State of Logistics 2022: Truckload

Reports of swoon “exaggerated” even as spot rates temper boom.

The $332 Billion Truckload (TL) market is showing exceptional strength in the contract market even as some latest company earnings show shippers are fast shifting freight away from the spot market.

“Reports of the death of the freight market ... have been greatly exaggerated,” said David Jackson, CEO of Knight-Swift Transportation Holdings, during a first-quarter earnings call with Wall Street analysts. The carrier reported a solid start to the year, with revenue, excluding fuel surcharges, jumping 45% year over year in the first quarter, which is usually the slowest period for most trucking companies.

J.B. Hunt enjoyed a 33% jump in revenue in the first quarter to $3.49 billion, the company reports. Sales from its trucking division jumped 77%, mostly on increased load volume and higher revenue per load.

“As the quarter progressed, volume levels strengthened as customer unloading activity improved, although rail network velocity continued to govern our ability to capitalize on even greater intermodal demand,” Hunt reports.

Truckload volumes typically decline from March to April when TL freight movement hits a seasonal lull. That was borne out again this year when the American Trucking Associations’ seasonally adjusted For-Hire Truck Tonnage Index decreased 2% in April after rising 1.8% in March.

There are signs of what FTR, the Indianapolis-based trucking research firm, calls “signals of potentially weaker demand and softer rates.” They could temper that outlook should fuel costs remain in record territory, well above $5 a gallon.

“The truck freight market has entered the inevitable period where conditions for carriers are transitioning from uniformly strong to those that will be more variable from month to month and from segment to segment,” says Avery Vise, FTR’s vice president of trucking.

Uncertainty, Vise says, is “high on both the demand and supply” sides. “Consumers are generally remaining strong financially, but prices are increasing due to inflation, cutting into buying power.” Demand in the industrial sector remains “high,” but he adds that supply chain woes persist and durability of that demand is not a given.

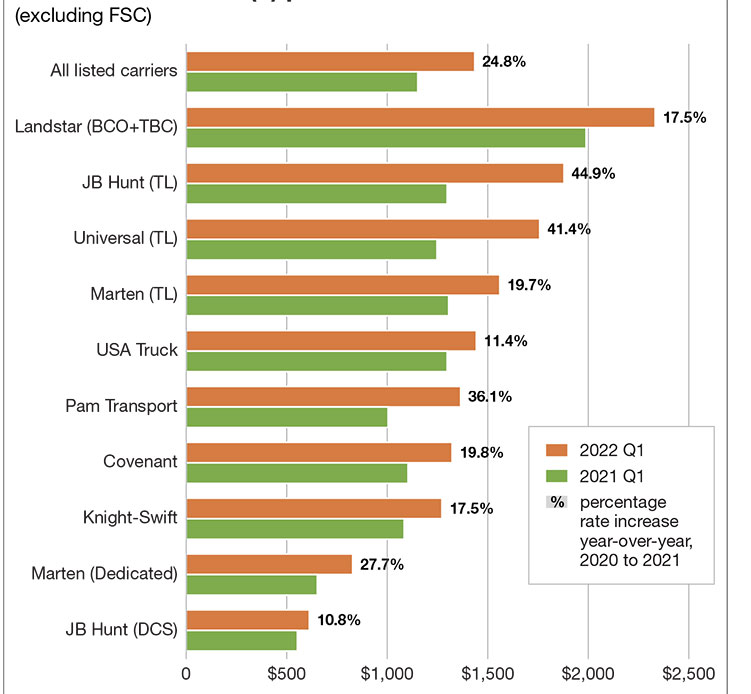

However, the chart by SJ Consulting (to the right) is a good indicator of strong contract pricing—not spot rates—during the first quarter of 2022 and negates the headlines such as: “Bloodbath for Trucking in 2022.” It shows the top 10 TL carriers enjoying revenue gains of 24.8% in the first quarter year over year from the 2021 first quarter.

The exceptions to the strong pricing in the TL market are some small carriers with 10 trucks to 20 trucks, which may have had a less favorable rate environment due to the fact that they provide their capacity to brokers and not to shippers directly, analysts said.

Orders for manufactured goods rose for the 22nd time in 23 months, rising 2.2% in April, according to the Commerce Department. Wall Street economists were expecting a 1% increase. Factory orders have been a bright spot during the pandemic and its aftermath.

Headwinds in the TL sector come down to inflation’s continuing drain and a potential shift in consumer spending. The war in Ukraine is another wild card, making it difficult to predict the future direction of U.S. freight transportation, analysts and carrier executives said.

Truckload revenue ($) per load

(excluding FSC)

Article Topics

Motor Freight News & Resources

National diesel average falls for the fourth consecutive week, reports EIA C.H. Robinson highlights progress of its AI-focused offerings with a focus on automating shipping processes Preliminary April North American Class 8 net orders are mixed Q1 U.S. Bank Freight Payment Index sees shipment and spending declines 2024 State of Freight Forwarders: What’s next is happening now What’s next for trucking? TIA rolls out updated version of framework focused on fighting freight fraud More Motor FreightLatest in Logistics

Port Tracker report is bullish on import growth over the balance of 2024 Varying opinions on the tracks regarding STB’s adopted reciprocal switching rule National diesel average falls for the fourth consecutive week, reports EIA New Descartes’ study examines consumer preferences, changes, and shifts in e-commerce home delivery preferences Potential Canadian rail strike could damage the country’s economy C.H. Robinson highlights progress of its AI-focused offerings with a focus on automating shipping processes UPS announces CFO Newman to leave company, effective June 1 More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources