Quarterly Transportation Market Update: Less-than-truckload primed for profit

After being battered by three years of recession that decimated profits, LTL carriers are now focusing on improving yields and profitability in order to recapitalize their rolling stock. Now shippers need to cope with a new era of tighter capacity, higher rates, and tougher carrier negotiations.

Latest Logistics News

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal More Special ReportsAfter several recession-battered years, the $33.5 billion less-than-truckload (LTL) market is set to get back to making money. Carrier executives and analysts are predicting rate increases in the 2 percent to 4 percent range. That does not include any increase in fuel surcharges, which right now are adding about 30 percent to every LTL bill.

Of course, any 2013 estimate is cautious. After all, we’re in the midst of global macroeconomic uncertainty, a presidential election cycle, and just so-so economic growth in this country.

But after being battered by three years of recession that decimated profits in the sector, LTL carriers are focusing more on improving yields and profitability in order to make decent enough returns to recapitalize their businesses and rolling stock. Improved conditions in the auto and housing sectors are buoying some carriers’ hopes that 2013 could be their best year for profits since 2006.

“Thin margins are not allowing LTL companies to earn their cost of capital, and without an increase in tonnage to drive density and operating leverage, price and productivity improvements are the only real ways to expand margins to justify reinvesting in the industry’s old and aging fleet,” says David Ross, the LTL analyst for Stifel Nicolaus.

In other words, LTL shippers who took advantage of a price war and excess capacity during the 2009-2010 recession should be budgeting for fairly significant price increases in their 2013 budgets. The price war that tried—and failed—to extinguish YRC Worldwide, the second-largest LTL carrier that has lost in excess of $2.6 billion over the past six years, is over. YRC is still in business, and is revitalized under a new management team led by CEO James Welch and his top lieutenant, Jeff Rogers, two respected LTL operators.

Whatever YRC’s future is, analyst Ross believes LTL capacity will be restrained over the next 12 months. There are no new entrants in the LTL market because of high barriers to entry for terminals, which are costly and time-consuming to build.

That’s good news for carriers, who are already showing some margin expansion as a result of re-pricing in their poorest-yielding accounts. This is necessary, adds Ross, to recapitalize aging fleets. He says that it may take two or three years to add enough new trucks to bring the average LTL fleet age into historical norms due to the cutback and elimination of new truck purchases during the recession.

“We’re focusing on improving yields, and that was not always the case in the past,” said Con-way Inc. President and CEO Doug Stotlar. “There is a new emphasis on profit, and that hasn’t always been the case in our industry. But it is now.”

So, how are shippers to cope with this new era of tighter capacity, higher rates, and tougher carrier negotiation mindset? Let’s look at what’s behind the numbers.

Pricing “firms”

Unlike the highly fragmented truckload sector, where even the largest carrier barely maintains a 1 percent market share, the top handful of LTL carriers control the majority of the market. In fact, the top five LTL carriers enjoy a collective 56 percent market share—FedEx Freight (16 percent), YRC (15 percent), Con-way Freight (11 percent), UPS Freight (8 percent) and Old Dominion Freight Line (6 percent).

With these top carriers now concentrating on shedding their worst performing accounts in order to better concentrate on higher-yielding business, it isn’t surprising that analysts and carriers agree that LTL pricing is firming.

“I would say that pricing is ‘largely rational,’” says Ross. “Certain regions are seeing tighter competition, and soft volumes in late summer put pressure on spot pricing. However, the majority of carriers in what is a highly consolidated industry continue to be focused less on market share gains than on recovering from the record low margins that characterized the freight downturn.”

Ross is expecting to see yield increases continue at least through the third quarter of next year—and carrier executives agree. “The pain inflicted by the economic downturn is still fresh in everyone’s mind,” says Steve O’Kane, president of A. Duie Pyle, a major Northeast regional LTL carrier. “When excess capacity drove prices down during that period, everyone in the industry was injured. But those that lead the way in trying to gain market share—or put a competitor out of business—saw their results suffer the most. I believe this lesson was learned dramatically, and it’s helping carriers maintain pricing discipline.”

Wayne Spain, executive vice president and COO of Averitt Express, agrees with O’Kane’s assessment. “Carriers had to discipline themselves to this ‘new normal’ and find ways to improve yield and drive costs out of their network in order to compete, including removing capacity,” says Spain. “As shipping volumes have slowly risen, supply and demand have moved closer to equilibrium. Now we’re beginning to see a closer alignment of rates with available capacity.”

Satish Jindel, who closely tracks the LTL sector as principal of SJ Consulting, says that there is definitely greater awareness among certain carriers that they need to sustain a minimum 96 operating ratio (OR) in order to recapitalize their fleet so they can stay in business. “The past three or four years have seen pretty bad results in the LTL sector,” says Jindel. “It makes them realize that they can’t have that type of 99 or 100 OR. That has helped pricing get firm.”

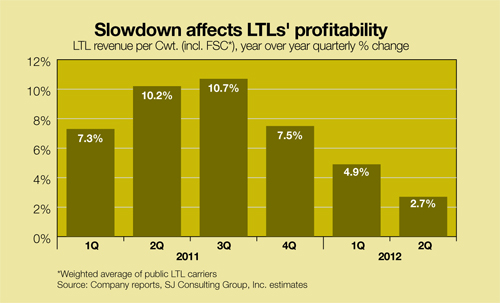

Chuck Hammel, president of regional LTL Pitt Ohio, says that he’s noticed a slight weakening of rates this summer as a result of some softening in the economy and less freight all around. “What we’ve done is slowed down on our rate increases,” says Hammel. “We increased everybody on the first of year. But things are slowly down and shippers are pushing back, so carriers are looking for business and are pricing aggressively in order to get new business. That began in the second quarter.”

Could yield improvement fail?

This newfound emphasis on yield improvement could be pushed off the road by a couple of factors. First and foremost is the macroeconomic situation. For example, if China’s economy slows, that will have a ripple effect on overall U.S. economic conditions—and, by extension, the LTL market place.

“I have never believed that we’ve ever fully come out of the 2009 recession,” says Jindel. “We’re still largely in the same situation of high unemployment and slow overall economic growth.”

Secondly, Jindel adds that there are certain carriers that, despite difficult times, have an inability to understand what cost is to service certain customers. “That leaves them offering pricing that is not profitable, and that creates a competitive response,” he says. “Some shippers are still using that to their advantage in avoiding price increases.”

Pitt Ohio’s Hammel agrees: “There are some shippers that, when you mention rate increases, will simply say, ‘There are a lot of other carriers that will take my business.’ And there may be.”

For that reason, Jindel’s 2013 LTL rate forecast is more in the 2 percent to 3 percent range, excluding fuel surcharges—which averaged 29.3 percent in the second quarter, compared with 29.8 percent in the second quarter of 2011. Some carriers will get higher than those average rate increases because of special geographic lanes and density issues. “The one other thing that’s helping yields stick is that there’s more discipline among carriers who had precipitated the decline in rates,” Jindel says.

The changing conditions and leadership at YRC are a major factor in the rate environment as well, Jindel says. “YRC management is more focused on the business enterprise as opposed to shareholder value; and that’s promoting greater emphasis on service improvement. Through that, you can get pricing improvement.”

2013 forecast: Cloudy and more expensive

For at least the next 12 months to 18 months, the analyst community is hinting that LTL rates should run slightly ahead of the rate of inflation. Active LTL capacity remains relatively in balance, supporting continued pricing momentum for LTL carriers. While some carriers have been adding drivers and trucks, analyst Ross says that may be offset by some financial failures of less well-capitalized carriers as lenders may be more inclined to let them fail.

Ross is forecasting LTL tonnage growth through 2014 amid a “slow, likely choppy, recovery,” with less than 3 percent annual freight growth and pricing rising faster than volume—1 percent to 5 percent annual yield increases, depending on supply/demand situations in specific geographic lanes.

Most carrier executives agree capacity will be “restrained” over the next 12 months. Except for Old Dominion, LTL returns simply are not adequate for the public carriers to be motivated to add capacity, they say.

With new Class 8 tractors costing in excess of $100,000, and terminals in major metropolitan areas costing upwards of $10 million, no one is likely to invest in adding capacity for an operating ratio in the mid 90s, O’Kane says. “It doesn’t make sense…just look where today’s LTL yields are as compared to the pre-recession era of 2006-2007. In a time when costs have gone up dramatically, industry yields are not much different than those of five years ago.”

O’Kane and other carrier executives contend that rate increases of 3 percent to 4 percent are both realistic and necessary. “But whether or not they play out that way is anybody’s guess,” adds O’Kane. “If the economy keeps expanding slowly, my guess is David Ross is close to being correct. The industry needs it to keep up with costs, and with an infrastructure that is outdated and works against greater productivity, the cost increases must be reflected in prices.”

LTL carriers also believe that the more volume a shipper has with a core carrier, the more opportunity to remove costs. Some examples of cost reduction can come from changing a live pick-up to a spotted trailer; shipping palletized freight rather than loose cartons; directionally loading trailers for a carrier; moving pick-up times earlier in the day to allow the carrier to work freight earlier; providing better information to assist the carrier in load planning; provide electronic bills of lading; or adjusting the lanes being used to better fit the carrier’s system.

“Not all shippers will be able to do what’s necessary to employ these cost savings measures,” O’Kane says. “But the more they consult with their service providers and exchange thoughts, the more ways both sides will be able to take cost out of doing business.”

Averitt’s Spain adds that shippers can improve their supply chains by sharing as much data as possible with their carriers to improve our ability to accurate forecast needs and provide flexible transportation options. “Collaboration, as always, is the key to a successful partnership,” Spain says.

Article Topics

Special Reports News & Resources

Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends Warehouse/DC equipment survey: It’s “go time” for investment Global Logistics/3PL Special Digital Issue 2022 Motor Freight 2022: Pedal to the Metal Top 50 Trucking Companies: The strong get stronger 2019 Top 50 Trucking Companies: Working to Stay on Top More Special ReportsLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources