2019 State of Logistics: Truckload

Truckload market grappling with excess capacity, lagging rates

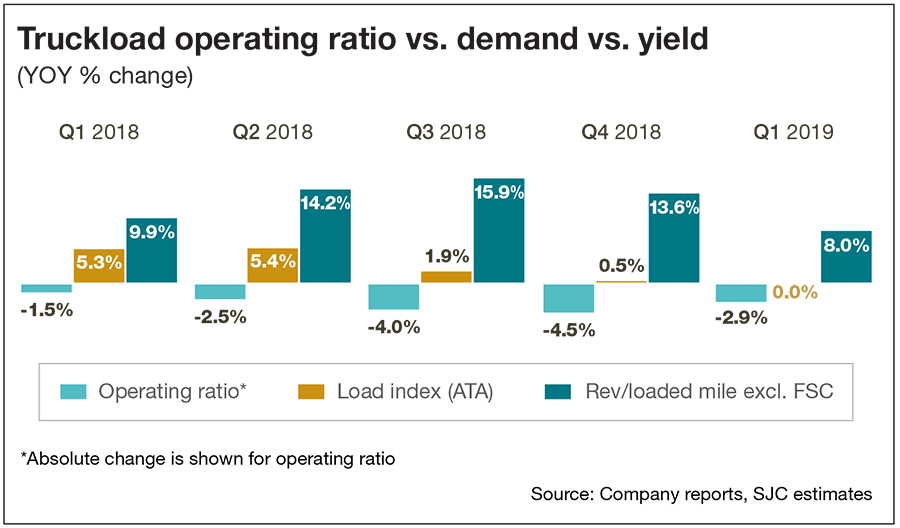

The good news for truckload (TL) shippers is that capacity seems to be adequate for the volumes predicted for the rest of this year. In fact, some bargain rates appear possible for TL shippers.

Early second quarter spot truckload rates lagged March averages for vans and reefers, but there were signs of a possible rebound, according to DAT Trendlines, which closely tracks dry van TL freight rates. DAT noted the load-to-truck ratio—which is often a predictor of rate movement—shot up 25% nationally, meaning that brokers and shippers had more difficulty finding trucks, according to DAT.

So, after a slow start to the year, DAT analysts say that TL rates shot up in the second quarter, with van and reefer rates moving upward in May, edging above the April averages after several weeks of declines. The fact that the TL sector is highly fragmented was cited as a factor.

Due to the ease of entry to the TL market, large players have a minute share of the market. For example, even the largest TL player, Swift-Knight Transportation with $4.6 billion in revenue, has about a 1% share in the $340 billion TL market. That gives pricing power to smaller carriers—and shippers in some cases.

“Truckload is a different market because there are so many smaller players, and demand won’t be as same as last year,” says Satish Jindel, principal of SJ Consulting. And that’s not necessarily a bad thing because of the flexibility in the TL carrier networks. Because they operate so few terminals, they have only a fraction of the fixed costs that a large LTL carrier would have. “And because of this, they should be able to take out capacity quite rapidly when demand slackens,” he adds.

Yet, contrary to basic economics, truckload carriers have almost invariably done the opposite. For most of this year, the leading original equipment Class 8 truck manufacturers had a lengthy, months-long backlog of orders for heavy trucks. Finally, demand slackened this spring when Class 8 orders fell 66% as manufacturers worked overtime to trim backlogs. April Class 8 sales were 14,800, the lowest since October 2016.

Nevertheless, the consulting firm FTR is forecasting North American truck manufacturers will build 342,000 Class 8 units this year—that’s up nearly 8% from last year’s drop-dead year. Melton Truck Lines, the nation’s 92nd largest trucking company, is typical. Melton executives told the American Trucking Associations that it’s ordering 490 trucks this year and selling 420, a 5% rise in its overall capacity of 1,350 trucks.

However, Jindel isn’t buying the decades-old argument that most new Class 8 truck orders are for replacement of aging vehicles. “Even if they say they’re just replacing trucks, they’re adding capacity to the industry if not their particular company,” he says. “That’s because their used trucks are being bought by smaller carriers who otherwise couldn’t afford them. They’re adding capacity, and they don’t need to replace trucks every three years.”

Another factor affecting TL volume is the drop in intermodal volumes, which fell 1.5% year-over-year in the first quarter of 2019 after posting strong growth in 2018, according to the Intermodal Association of North America’s Intermodal (IANA) Market Trends and Statistics report. International intermodal volumes increased 1.2%, but domestic containers and trailers dropped 4.1% and 5.4% respectively. Tariffs on aluminum and steel-related imports were cited by IANA for the drop.

Read the feature article on the 2019 State of Logistics here.

Article Topics

Motor Freight News & Resources

A buying guide to outsourcing transportation management Harness Network Design for Supply Chain Success New Ryder analysis takes a close look at obstacles in converting to electric vehicles Between a Rock and a Hard Place National diesel average falls for the fourth consecutive week, reports EIA C.H. Robinson highlights progress of its AI-focused offerings with a focus on automating shipping processes Preliminary April North American Class 8 net orders are mixed More Motor FreightLatest in Logistics

A buying guide to outsourcing transportation management How site selection can help recruit top talent Harness Network Design for Supply Chain Success SKU vs. Item-level Data Visibility: Why it Matters for End-to-End Traceability 2024 Gartner® Magic Quadrant™ for Transportation Management Systems Key benefits of being an Amazon Business customer with Business Prime USPS cites continued progress in fiscal second quarter earnings despite recording another net loss More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources