2016 State of Logistics: Ocean freight

Ocean shippers to keep expectations in check

Latest Logistics News

Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes More Ocean FreightA recent survey conducted by London-based Drewry Maritime Consultants confirms many of the findings contained in this year’s “State of Logistics Report,” but adds that ocean cargo shipper expectations may be modest at best.

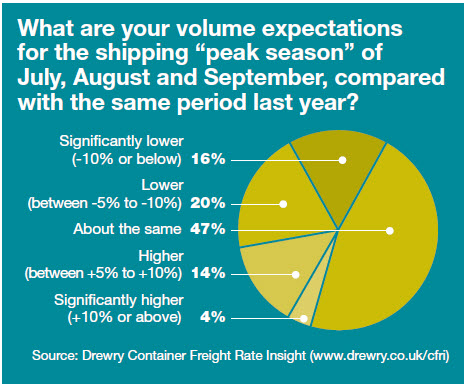

Nearly half of the shippers who responded to the survey said that they expect volumes for the third-quarter peak season to be the same as they were last year, while another 35% anticipate lower volumes. Only 18% predicted higher volumes for container shipping’s busy period.

“The results of the survey confirm that international trade remains sluggish,” says Drewry analyst, Martin Dixon. “It will also be disappointing news to ocean carriers that are in need of a pick-me-up in another difficult and unprofitable year as well as to terminal operators, many of whom have under-utilized capacity.”

As noted in LM ocean carriers have taken the unprecedented step of removing capacity in key trades ahead of the peak season in a bid to support freight rates, suggesting their short-term demand forecasts were telling them much the same story.

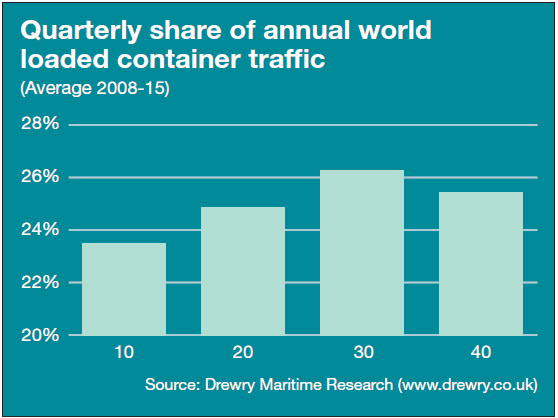

While the ratio does vary trade-by-trade, the third quarter has generally been the busiest period for the industry, as retailers in the major consumer centers of the U.S. and Europe stock up on goods for the beginning of the school year and the winter holiday season. Between 2008 and 2015, the average proportion of annual world container volumes moved in the third quarter of those years was 26.3%, ahead of 25.4% in the fourth quarter.

“In a generally unpredictable market, this constant of knowing when the peak demand quarters will occur has allowed carriers to plan their deployment strategies accord¬ingly, in turn supporting rate increase requests,” says Dixon.

Drewry also notes that traditionally the third quarter is when carriers have been able to swell revenues through peak season, congestion and equipment repositioning surcharges. However, last year was “a non-event” in the high-volume westbound Asia to North Europe trade when the proportion of traffic only reached 25.8%, marginally better than the second quarter. “The peak was more evident in the Transpacific headhaul routes, but carriers will be wary of losing that predictability of volumes as it could reduce their ability to push through general rate increases and peak season surcharges,” Drewry adds.

Survey respondents opinion that the 2016 peak season will not bring much respite to carriers, with only 18% of all shippers expecting any sort of growth on last year. Drewry researchers say that the poor state of the global economy was cited most for the lack of optimism. Other respondents pointed to lower levels of re-stocking as a reason for their lower expectations, saying that they moved more goods earlier in the year than usual to take advantage of low freight rates. However, this appears to be a relatively rare occurrence, as 82% of shippers said that they haven’t altered their shipping patterns this year.

Article Topics

Ocean Freight News & Resources

Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications More Ocean FreightLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources