Andreoli on Oil+Fuel: Planning for the worst, and hoping for the best

Now more than ever, business leaders should be planning for the worst, and hoping for the best.

If I concentrate, I can still remember a time when my greatest concerns revolved around whether or not the final phase-in of IMO 2020 sulfur regulations would disrupt global trade and if the U.S.-China trade war would be resolved before the next U.S. presidential election. It is amazing how much the world has changed in the months since China added the SARS-CoV-2 virus to its long list of exports.

At the time of writing, the number of new COVID-19 cases reported per day in the United States has leveled off at around 26,000. It appears that despite being unsystematic and unevenly applied, draconian social distancing policies have successfully “flattened the curve.”

Unfortunately, they have also flattened the economy, and tensions between the United States and China are higher now than ever, leaving little optimism that the trade war will be resolved any time soon.

Neither a vaccine nor a treatment is likely to arrive before the New Year’s Eve ball descends on an empty Times Square, and until virus testing is increased to a level sufficiently high to support “contact tracing,” social distancing will continue to be the only effective mitigation strategy.

This leaves business leaders to wrestle with fundamental questions about how to prepare for an extremely uncertain economic future. How much will the U.S. economy contract, how long will the recession last, and what shape will the recovery take? Moreover, will the economy return to normal, or will there be long-term structural changes?

Unfortunately, nobody has the answers to these questions, but the silhouette of truth can be made out through smoke and ashes rising from our burning economy.

Epidemiologists warn that in the absence of “herd immunity,” a reduction in social distancing will cause infection rates to surge, but if the stay-at-home orders are prolonged, the economic shock may grow too large to be managed through fiscal, monetary, and other federal stimulus measures. Unlike the federal government, state and local governments cannot run fiscal deficits, so the reduction to the tax base will require that state and local governments reduce expenditures and secure financial support from the federal government.

The loss of lives must be balanced against the loss of livelihoods and the myriad social, mental, and public health problems that accompany severe recessions. Given the forces at play, the predator-prey model is probably the best for predicting how our fight against the virus (and amongst ourselves) will evolve. As the infection rate declines, public pressure to relieve some of the social distancing policies will increase, but the populous will be divided on when this should happen.

When social distancing protocols are relaxed, economic activity should gradually pick up, but so too will the infection rate. In turn, policymakers will be pressured to reinstate social distancing protocols. In short, we will likely face multiple waves of COVID-19 infections in the months ahead.

We likely face a severe economic contraction and a long and bumpy economic recovery rather than a quick, v-shaped return to normal. The IMF does not forecast U.S. real GDP to regain the 2019 level until at least 2022, and this assumes that stimulus packages work and the COVID-19 impacts on consumer demand do not cause a financial crisis.

The Fed estimates that unemployment will increase by 47 million, which translates to an astonishing unemployment rate of 32%—a full seven percentage points higher than the peak of the Great Depression. Other economists have estimated that each month of partial economic shut-down will cause real GDP to fall by 5%, thus, a double-digit economic contraction is not out of the question.

As the U.S. economy rebuilds, it will be structurally different. It will be years before restaurants and travel-related industries recover, and many brick-and-mortar retailers will never re-open. This will leave a lot of workers that need to shift careers.

The pandemic-induced recession is likely to be of a magnitude equal to or surpassing the Great Recession of 2008-2009, and it’s worth exploring how that economic contraction affected the long-term outlook for the U.S. economy.

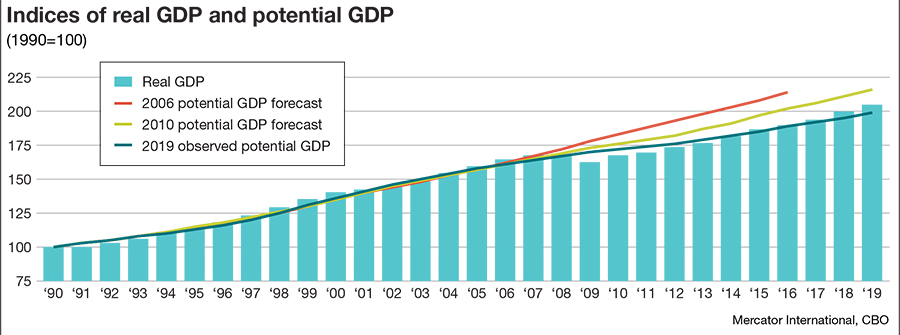

Twice yearly, the nonpartisan Congressional Budget Office (CBO) produces a 10-year forecast of potential GDP, which is the maximum GDP that can be produced without inducing an acceleration of inflation. In 2006, the CBO forecasted that potential GDP would grow at an annual rate of 2.8%, increasing by 32% by 2016. Shortly thereafter, the economy collapsed, with the first wave of home foreclosures arriving in the fourth quarter of 2006.

In 2010, the economy was past the worst of the recession, and the CBO forecasted that potential GDP would be 25% higher in 2016 than it was in 2006, reflecting a post-recession growth rate of 2.3% per year. Thus, the CBO initially estimated that the recession would cause the long-term annual growth potential to decrease by a half of a percentage point.

In 2019 the CBO estimated that historical potential GDP in 2016 was only 17% higher than it was in 2006 (CAGR = 1.6%), and real GDP fell short of potential GDP in 2016 having grown at an average annual rate of just 1.4%—half the rate that the CBO forecasted potential GDP to grow by in 2006.

Following the Great Recession, investment was significantly curtailed, and the labor force participation rate fell from 66% in 2006 to slightly under 63% by 2016.

In its most recent outlook, the CBO forecasted potential GDP to grow at a compound annual rate of 1.9% per year through 2029. We should expect that investment will be similarly curtailed and the labor force participation rate will certainly suffer over the next few years, as they did following the Great Recession. We should not be surprised if potential GDP growth rates end up being closer to 1% than 2%.

Of course, much can happen between now and the end of the year, and I hope that I am misreading the tea leaves. Now more than ever, business leaders should be planning for the worst, and hoping for the best.

Article Topics

Ocean Freight News & Resources

2024 State of Freight Forwarders: What’s next is happening now Baltimore bridge recovery efforts continue with opening of new channel Q1 sees a solid finish with strong U.S.-bound import growth, reports S&P Global Market Intelligence Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans More Ocean FreightLatest in Logistics

April Services PMI contracts after 15 months of growth, reports ISM 2023 industrial big-box leasing activity heads down but remains on a steady path, notes CBRE report U.S. rail carload and intermodal volumes are mixed in April, reports AAR Q1 U.S. Bank Freight Payment Index sees shipment and spending declines S&P Global Market Intelligence’s Rogers assesses 2024 import landscape Pitt Ohio exec warns Congress to go slow on truck electrification mandates Q1 intermodal volumes are up for second straight quarter, reports IANA More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources