2016 State of Logistics: Rail/Intermodal

Volumes dip, service recovers

Latest Logistics News

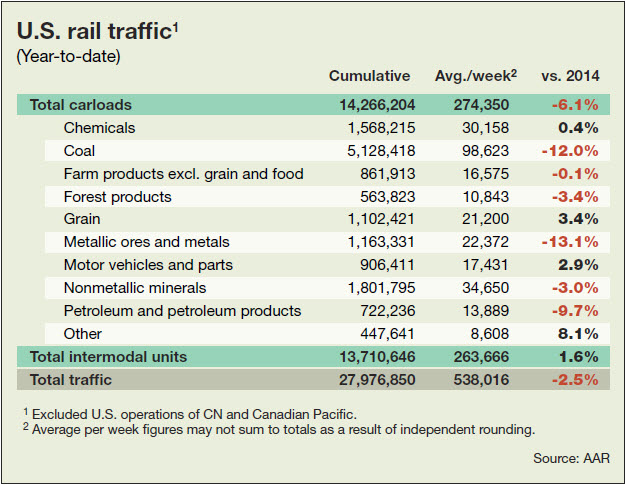

U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR Norfolk Southern shareholders sign off on 10 board of directors nominees Potential Canadian rail strike could damage the country’s economy U.S. rail carload and intermodal volumes are mixed in April, reports AAR Q1 intermodal volumes are up for second straight quarter, reports IANA More Rail & IntermodalAs both the general and freight economies continue to see sideways or declining growth, that pattern also applies to the rail and intermodal sectors. In fact, that’s been made clear with the declining volumes on a year-to-date basis for freight rail, with intermodal following suit.

Through the end of May, domestic carload volumes are down 13.6% annually at 5,050,191, according to Association of American Railroads (AAR) data, while the weekly average carload for May is off 10.3% annually—the third lowest on record behind March 2016 and April 2016.

As for intermodal, compared to a year ago at this time volumes aren’t getting the bounce they saw resultant of the West Coast port labor contract being resolved. Year-to-date through May, intermodal container and trailer volumes are off 1.3%, with intermodal units regularly outpacing rail carload volumes, something that never happened prior to May 2015.

AAR officials are quick to point out that rail volumes, spe¬cifically coal, are declining due in large part to low natural gas prices and high coal stockpiles at power plants. What’s more, the AAR says that coal currently accounts for around 26% of non-intermodal traffic for U.S. railroads, which is decidedly down from 33% a year ago and 45% in late 2011.

According to John Gray, AAR’s senior vice president of policy and economics, the association expects non-coal carloads to strengthen when the economy improves, while intermodal’s decline is probably at least partly a function of high business inventories that need to be drawn down before new orders—and thus, new shipments—are made.

Tony Hatch, principal of New York-based ABH Consulting, notes that a lot of the carload declines are due to what he called “terrible energy and mediocre industrial numbers.”

“Over the last several years, we thought that as energy prices came down, there would be gains in consumer numbers,” says Hatch. “But intermodal is only doing OK at the moment, and that shows in the growth rates.”

Hatch stresses that these lower volumes are not the byproduct of railroads doing something wrong. Instead, he cites how some Class I railroads have very good earnings results amid the market challenges in the first quarter, which is reflective of the carriers ability to manage variable costs and more productive service levels as well.

On the service side, service-related issues on the rails are not as prevalent as they were a little more than a year ago.

“Within the universe of the rail carload sector, things are running pretty smoothly,” says Larry Gross, senior analyst at FTR. “On the pricing side, it’s a question of how aggressive railroads are with low volumes while trying to maintain still strong operating ratios. Meanwhile, there are still opportunities for the railroads to cut costs.”

One thing rain operators are doing, says Gross, is running longer trains, coupled with new technologies related to distributed power. “However, this doesn’t improve service, as longer trains means less frequent trains. Bottom line is that there’s a limit to how much cost railroads can pull out as they want to continue to raise rates, but there’s a lot of resistance to that.”

Regardless of what happens with pricing, North American Class I railroad capital expenditures (capex) continue to be strong, even though 2016 levels are down annually. These expenses are allocated towards things like infrastructure, equipment and staffing.

Class I railroads are pegged to spend roughly $16 billion on capex this year. While it is down annually, it’s still strong. Class I railroads spent a record $30.3 billion in 2015, with 2016 estimates pegged at roughly $26 billion on rail infrastructure and equipment, which would be the third highest output on record, according to the AAR.

Article Topics

Rail & Intermodal News & Resources

U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR Norfolk Southern shareholders sign off on 10 board of directors nominees Potential Canadian rail strike could damage the country’s economy U.S. rail carload and intermodal volumes are mixed in April, reports AAR Q1 intermodal volumes are up for second straight quarter, reports IANA 2024 State of Freight Forwarders: What’s next is happening now STB announces adoption of final reciprocal switching rules More Rail & IntermodalLatest in Logistics

Automate and Accelerate: Replacing Pick-to-Light with the Next Generation of Automation STB Chairman Martin J. Oberman retires Get Your Warehouse Receiving Audit Checklist Now! LM reader survey drives home the ongoing rise of U.S.-Mexico cross-border trade and nearshoring activity Last-Mile Evolution: Embracing 5 Trends for Success Optimizing Parcel Packing to Cut Costs A buying guide to outsourcing transportation management More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources