2023 State of Logistics: Rail/Intermodal

Rail/Intermodal volumes remain uneven as service improvements continue to take hold.

While the pandemic may no longer be front and center, its impact is still felt in the freight railroad and intermodal sectors.

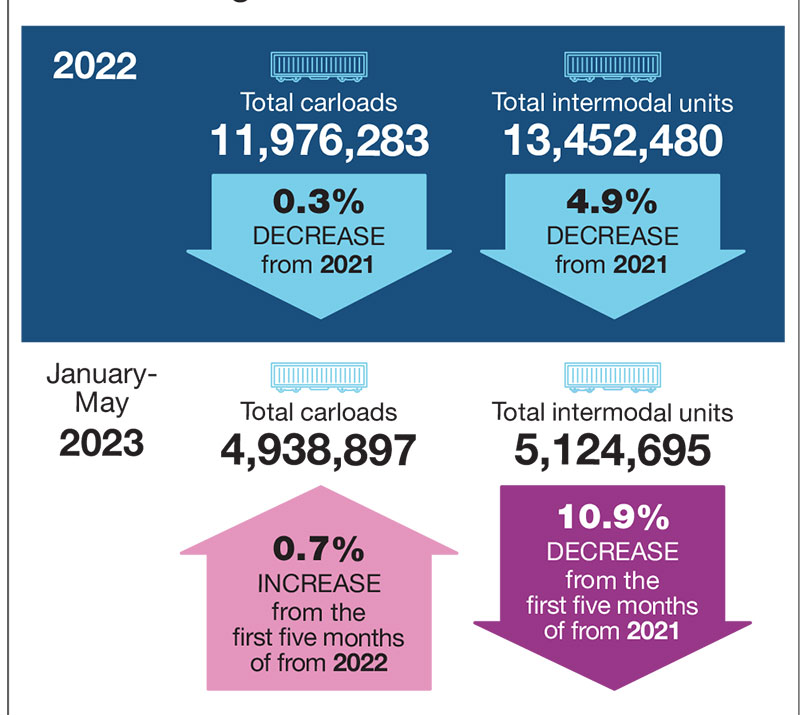

Taking a quick look back over recent years, from a rail carload and intermodal volume perspective, things go along these lines: 2020 volumes plunged while the economy was locked down; 2021 saw gains that were, in part, aided by helpful annual comparisons; and 2022 volumes ended the year in what could be viewed as a mixed bag, with total U.S. rail carloads off 0.3% annually, while intermodal containers and trailers were down 4.9%.

Fast forward a year later, and those numbers are similar, with some variation. On a year-to-date basis through May, U.S. rail carloads are up 0.7% annually, with May alone up 0.8% for its third monthly annual gain over the first five months of 2023, according to data issued by the Association of American Railroads (AAR). The average weekly carload tally for May—the most recent month for which data is available—came in at 225,851, which the AAR said was “down fractionally” from the March and April averages.

As for intermodal volumes, May U.S. container and trailer volume came in at 1,190,553 units, for an 11.1% annual decline, compared to a 4.3% decline over the same period a year ago. And through the first five months of 2023, U.S. intermodal volume is down 10.9% compared to the same period in 2022. May’s annual decline represented the fifth consecutive month of annual declines, while the month’s weekly intermodal average—at 238,111 containers and trailers—represented its highest tally over the last six months through May.

The AAR observed that a key driver for intermodal volumes under-performing pertains to around half of intermodal shipments being tied to international trade, with port activity closely tied to railroads. And with U.S.-bound imports declining over the last several months, that has subsequently led to decreasing rail intermodal volumes on a year-to-date basis, coupled with other factors like inflation, reduced consumer demand, and a shift in spending by consumers from goods to services.

AAR president and CEO Ian Jefferies told Logistics Management that when looking at rail carload and intermodal volumes on a year-to-date basis, they’re mostly in line with expectations. “There have been some ups and downs, and the economy still has some uncertainty going on,” he says. “There’s some variation in some key economic indicators, and rail traffic reflects that.”

Even with the uneven volumes, Jefferies points to a few bright spots volume-wise, including motor vehicles and parts, which saw a 17% annual gain in May and a 6.5% gain year-to-date. He adds that coal volumes are “trudging along,” down 1.7% annually in May, but up 29.2% year-to-date, while also observing grain loadings have been a bit of a mixed bag.

“Intermodal is not where we want it to be, but at the same time, I don’t think that’s an overwhelming surprise when we look at the decrease in import volumes at the ports,” adds Jefferies. “It may be a bit of a bumpy ride with the economy, but we will be ready to do our part with our customers as things move on through the rest of the year.”

From a service perspective, freight railroads have been under a watchful eye by the Surface Transportation Board (STB). That was made clear in a recent decision it issued titled “Urgent Issues in Freight Rail Service—Railroad Reporting” that explains that rail network reliability is essential to the U.S. economy and a foremost priority for the STB itself.

STB said that various stakeholders have indicated that there have been substantial increases in problems arising from tight car supply and unfilled car orders, delays in transportation for carload and bulk traffic, increased origin dwell time for released unit trains, missed switches, and ineffective customer assistance.

U.S. rail cargo volumes

The board added that the data for key performance indicators, including velocity, terminal dwell, first-mile/last-mile service, operating inventory, and trip-plan compliance “show that railroad operations remain challenged generally,” adding that “at this time, therefore, continued monitoring is needed.”

Anthony Hatch, principal of New York-based ABH Consulting, explained that Class I railroad service metrics appear to be showing signs of improvement, with the exception of Norfolk Southern, which is still dealing with the impact of the East Palestine, Ohio, derailment in early February.

“One of the key things we’ve been watching is the number of crews that have graduated and put in the field. They’re not done in dealing with crew shortages. In a network business, shortages in one specific area are hard to cover, as people can’t be easily moved around, as they are regionally trained. That can back things up in areas even where there’s enough crew capacity. The reduction in demand has helped with some of this; however, there’s definitely business the railroads lost, because they couldn’t handle it, due to service-related reasons.”

- Anthony Hatch, principal of New York-based ABH Consulting

Article Topics

AAR News & Resources

U.S. rail carload and intermodal volumes are mixed in April, reports AAR U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report U.S. rail carload and intermodal volumes are mixed, for week ending April 6, reports AAR Railway Supply Institute files petition with Surface Transportation Board over looming ‘boxcar cliff’ U.S. March rail carload and intermodal volumes are mixed, reports AAR Federal Railroad Administration issues final rule on train crew size safety requirements More AARLatest in Logistics

Port Tracker report is bullish on import growth over the balance of 2024 Varying opinions on the tracks regarding STB’s adopted reciprocal switching rule National diesel average falls for the fourth consecutive week, reports EIA New Descartes’ study examines consumer preferences, changes, and shifts in e-commerce home delivery preferences Potential Canadian rail strike could damage the country’s economy C.H. Robinson highlights progress of its AI-focused offerings with a focus on automating shipping processes UPS announces CFO Newman to leave company, effective June 1 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources