It’s time to transform reverse logistics

Reverse logistics can no longer be considered a standalone capability. It should be seamlessly incorporated into the end-to-end supply chain as a standard process—contributing to the delivery of a superior customer experience while being mindful of cost and sustainability impacts.

The pandemic laid bare the fragility of global supply chains. Supply and demand management quickly moved out of previously typical predictive paradigms and into a complex, self-perpetuating whiplash cycle that has yet to subside.

As a result, the supply chain has risen in the ranks to one of the most important business functions on the CEO agenda. But there is one area that doesn’t get the focus it deserves even as it serves a very critical function within the supply chain: reverse logistics.

According to Allied Market Research, the global reverse logistics market valued $635.6 billion in 2020 and is projected to reach $958.3 billion in 2028, registering a CAGR of 5.6%. From product returns to refurbishment and repairs to recycling of packaged materials and disposing end-of-life products, reverse logistics involves many areas across the organization including returns management, sales, finance, warehousing, logistics, recycling management and environmental compliance. It is also a critical element of customer experience.

Shippers need effective reverse logistics in order to extract value from returned and damaged products—while also meeting demands from all stakeholders to reduce negative impact to the environment.

Three core areas driving reverse logistics

While many associated reverse logistics with e-commerce returns, it actually applies to a much broader spectrum of supply chain activities. As we see more convergence around serving each unique customer’s needs, reverse logistics will become a standard capability that all companies will need to factor into the supply chain operating models. Today we see three core areas driving growth in this space. They are as follows.

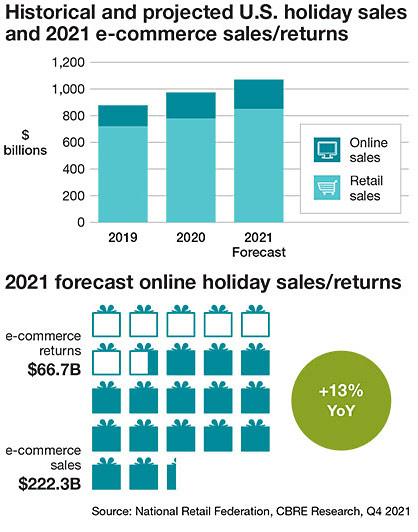

1) Retail e-commerce. In the retail space, the customer is king. Providing the right customer experience is critical to building customer loyalty and gaining share of their wallet.

Returns are a very impactful part of that experience, and providing a seamless, easy way for end-customers to request and process a return has become commonplace—even while the cost and complexity to do is ever increasing.

Couple this with increasing demands for sustainability, and it’s clear that reverse logistics in retail requires even more attention to minimize the overall impact to financials and the environment.

2) Assets-as-a-service. Another area that’s quickly emerging in the reverse logistics space is assets-as-a-service (equipment that is sold as a subscription, verses traditionally financed through lease or capital purchasing). We’re seeing increased requirements around reverse logistics for specific devices like smart phones, wearables, and medical devices.

For example, returned smartphone devices must be inspected, repaired, updated, tested and then dispositioned. Medical devices have the same basic flow, but also require special handling of data, sterilization, replacement of parts that have a potential biohazard, testing, and then dispositioning to determine future use.

Each of these steps requires strict processes, the right technology to capture all the costs and inputs at a serialized unit level, and the right health and safety protocols to ensure that no patient or end user will be put at risk. Additionally, other sectors, like automotive, are slowing moving into this space, contributing to the evolution of the mobility space across the world.

3) Sustainability. The world is collectively demanding greater transparency across global supply chains. New research from the UNGC/Accenture CEO Study finds that supply chains are now a major part of the CEO’s overall environmental focus—and that’s because supply chains are often the biggest source of carbon emissions in a business, making them central to the battle against climate change.

Reverse logistics is a key area for companies to embed sustainability practices as part of the circular economy. As companies move toward including “end of life” in the product development lifecycle, the role of sustainability in reverse logistics will rise to be at par with the forward logistics that distributed the product in the first place.

Reverse logistics comes at a high price

Optoro estimates that, on average, it costs $33 or 66% of the price of a $50 item for retailers to process a return—up from 59% last year. There are many factors contributing to the high cost of returns, including transportation, processing, discounting and liquidation losses.

As an example, electronic consumer products, such as laptops, table, and mobile phones—as well as medical devices that are used by patients remotely—experience the highest reverse logistic cost per item. These costs are 15 times higher than other product segments due to additional services required, such as testing, refurbishing, and sterilization—in addition to size and other expenses.

Shippers today are working to address the cost issue, but the reality is that most don’t have full visibility and awareness of total costs of returns. We’ve seen some companies evaluating true tradeoff choices, such as providing consumers with full credit on the returned product, but foregoing the physical return as the cost to do so is greater than the product cost itself—and causes negative margin impacts to the bottom line.

Key actions for transforming reverse

Shippers need a transformational approach to reverse logistics that encompasses analytics, process improvement and changes to the operating model—and that needs to be extended across the full supply chain so that reverse is factored in as part of core processes across operations.

In a nutshell, companies need to determine how to make the returns process customer-friendly while being mindful of the total cost of returns and environmental impact. We’ve identified the following actions that companies should focus on now.

Improve data for actionable insights. Many shippers have made progress in improving reverse logistics with limited data and analytics capabilities by fine-tuning policy and improving process efficiency.

But in order to unlock full value, they need advanced data management and analytics capabilities to truly transform and modernize the processes that are today, for most shippers, still highly manual. Moreover, capturing and integrating an extensive range of data types from multiple areas of the business is a key challenge.

With the right analytical tools, companies can speed decision-making on the most profitable disposition channel for each return. This will help avoid unnecessary shipping, increase availability to have assets back in inventory and ultimately reduce the number of items that end up in landfills.

Additionally, advanced data analytics help identify consumer fraud, reduce the cost-to-serve of returns and increase the earnings impact of returns instead of just evaluating costs.

While many shippers are still focusing on building the internal analytics capabilities and organizations for their core businesses, inventory management, sales, and pricing, third-party solutions can offer tracking and dispositioning capabilities that better unlock reverse logistics value.

Update the operating model. Many reverse logistics initiatives fall short if shippers do not think through operational model changes that need to be in place to support and sustain effective reverse logistics management. Reverse logistics is fundamentally cross-functional and touches on all the same points of its counterpart, forward logistics: sales, marketing, merchandising, finance, distribution and customer service.

For example, while efficient returns processing is often seen as the responsibility of the logistics operations team, how and where returns occur and the ability to maximize the potential resale value requires coordination of other functional areas.

We often see a lack of accountability for efficient returns management within one or two business units, which creates a major pain point, especially in large enterprises. Additionally, without true collaboration between all the functional areas involved, companies find themselves faced with siloed, ad hoc decision making and a limited ability to optimize the economics of reverse logistics and the impact for the end-to-end business.

To increase strategic focus and coordination, we recommend conducting operating model alignment and determining a single group responsible for managing end-to-end impact of reverse logistics and coordinating between cross functional stakeholders to drive reverse logistics economics.

Embed sustainability in the core with circularity. Without full visibility of total costs, root causes of the product returns and decisions related to them are made on improvised basis—driving inefficient and negative sustainable outcomes.

While it may have previously been less expensive and logistically easier to dispose damaged returned goods in a landfill than identify a separate disposition channel like recycling, that thinking no longer rings true.

Companies are looking at new opportunities to reuse, refurbish, remanufacture, or recycle resources back into the supply chain. An enhanced reverse logistics capability can help companies in taking materials back from the end-consumer—both products with remaining useful life as well as those at end of life.

By harnessing digital technologies like Artificial Intelligence to provide logistics insights for product retrieval, reverse logistics can be made more cost-effective and companies can engage customers in their wider circular journey.

Reverse logistics can no longer be considered a standalone capability. It should be seamlessly incorporated into the end-to-end supply chain as a standard process—contributing to the delivery of a superior customer experience while being mindful of cost and sustainability impacts. The companies that make this shift will see more value and impact from their operations.

Article Topics

E-commerce News & Resources

Technology Issue: Enter the “great digestion” era UPS reports first quarter earnings decline Solving the last-mile delivery issue in New York City UPS is set to take over USPS air cargo contract from FedEx UPS presents updated financial goals and strategic targets at its investor day FedEx fiscal third quarter earnings see gains amid ongoing volume declines National Retail Federation 2024 retail sales forecast calls for growth More E-commerceLatest in Logistics

Norfolk Southern shareholders sign off on 10 board of directors nominees Between a Rock and a Hard Place Inflation and economic worries are among top supply chain concerns for SMBs Port Tracker report is bullish on import growth over the balance of 2024 Varying opinions on the tracks regarding STB’s adopted reciprocal switching rule National diesel average falls for the fourth consecutive week, reports EIA New Descartes’ study examines consumer preferences, changes, and shifts in e-commerce home delivery preferences More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources