Armstrong says.

ITM includes ocean and airfreight forwarding, associated inland transportation, shipment consolidation and deconsolidation, customs house brokerage, and related warehousing services.

Armstrong notes that the ITM environment has dramatically changed since mid-2022, with ocean freight rates from Asia to the United States trending down to pre-pandemic levels.

“In the third quarter of 2022, ocean shipping rates and domestic transportation rates began to disinflate in the United States as consumer demand moderated and supply chain operations stabilized,” says Armstrong. “China to United States and Europe ocean shipping rates have declined as much as 90% since the peak in early 2022.”

In turn, 2023 has seen an increased willingness for ocean carriers to provide contracted capacity and good rates for targeted port-to-port pairs as import growth of furniture, consumer, and retail products has waned. Generally, outside of current labor disputes, ports are less congested and drayage capacity is readily available.

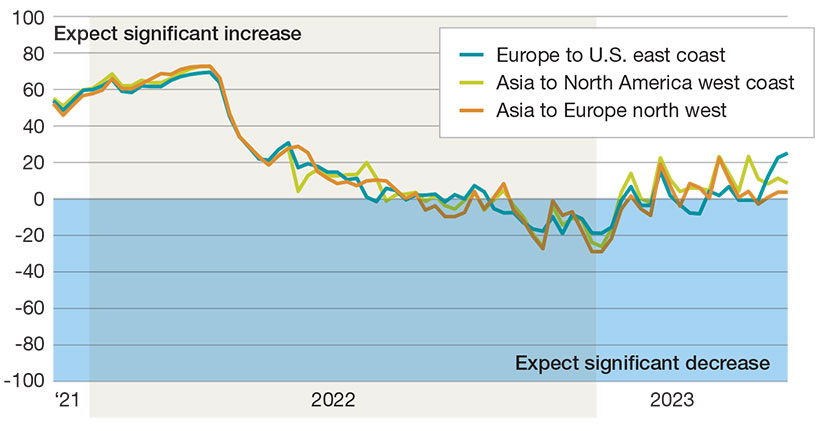

Ocean freight confidence index

“In the second half of the year, ITM demand should start rebounding from China once shippers need to replenish inventories,” says Armstrong. “This should stabilize ocean rates from Asia to North America.”

As rates come down, shippers have also changed the way they contract with forwarders and carriers. “Shippers are opting to contract longer term contracts, trying to lock in low rates for the remainder of the year and before,” says Murnane. “Those who had higher rates are seeking to renegotiate their contracts to take advantage of the lower rates. The first half of 2023 has seen a large number of contracts being tendered by shippers to benefit from lower rates.”

Both forwarders and carriers are willing to provide low rates to secure volumes, which will keep rates low for the upcoming months, notes Murnane. With ample capacity to choose from, carriers are not booking capacity well in advance.

“Rather, they’re waiting until the ‘last minute’ to book their capacity, and thus giving them as much flexibility as possible,” says Murnane.

Digital forwarder challenges.

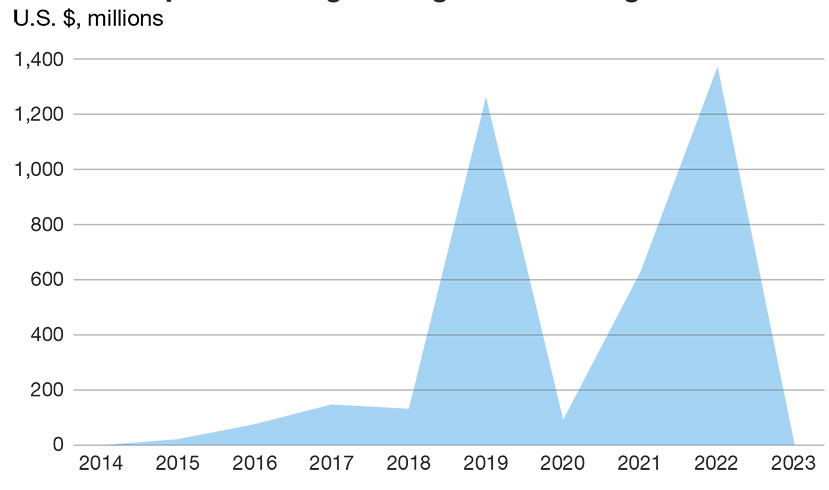

Digital forwarders are adapting to new market realities and the tougher venture capital investment environment. But a worsening macroeconomic environment has led many to-evaluate their growth strategies.

After bouncing back in 2021 following the pandemic, the global freight forwarding market contracted by 3.7% in real terms (holding prices and exchange rates constant) in 2022 according to Ti estimates.

The major forces that shaped the world economy in 2022 are set to continue into 2023. Consequently, the global forwarding market is expected to contract even further in 2023 (-3.9% in real terms).

During the pandemic, and especially after the reopening of economies, most of the digital forwarders hired a lot of staff as they were planning for a different economic reality.

“But the volumes did not materialize, and consumer demand moderated in early 2022,” says Viki Keckarovska, research manager and freight forwarding team head at London-based Transport Intelligence. “As a result, most of the digital freight forwarders started laying off staff.”

Keckarovska attributes this to two reasons: over-hiring to keep up with rising demand; and a tougher investment environment. “We’re seeing a shift in the venture capital landscape with investors being more cautious and slowing down the deployment of capital in digital forwarders,” she says.

So, digital forwarders will have to re-evaluate their growth strategy and their strategies to become more targeted toward profitable growth, Keckarovska notes.

“To achieve this, they will have to optimize their resource allocation,” she says. “The layoffs are a key element of the cost optimization process. We might therefore expect to see more layoffs in the coming months among digital forwarders.”

—Karen E. Thuermer, contributing editor

Ti’s latest poll data, as reported in Ti’s Ocean Freight Confidence Index, indicates that a more volatile market is expected with more regular and smaller monetary swings in both directions. “Supply continues to outstrip demand, contributing to falling freight rates and consequently reduced yields among forwarders,” says Keckarovska.

With passenger air travel back at full swing, belly capacity has injected capacity to a crowded market, leading to overcapacity. International Air Transport Association (IATA) data shows that average load factors are close to ~45% for this year, which are near 2019 levels.

“Airlines and forwarders are getting jumpy because of falling rates, not so much the volumes,” says Niall van de Wouw, chief airfreight officer at Xeneta. “It’s the fear-of-missing-out that is driving the aggressive drop in cargo rates because no one wants to lose volumes—and they also want to get more of the cargo that’s in the market. We can see forwarders taking big risks.”

Leveraging technology, sustainability

These challenging conditions are forcing forwarders to reassess strategies and find ways to improve operations, streamline processes, and add value-added services to pull back eroding margins. One solution is to invest in technology and digital capabilities.

Consequently, forwarders are employing technology to manage and coordinate the transfer of goods, including accepting bookings, organizing documents, tracking shipments, and providing bids and invoicing.

Ti research finds that top freight forwarders have already developed online customer platforms for quotations and instant bookings. For instance, DSV’s digital platform myDSV, launched in 2017, achieved over 90% of DSV bookings by the end of 2021.

Venture capital funding in freight forwarding

“Investments in technology, in particular in visibility, will increase, because this is considered a critical service differentiator by shippers and a service that forwarders and carriers need to offer,” says Keckarovska.

Another factor making an impact on freight forwarders is increasing pressure to adopt sustainability measures. Consequently, global forwarders are dedicating significant resources to sustainable practices. DHL, for one, says it’s investing $8.25 billion by 2030 to reduce all logistics-related emissions to zero by 2050.

Ti notes that of the top freight forwarders, a few companies demonstrate more ambitious targets for the next 10 years to 15 years, such as 100% use of renewable energy or an aim for carbon neutrality.

“The majority of companies, however, are working toward carbon reduction, but at a slower pace,” say Keckarovska. “For instance, out of the top 10 sea and airfreight forwarders, only five have set carbon neutrality target dates.”

So, what are the takeaways? Analysts advise shippers to attach great importance to selecting a transportation provider that offers real-time visibility and tracking solutions for on-time performance. “The volatile freight rates that we’ve seen over the past two years increased the need to rely on freight rate benchmarking,” says Keckarovska says.

However, shippers still lack real-time insights into rates. “Getting access to freight rate benchmarking with real-time data will enable shippers to react appropriately and quickly to fluctuations in rates, to uncover cost reduction opportunities and execute their procurement with better market intelligence,” adds Keckarovska.

Article Topics

Armstrong & Associates News & Resources

LM Podcast Series: 3PL market update with Evan Armstrong 3PL market update with Evan Armstrong Wincanton’s board endorses GXO’s acquisition offer Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes 2023 In Review: Let’s turn the page Digital Freight Matching (DFM) Roundtable: Swift momentum amid an uncertain economy Third Party Logistics (3PL) providers bolster e-commerce fulfillment services More Armstrong & AssociatesLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources