2024 Transportation Rate Outlook: More of the same?

Our annual gathering of freight transportation industry analysts reveals that the cycle of rate and capacity fluctuations continue their age-old volatility, but in a more muted fashion. Here’s a look at the elements that have ushered in this current malaise.

Way back in 1980, Bruce Dern starred in a little-known film called “Middle Age Crazy.” There’s a scene where his character is asked about the future, and his character replies: “The future? The future sucks!” Given the state of the world, one might feel that way here at the beginning of 2024; however, there are some glimmers of light.

The U.S. economy is faring pretty well, with inflation moderating and disruptions of international trade seeming to wane a bit, despite continuing instability around the globe. Unemployment remains at historic lows, and off-shored manufacturing seems to be gradually returning either to North America or Mexico as the labor arbitrage advantage of Asian sourcing is diminishing and tension with China is on the rise.

So, barring any unforeseen catastrophic circumstance, 2024 looks to be a bit more of the same—freight rates stable or declining across the modes, at least for the first two or three quarters, and capacity a non-issue in most cases, at least during the first half. As the French may say: plus ça change, plus c’est la même chose. Which in this case means the cycle of rate and capacity fluctuations continue their age-old volatility, just in a more muted fashion.

Our goal here is to take a look at what 2024 portends in terms of rates and the cost of moving product through the supply chain. And, as usual, we’ve gathered a number of industry experts and practitioners to gain a variety of insight from around the logistics and freight transportation markets. Let’s dive in.

Setting the table

The shipper view of the future is more uncertain than usual, with some commenting that they would wait until they ran through their annual bid cycle in the new year before making any judgments.

According to Michelle Livingstone, formerly vice president of transportation at The Home Depot and adjunct professor in University of Denver’s Graduate Supply Chain program: “My crystal ball is a little fuzzy, but I would be planning for low- to mid-single digit rate increases for truckload [TL] and intermodal during the back half of 2024.”

Domingo Amunategui, former vice president of supply chain at forest products producer Arauco, says that the he would expect a balanced market without major changes to price or capacity, excepting maybe the usual seasonal upticks. “Carriers who focus on service or value-added solutions [i.e., visibility] will probably gain market share,” he says. “I personally lean toward a mild recovery with the seasonal spring/summer volume increases.”

Jason Kuehn, partner at Oliver Wyman, continually tracks freight transportation industry trends. His position is in line with others. “Overall, we think we’ll have another year of uncertainty, and with uncertainty comes rather lethargic rates. Even though inflation has moderated, it’s still above Fed target levels. This suggests that the Fed may take a wait-and-see approach, but is not likely to lower rates. This will still constrain economic growth.”

So, without much economic growth, rates are likely to remain flat to modestly higher. Truck rates may slowly increase as capacity drops out like it was doing during the second half of 2023. Rail rates are largely a derivative of truck rates, so if rails raise prices to offset their cost increases faster than trucks do, there will be modal shift to trucks and this will keep a damper on rail rates.

With that foundation, let’s go into the modes.

Trucking

Trucking suffered in 2023, and there’s precious little empirical evidence that it will get a lot better any time soon. Revenues are down, costs are up, and volume is limp.

There was an injection of capacity during the pandemic, as operators sought to capitalize on the huge upward spike in rates. However, as market reports indicate, that’s shaking itself out, but at a cost, with a large number of carriers exiting the market. The issue now is more a supply-demand balancing act than an issue of what’s going on in the current economy.

Industry freight transportation veteran Ted Prince, principal of TP Associates, characterized it this way: “We are in a land of no comps.”

According to John Larkin, strategic advisor at Clarendon Group and senior partner at Venture 53: “A turnaround in 2024? Maybe, unless the Fed ups rates again, putting more pressure on growth.” His bottom line is that expectations are “muted” and not much change is anticipated, with the possible exception of later in the year.

Larkin contends that dedicated, cross-border, and less-than-truckload (LTL) rates should rise 4% to 6% in 2024. Each of those sectors has had steadier demand than the TL and intermodal segments. He adds that cross-border volumes—between Mexico and Canada—are holding up, even as outsourcing to China has peaked and now appears to be in a slow, but steady decline.

LTL carriers are benefitting from in-sourcing, automated manufacturing, and the failure of Yellow Freight. On the other hand, truckload carriers and intermodal operators are taking the brunt of the ongoing freight recession.

While some excess inventories are being run off and surplus capacity is exiting the industry, 2024 should be a little better rate-wise for truckload and intermodal players, with rate increases on the order of 1% to 3% in the realm of possibility. With a reversal in interest rates and some new fiscal policy stimulus, rate increases could exceed the 1% to 3% range during 2024.

According to a recent report from ACT Research: “With recession averted for now, for-hire volume growth should return as overall fleet growth fades, likely in the second quarter of 2024. But even as freight will likely rebound next year, it’s unlikely to be enough to tighten the market in the seasonally soft winter months, allowing the shipper’s market to persist. We expect freight rates to be pressured by these dynamics well into 2024.”

Spot market pricing is a good bellwether of what truck rate trends are, and if there was a single-word descriptor it would be “doldrums.” While some sources expect rates to begin climbing as early as the first quarter of 2024, there wasn’t much solid evidence to support that at press time—while most of our other participants are leaning toward second-half, at best.

Rail carload & intermodal

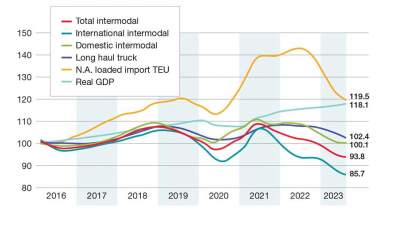

Intermodal volume thrives when international cargo is growing—which is not happening at the current time. The long-standing tradition of “peak season” devolved into “peep season” a few years ago and has not bounced back in any material way. The consensus expectations are that intermodal rates will not change much during 2024.

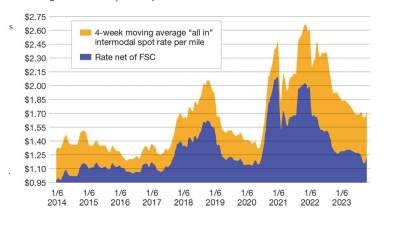

The U.S. Producer Price Index shows that intermodal is at a current level of 214.34, a nudge up from 212.33 last month, but down from 227.89 a year ago. This is a change of 0.95% from last month and -5.94% from a year ago.

Prominent intermodal guru, Larry Gross, president of Gross Transportation Consulting, is very diligent in tracking trends in this sector. In his view, intermodal is the tail of the dog from a rate perspective. Intermodal rates can’t move up faster than truck rates, and if they do, then lost volume is the result.

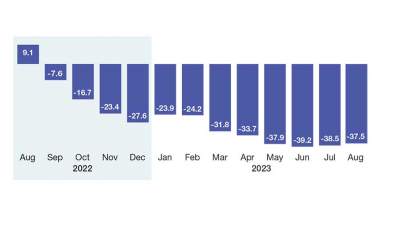

“We have certainly seen that in recent months with the performance of the rail-owned domestic container fleet,” says Gross. “Rail-owned boxes are where non-asset IMC’s have obtained most of their capacity. Pricing is set by the railroad, and about 12 months ago they reached a point where they were unwilling to further reduce rates.” And this led to revenue moves in rail-owned domestic containers being down more than 21% through October.

Gross points out that, in contrast, private boxes are up 3.5% year-over-year. “Our expectations for long-haul truck rates in 2024 is for very modest—low single-digit—increases,” says Gross.

According to reports, domestic intermodal market share has stabilized recently, but at a considerably lower level than where it stood four years ago. Price is certainly a key tool that can be deployed by the sector to recover some of that lost share. This would simply involve holding intermodal rates steady while truck rates move up.

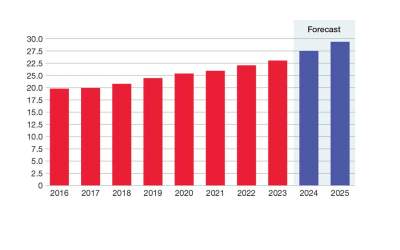

Gross contends that the railroads have been quite vocal of late with regard to an industry “pivot to growth.” It will be interesting to see whether their pricing decisions reflect a focus on growth versus margin enhancement.

What has been lost was starkly laid out at the recent Rail Trends conference by Rob Cannizzaro, COO of the Intermodal Association of North America (IANA). He stated that intermodal rail has lost about 1.4 million intermodal loads since 2017, which translates to about $3.5 billion in revenue. Indeed, ample truck capacity and lower rates, coupled with spotty intermodal service, have tarnished the once-glittering jewel in the rail portfolio.

Rail analyst Tony Hatch says he sees 2024 as pretty much more of the same, with rates rising, but only aimed at achieving the carrier goals of keeping up with inflation. Service will continue improving, employment and training has increased to support it, but as he sees it, there is still a lingering freight recession in a “ho-hum” economy.

According to Hatch, predictions are difficult because, in his view, we haven’t had a decent base year in quite some time due to a continuing series of disruptions, such as the pandemic and tariff wars, which skew results and make comparisons and trends difficult to pin down.

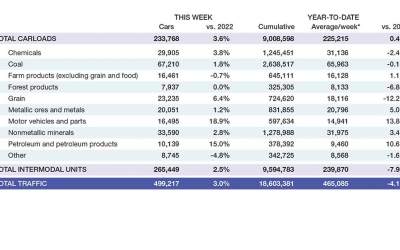

Carload business is sagging a bit, with the exception of motor vehicles and petroleum. Forest products is the big loser, which represents the key elements in construction, like plywood and dimensional lumber. Because new home construction seems to have stalled out with the rapid rise in mortgage rates, this is unlikely to change in the near-term.

Otherwise, rail appears to be, if not materially ramping up, at least seemingly taking steps to improve both image and customer “friendliness,” yet is still struggling with image issues, labor discontent and prices. So, what does any of this mean for 2024? Probably more of the same—carload rates inching up in certain cases and intermodal struggling to rebuild market share.

Ocean

Ocean rates have sunk to the lowest levels since before the rocket ship that launched major increases during the pandemic took flight. The effect of drought conditions on Panama Canal operations are making the news, but are not expected to have a material effect on rates in 2024.

Much of the U.S. East Coast traffic currently moves via the Suez Canal and will remain unaffected. As Ted Prince, former ocean carrier executive and transportation veteran puts it: “The Panama Canal is more about bulk, it can’t accommodate the largest vessels, and so 70% to 80% of East Coast freight is already moving via Suez.”

Prince says that the liner companies are doing a better job managing capacity by shrinking strings and blanking sailings in the face of a surge of new capacity coming on-stream. Much of that can be absorbed by slow steaming or super-slow steaming, so shippers can likely anticipate no large changes in rates.

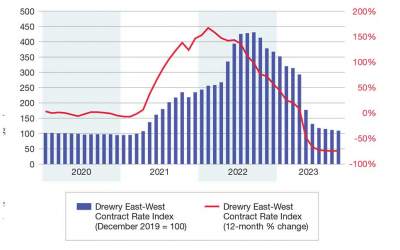

Philip Damas, head of supply chain advisors practice and managing director at Drewry Shipping Consultants in London, keeps a watchful eye on the market. In his view, as logistics staffs for retailers and manufacturers are preparing their annual ocean bids, Drewry expects that there will be further reductions in ocean freight rates in 2024, but not as large as in 2024.

“In the annual rate outlook webinar in January 2023, I predicted that year-long and six-month ocean freight rates would decline by more than 50% in 2023 due to excess ship capacity and weaker traffic volumes in global shipping,” says Damas. “Do not expect another halving of your ocean rates in 2024.”

According to Damas, factors that will cut ocean rates again in 2024 are that container shipping’s weakest ever supply-demand balance is expected during the coming year; the highest ever amount of ship capacity addition (404 new ships are scheduled to be delivered globally next year); as well as the current downward momentum of ocean contract rates.

“There has been more than a year of continuous reductions in ocean contract rates,” adds Damas. “For the ocean bids, which Drewry currently manages, we’re seeing ocean carriers continue to be very competitive on prices. In other words, 2024 will be a second year of a ‘buyer’s market’ for international container shipping, and retailers and manufacturers can expect to save a lot of money again.”

Air cargo

Air cargo executives are expecting 2024 demand to be flat or at best slightly above 2023 levels, according to speakers at The International Air Cargo Association (TIACA) Executive Summit event. They did sound a cautionary note that demand for 2024 was difficult to predict, given all the uncertainties in the current market.

Challenge Group chief executive Yossi Shoukroun expects the geopolitical situation to be a drag on demand expectations. “The coming year in terms of the global economy and the geopolitical situation, unfortunately, will not change and hopefully will not escalate, but the signs are not that good,” he stated.

This could, in turn, put pressure on air cargo capacity, Shoukroun added, as passenger services are reduced in response to lower demand from travelers due to the instability and higher fuel prices. Passenger demand could also be affected by extreme weather conditions, he said. Both of these developments would benefit freighter operators, he added, as they pick up on the lack of bellyhold space, which will—in turn—have an impact on pricing.

Several major players are investing in new freighter capacity and also in converting existing passenger assets to freight, so at least some optimism persists. Long-time industry-analyst Chuck Clowdis sees no major factors that will drive air cargo pricing upward in 2024. He also observes that high capacity usually means better rates to fill scheduled cargo flights.

Still, says Clowdis, air cargo service providers continue to add new service lanes and additional conversions to cargo configurations from passenger bodies.

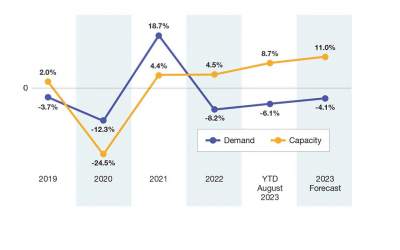

The International Air Transport Association (IATA) forecasts a 4.1% decline in air cargo demand in 2023 versus 2022. Year-to-date, 2023 IATA demand is at -6.1% while capacity has grown at +8.7%. The weaker air cargo demand is a result of continued high inventory levels, further increases in capacity and the fact that relative pricing between air and ocean shipping has driven some mode shifting—which does not bode well for 2024.

Capacity growth is continuing to outpace demand, with international belly capacity reaching close to 2019 levels. Market rates are continuing to decline, but have slowed and been mostly flat from May, although still elevated from pre-pandemic levels.

Parcel

Seasonal volume has been disappointing, and UPS is working to recoup losses in shipment count related to their labor challenges. Meanwhile, FedEx has been working to restructure some of its operations to become more efficient.

There’s also a continuing shift, as Amazon seeks to take on more and more of its supply chain. As reported in the Wall Street Journal: “The U.S. has a new No. 1 private parcel carrier. Amazon.com delivered more packages to U.S. homes in 2022 than United Parcel Service, after eclipsing FedEx in 2020.”

Satish Jindel of SJ Consulting observes that Amazon is now aggressively leveraging its supply chain and parcel transportation network beyond its private use and making it available to other shippers, which will surely hit competitors in all segments: freight forwarders; TL brokers, and parcel carriers.

According to Jindel; shippers can expect to benefit. “With the uncertain global environment, the consumer spending will not generate much economic growth, but government spending on arms and defense should increase, which may help segments that transport for such industries,” he says.

Brian Sternberg, a 40-year parcel veteran and former UPS contracts/pricing executive, says that 2024 will be more of a “buyers’ market,” moving from a “sellers’ market” 12-18 months ago. “This will be a great opportunity to realign your contracts with the current provider and also introduce non-incumbents to the party,” he says.

Sternberg points out that moving into 2024, the parcel carriers will continue extracting revenue as they have every year since the late 1980s. Expect annual price increases on the base rates, (6% to 10%), depending on customer package characteristics, not including accessorial charge increases, which can significantly add to overall cost (adjustments to fuel, weight, packaging, dimensional, peak surcharges, late payment fees, shipping charges, residential fees, and delivery area adjustments.

At press time, we confirmed that FedEx will announce a 5.9% “average” increase on January 1, 2024, as UPS will also do, effective December 25, 2023, with larger increases on the majority of accessorials.

“Evergreen” contracts that don’t expire often allow increases, as these contracts are based upon carrier daily rate and service guides (tariffs) that change yearly and contain those increases. In many instances termination fees are stated and consumer price increase (CPI) verbiage is built into these agreements, diluting discounts. Carriers are also continuing the limiting of guaranteed service refunds on ground and deferred air services.

Fuel

Fuel has been an increasing cost of operations for a number of years, and both market volatility and supply will not likely improve that picture during 2024.

Matt Muenster, chief economist at Breakthrough Fuel, is a keen observer and analyzer of behavior and market conditions in the diesel fuel arena. “We’re presently forecasting 2024 U.S. diesel prices to remain relatively close to the average diesel price experienced during 2023,” he says. “Slow economic growth will likely drive diesel prices lower during the first quarters of 2024 before improving freight demand and seasonal pressures on diesel see its price rise during the second half of the year.”

Geopolitical risk remains a factor in elevated transportation energy costs and is the most prominent upside price risk. Crude oil prices are responsible for approximately half the final price of diesel and are experiencing downward price pressure because of slow economic growth in emerging and developing economies alike.

According to Muenster, OPEC+ agreements to reduce crude oil production and the U.S. intent to restock its Strategic Petroleum Reserve are likely to maintain a firm price floor for crude oil near $70 per barrel, and crude oil prices could experience more upside price pressure through the second half of the year should economies like the United States and China begin to experience a turnaround.

Muenster’s analysis shows that U.S. Diesel inventory levels remained low through 2023 despite freight volumes being well off their 2022 pace. The supply side of the market will continue to drive diesel price volatility and will likely support elevated diesel prices despite relatively low expectations for U.S. economic growth.

“Transportation energy emissions will continue to drive incentives and costs into the market,” adds Muenster. “There are a host of policies in the U.S. and abroad that will require industry stakeholders to invest time and resources to ensure unnecessary costs can be avoided.”

Final thoughts

All of this leads to a couple final thoughts. Major changes with lasting impact in improving freight operations don’t come along frequently.

We had the big shift from steam to diesel power. We’ve had the birth of containerization, which was followed by the continuing development of the mega-ships. We’ve seen highway trailers morph from 35-feet to 53-feet and, in some cases 57-feet. And over the years, railcars have grown from 50-ton capacity to 130-ton capacity and so on.

However, most of these significant shifts have now reached their practical upper limits. The next big transformation is coming from AI-enabled technologies that will be creating a great leap forward in operational productivity improvement and cost reduction. Keep an eye on developments in this area as it rapidly advances.

Article Topics

Gross Transportation Consulting News & Resources

Industry experts examine the impact of Baltimore bridge collapse on supply chains 2024 Transportation Rate Outlook: More of the same? 13th Annual Rail/Intermodal Roundtable: Emerging optimism? 12th Annual Rail/Intermodal Roundtable: A rocky ride Intermodal expert Larry Gross offers up straight talk on the state of the sector at RailTrendsLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources