Supply Chain Currents Part II: A different model for shipper/carrier relations

This is the second of two columns that visits the concept of “index-based variable-rate pricing” as a way to establish more market stability for both shippers and carriers.

Yogi Berra has been quoted as saying:

“When you come to a fork in the road, take it.”

In today’s environment, with rapidly shifting market conditions, we are at a fork in the road of sorts: We can continue down the traditional path of annual bids and constant searching for volume and capacity as markets change, which frustrates both shippers and carriers, or we can attempt a new way to bring some element of stability to the movement of freight.

Transportation and moving freight has been around as long as there have been people willing to trade, so there isn’t much new under the sun—and things tend to transform deliberately and seldom rapidly.

However, every once in a while there are shifts, some subtle, others not, that begin to move the needle in a new direction. Index-based variable-rate pricing may just be one of those.

The notion of “index-based variable-rate pricing” is one way of targeting the goal of improving market stability. While there have been a few companies that offer this sort of approach, it’s neither well known or widespread in its adoption.

Index-based pricing

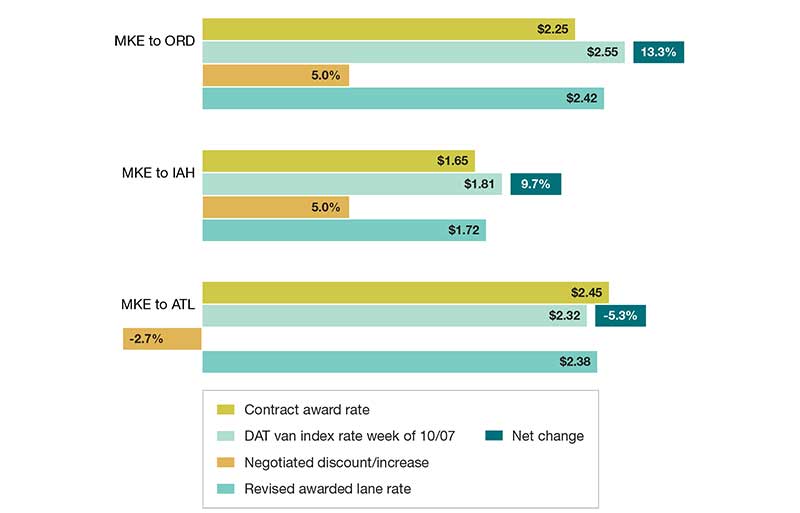

(Representative example)

The methodology involves negotiating a base price for a fixed period of time, let’s say a year. But contrary to past practices, this price would be flexible, responding to market pressures and volatility. The parties to the agreement would pick a mutually agreeable index as a proxy for variable rate adjustments (e.g., DAT for truck; FBX for ocean container; and BAI for airfreight), or any other one the parties can mutually agree upon. The accuracy and precision of the index isn’t nearly as important as its ability to track market conditions and shifts.

Then, the base contract rate would be adjusted in accordance with the index, which would be over a specific time period agreed upon in advance, be it weekly, monthly or some other period. There is also an option to install goalposts of min/max on any lane or series of lanes, although not necessarily required.

Because this arrangement is designed to provide equitable commitments of volume and pricing, the parties would negotiate a discount off the index rate so in practice the rate to be paid would track to the index fluctuations, but would be below it by a negotiated percentage to reflect the value of the commitments being made.

Similarly, when rates fall below the contract rates, the revised rates would track above the index by a negotiated percentage.

An example of how this might work in practice goes like this.

- During the RFP process and subsequent sourcing event, the negotiated base rates for each lane (or other criterion, such as region or zone) are defined.

- The percent change in the base rate will be pegged to the percent change in the rate by destination region or by individual lane, but tracks either below or above, as shown in the following example.

- Based on the change from the index base rate, the price will increase/decrease the awarded rate, which becomes the price actually paid for each move during the specified period.

- Because the revised awarded rate falls between the min/max, where applicable, all shipments for the example week of 10/07 will be paid using the percentage change in the agreed-upon index.

Of course, the computation methodology can be negotiated and tweaked by the parties to the agreement. The goal here is not providing the specific answer but, rather, the over-arching theme and key objective is creating a framework that will produce more stability and reliability in the relationship.

Engineering transparency

Tradition tells us that there’s inherent, built-in mistrust—or, at least, some competitive tension—between shippers and carriers. Engineering transparency and fairness into the process will go a long way to ameliorating such issues:

- Building a basic foundation for the deal structure that aims to provide an accurate picture of volume and capacity, both historic and predicted.

- Agreeing on the appropriate market-tracking index (e.g., DAT Van or equivalent) that reflect market conditions and is something both shipper and carrier recognize and can accept.

- As a shipper, recognizing that you will sometimes pay rates higher than the lowest available market price; as a carrier accepting you will sometimes not get the best price available, either, nor will you have to compete in the “race to the bottom” on rates when there is ample capacity in the market. This means having the willingness, integrity, steadfastness and honesty to take the bad with the good and play the long game.

- Opportunistic behavior frequently drives sub-optimal outcomes for both shippers and carriers. Shippers shift volume to chase lower-cost capacity when the market is soft. Carriers shift capacity to chase higher-paying freight when the market it tight. This leads to a lessening of network stability and a much more difficult and challenging planning and budgeting process.

- Mitigating such opportunistic behavior on behalf of both shipper and carrier by negotiating a “discount” structure that reflects the shipper’s willingness to commit volume and the Carrier’s willingness to commit capacity.

- The discount structure is aimed at reflecting the value of increasing stability in the network to the mutual advantage of shipper and carrier.

- While this solution may not apply to all carrier providers in a given shipper portfolio, it can be implemented among a key number of core carriers on selected lanes to reduce volatility and churn.

None of this means that this approach has to apply to all lanes in a portfolio. That is a decision best reached between shipper and carrier. Large lanes with consistent volumes can be handled differently from low-volume lanes with less predictable traffic.

Shipper reaction?

So, what do shippers and carriers think about this? We asked a few. Bill Hutchinson, senior vice president, enterprise logistics at mega-

paper producer WestRock, has a positive reaction with respect to responding to network changes and market shifts.

According to Hutchinson, the primary applicability would be on lanes with high volume fluctuations or changing nodes in the network. “Right now, there’s no way to collar freight cost for both parties,” he says, adding that the term “partnership” has been overused and abused for a long time and this is a good way to think about changing that.

His team is currently in the brokerage market much more frequently than in years past, mainly so they can have a catalogue of viable, current pricing versus paper rates. This is a time-consuming exercise that’s simply a necessity, given the way business is conducted in today’s world.

“Everyone’s afraid to make serious commitments, and so is trapped in the mostly antagonistic bid process,” says Hutchinson. “By extension, the overall goal should be improving service using the right index to benchmark rates and flex rates to reflect market conditions and reduce supply chain disruptions.”

“Over the decades, I’ve worked with a bunch of wicked-smart people trying to figure this out and none have come to a firm conclusion,” says Michelle Livingstone, recently retired as vice president of transportation for The Home Depot and founder and CEO of M. D. Livingstone Consulting.

One challenge, according to Livingstone, is finding an index (or indices) that accurately captures changing market conditions in a timely manner. “We’ve tried multi-year deals in the past on one-way, over-the-road business, with escalators and de-escalators, with limited success,” she says. “Contracts don’t seem to have teeth these days because neither party feels constrained by them.”

Livingstone poses the question: “Mitigating the volatility for both shippers and carriers is a worthwhile effort. How do we get to where contracts have real meaning so both parties can forecast and operate efficiently?”

The fundamental thesis is that this is potentially a good model for both shippers and transportation service providers. The trucking executives I spoke with made a few key points, including the fact that “going down this path would mean a dampening of the upside and downside on pricing.”

Keys to success

The success of an approach like this requires collaboration and cooperation between shipper and carrier and a willingness to experiment with the model to arrive at a mutually-acceptable solution. It also requires continuous monitoring, adjusting and tuning until it becomes a sustainable solution.

It brings to mind the saying: How many chances do you give a baby to walk? The answer is you stay with it until you achieve success, as that is the only acceptable outcome.

This may not be a panacea for creating more normalized relationships between buyers and sellers, but it does provide an opportunity for experimentation and testing to see if freight transportation can be made a more reliable and predictable marketplace.

The answer lies in accepting a certain level of risk that you won’t—in every instance—always have the lowest rate (as the shipper) or the highest price (as the carrier.) It will ultimately hinge on the ability for the parties to agreements having faith and trust in each other, preferring stability and predictability to looking for every opportunity to take advantage of whatever the current market situation is.

In the “long-haul,” this will make for better supply chain performance, lower cost and better operational efficiency. Dr. Chris Caplice, executive director of MIT’s Center for Transportation and Logistics defined reality as: “Things you don’t believe that still happen.” Maybe there’s a way to get closer alignment in the future.

Article Topics

MIT Center for Transportation & Logistics News & Resources

Supply Chain Currents Part II: A different model for shipper/carrier relations 2023 Supply Chain Outlook: Preparing for what’s next DAT’s Caplice reviews spot market strategy for 2024 budget planning MIT’s Supply Chain Sustainability Report features KPMG insights Transportation Management Virtual Summit Roundup MIT and ASU offer up an online Master’s in supply chain management 2018 Logistics and Supply Chain Virtual Summit Roundup: Navigating the new reality More MIT Center for Transportation & LogisticsLatest in Logistics

Norfolk Southern-Ancora Holdings proxy battle accelerates GXO’s acquisition of Wincanton is a done deal Q1 sees a solid finish with strong U.S.-bound import growth, reports S&P Global Market Intelligence Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources