Price Trends: Forecasting during the Coronavirus

Pricing across the transportation modes

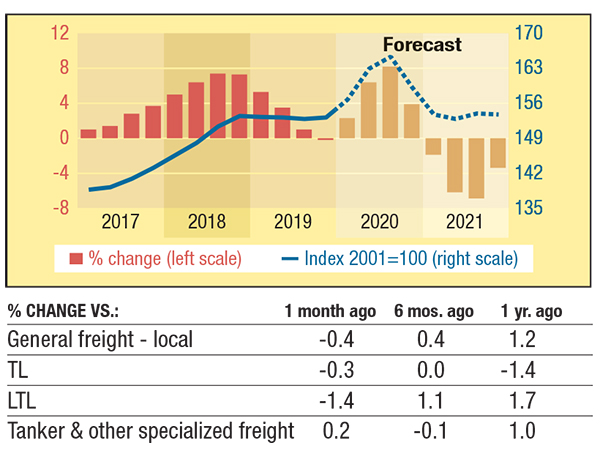

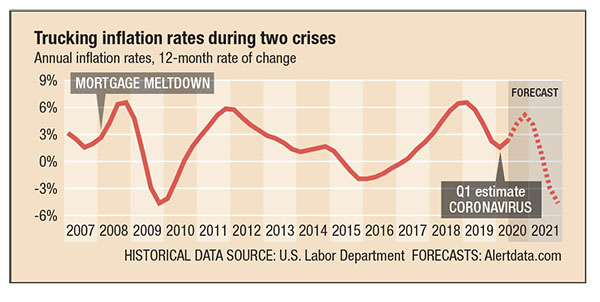

Trucking

Average transaction prices in the trucking industry now are forecast to jump 5.2% this year followed by a 4.8% decline next year. That’s in sharp contrast to our pre-coronavirus forecast published last month that called for an average annual price rise up 2% in 2020 and another 1.2% hike in 2021. During the Great Recession 12 years ago, trucking industry prices increased 6.6% in 2008 and then fell 4.6% in 2009. Back then, the truckload market experienced the sharpest price swings, and that’s likely to happen again. The annual inflation rate for truckload services is forecast to hit 4.3% in 2020 followed by a 7% deflationary price swing back down in 2021.

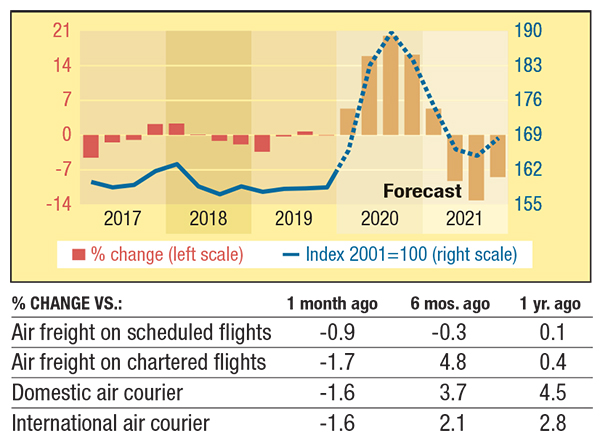

Air

We’re all flying in the dark when it comes to predicting price trends for air cargo chartered services as well as for U.S. companies that fly cargo in the belly of scheduled flights. In the latter market, over the past six years average inflation rates have ranged only between 1% and -3.7%. We’re tracing the price trend line from 2008 simply as a guide to model what volatility may be ahead; prices for U.S. air cargo services on scheduled flights could easily rise 14% and higher in 2020 followed by a 7% price drop in 2021. Reduced capacity pushed global air cargo prices higher after China’s post-coronavirus economy got going again. The same could happen here.

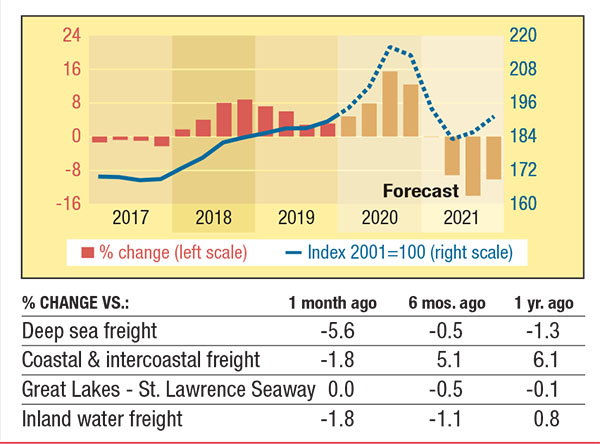

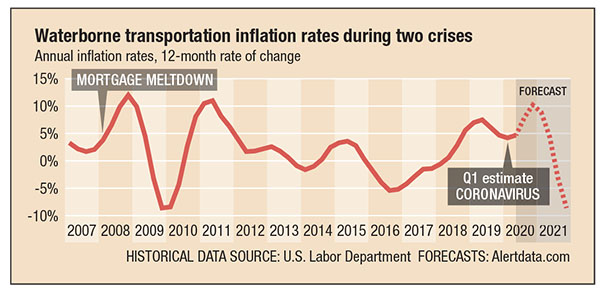

Water

The last time that the U.S. and European economies faced such dire uncertainty, U.S.-owned waterborne cargo service companies saw their 2.1% price hike in 2007 rapidly accelerate to a 12% rate in 2008. This time, after a 4.7% average price increase in 2019, we’re projecting a 10.2% average price hike in 2020 followed by an 8.6% drop in 2021. U.S. companies moving cargo over deep water and inland waterways likely will face similar price waves. Deep sea vessels are expected to log a 12.8% price increase this year and a 15.3% price drop next year. Inland freight transportation tags match that fate, up 11.8% in 2020 and then down 4% in 2021.

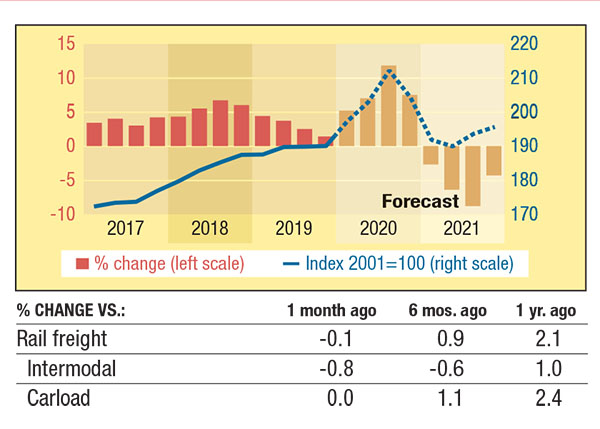

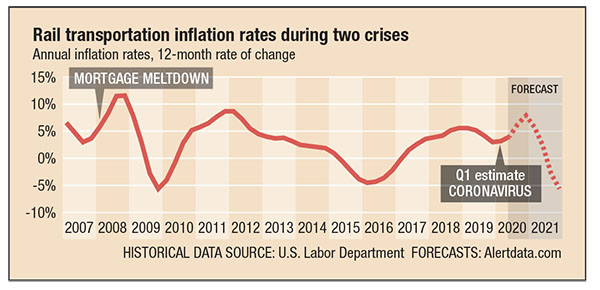

Rail

With the coronavirus virtually stopping freight moving from China in the final quarter of 2019, volatility and uncertainty in rail industry prices should come as no surprise. Survey data from the first quarter of this year show that prices for intermodal rail service increased 4.6% from the same quarter a year ago. Carload prices jumped 5.3% at the same time. Looking at the entire industry, rail transaction price inflation was pegged at 3% last year and is forecast to increase a much sharper 7.9% hike this year followed by a 5.6% price drop in 2021. These price swings are not out of the ordinary compared to the 2008-2009 time period when rail prices swung up 11.6% and down 5.6%.

Here’s today’s question for readers of the Price Trends column: How can we possibly presume to predict transportation industry prices in this extremely uncertain economy?

Simple answer: Businesses must plan for the future so we have no choice but to try something. However, as Michael Gilliland from the SAS Institute and author of “The Business Forecasting Deal,” (2010, John Wiley & Sons, Inc.) writes, we do have a choice “to recognize the uncertainty inherent in all predictions about the future and address business forecasting in practical terms, not wishful thinking.”

Today the coronavirus crisis is crippling first China and now the entire world economy. An unsettling uncertainty looms over our daily lives and our business forecasts. That’s why I pulled Gulliland’s excellent book off the shelf in my study—to calm my nerves. After conquering my fear, I spent a day reviewing the new price trend forecasts that had been created by my intrepid and much calmer economist partner.

Given the completely unique and unknowable outcome of the current unprecedented situation, my numbers guy decided to take a naïve approach to the forecast revisions. Naïve models such as seasonal moving-average models can quickly deliver a reasonably accurate outlook, especially when forecasting price trends.

In creating a new model quickly, he looked back at the last time the economy had an unexpected shock. That was only 12 years ago, 2008, when the mortgage meltdown crashed the stock market and pummeled businesses around the globe. The scale and timing of the shock in 2008 bears some likeness to today. In both 2008 and 2020, the initial shock occurred in the first quarter of the year; both are election years; and the magnitude of the U.S. government’s stimulus response is not dissimilar.

To do the revisions, the new model used the quarter-to-quarter percent change in prices that occurred beginning in 2008 through 2010 for each time series. Those percent change data were then applied to the current forecast horizon from the second quarter of 2020 to the fourth quarter of 2021. The results are the new forecasts you’ll see in this month’s price trends column (left).

Now, we are not under any illusions to suppose that what is happening in 2020 is exactly comparable to 2008. In fact, it seems very likely that the effect of the coronavirus-led shock on today’s economy will be significantly more severe and longer lasting than the mortgage crisis shock a dozen years ago. And obviously, more forecast revisions will be forthcoming. We’ll be (anxiously) awaiting updated transportation industry price data from the Bureau of Labor Statistics, more reports from industry analysts, and more first-hand stories by writers at The Wall Street Journal and editors at Logistics Management magazine.

One thing we can predict with certainty is that adjustments to everyone’s forecasts will be fast and furious over the months to come. Alas, that is the challenging and unchangeable nature of economics and business forecasting.

Trucking

Air

Water

Rail

Article Topics

Motor Freight News & Resources

FTR’s Trucking Conditions Index falls to lowest level since last September Cass Freight Index points to annual shipments and expenditures declines April retail sales are mixed, reports Commerce and NRF Following USTR review, White House announces tariff increases on certain U.S.-bound imports from China LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity Last-Mile Evolution: Embracing 5 Trends for Success A buying guide to outsourcing transportation management More Motor FreightLatest in Logistics

FTR’s Trucking Conditions Index falls to lowest level since last September U.S. rail carload and intermodal volumes are mixed, for week ending May 11, reports AAR Cass Freight Index points to annual shipments and expenditures declines ALAN opens up its nominations for 2024 Humanitarian Logistics Awards U.S.-bound import growth remains intact in April, reports Descartes Looking at a reshoring history lesson NTSB: Ship lost power twice before slamming into Baltimore bridge, closing port More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources