State of Logistics 2013: Ocean

Lars Jensen, CEO and Partner with SeaIntel Maritime Analysis in Copenhagen, notes that one of the most important developments in the past month has been the rapid decline in spot rates—particularly on the Asia-Europe trade lanes

“The situation is slightly more benign in the trans-Pacific trade, at least when the magnitude of the rate decline is considered,” says Jensen. However, in reality we see that the partially successful general rate increase [GRI] on the trans-Pacific was entirely eliminated in just three weeks this past spring.”

According to Jensen, it’s clear that both carriers and shippers are facing “troubled times.” Despite rates having fallen by 41 percent since the beginning of 2013, carriers are poised to increase capacity from Asia to East Coast South America by more than 20 percent—seemingly a recipe for continued rate declines.

“Additionally, we continue to see carriers place new orders for ultra-large container vessels,” says Jensen. “It’s in this troubled minefield of overcapacity, combined with new fuel efficient vessels that carriers need to make profits in the coming years. Cumulatively the carriers have lost almost $7 billion in the past 4 years, and clearly such a trend cannot continue indefinitely.”

Who will then stand to be the winners of what appears to be a protracted war of attrition? Based on developments in the past decade, the winners will need a solid combination of three factors, say SeaIntel analysts:

1) Access to additional capital.

2) Access to a fleet predominantly made up of new fuel-efficient vessels.

3) An operational and organizational setup resulting in the lowest unit costs in the market.

“Looking at 2012 annual accounts, clearly some carriers appear to be off to a better start than others; however this is not a sprint, it’s a marathon, and the winners may not yet have emerged from the pack,” says Jenson.

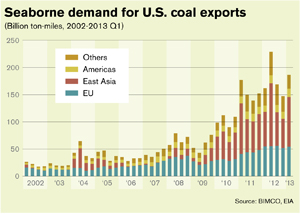

Meanwhile, business for more bulk and breakbulk carriers may be heating up as China’s demand for coal continues to accelerate.

The influence of U.S. coal exports on seaborne transportation has grown significantly over the past decade. In 2002, the U.S. exported 20.1 million tons by sea, but in 2012 that number had increased to 106.7 million tons.

The effect on shipping has multiplied due to the fact that much of the demand growth has come from East Asian countries. With a large part of the U.S. Coal destined for East Asia being shipping out of the U.S. East Coast ports, this will increase the demand for tonnage.

As a consequence, the transportation demand stemming from U.S. coal exports has surged from 84.7 billion ton-miles in 2002 to an estimated 707.3 billion ton-miles in 2012—representing 835% growth over the period.

“In comparison, the Chinese coal imports in 2012 accounted for an estimated 697.6 billion ton-miles of demand for seaborne transportation, says Peter Sand, chief shipping analyst at the Copenhagen-based consultancy BIMCO. “This means the U.S. coal exports were more important to the dry bulk shipping market than the Chinese coal imports in 2012.”

Article Topics

Latest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources