2011 Q4Q Winners: AIR CARRIERS

Latest Logistics News

USPS cites continued progress in fiscal second quarter earnings despite recording another net loss U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR New Ryder analysis takes a close look at obstacles in converting to electric vehicles Norfolk Southern shareholders sign off on 10 board of directors nominees Inflation and economic worries are among top supply chain concerns for SMBs More News

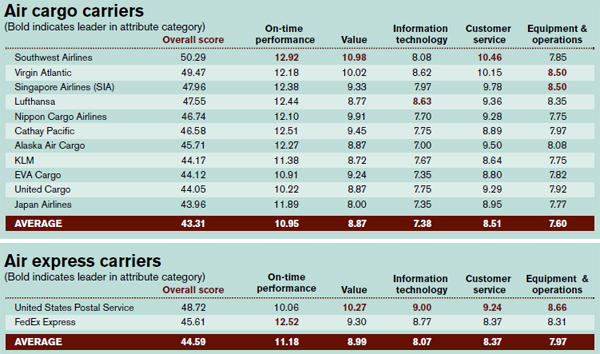

Source: Logistics Management, Peerless Media Research Group

Resilient leaders

While every freight transportation mode took a financial hit during the Great Recession, no other mode had to navigate the level of global volatility that the air cargo sector faced.

In fact, events affecting the air cargo industry over the past 12 months seem almost biblical: tornados, earthquakes, tsunamis, terrorism, wars, revolutions, volcanoes, as well as failing economies and continued sky rocketing oil prices.

As our air cargo correspondent Karen Thuermer reported in LM’s State of Logistics Report last month, the world’s air cargo carriers should be applauded for the work they’ve done to maintain a high level of service during these trying times.

And while the air sector certainly did gain some financial altitude over the course of 2010, they’re still looking for a patch of smooth air in 2011. According to analyst and association reports, despite the fact that air freight revenues rose 11.2 percent in 2010, the sector hit the wall by the end of the year. Most of that growth was in the first half 2010, but by mid-year it retracted as retailers, facing disappointing sales projections, turned largely to moving shipments by ocean.

Recent reports indicate that air carriers saw business continue to dwindle during the first half of 2011 as customers, facing higher transportation costs due to rising oil prices, continued to go with cheaper options whenever possible. Outgoing International Air Transport Association (IATA) director general Giovanni Bisignani recently stated that the association expects the profit margin for 2011 to be a very disappointing 0.7 percent, with overall profits coming in at $4 billion, down a hefty 78 percent from 2010.

Any way the analysts slice it, the air cargo business has shown remarkable resilience over the past two years—and shippers have shown their appreciation.

According to the readers of Logistics Management, the 11 carriers below have weathered the storms and have landed safely as 2011 Quest for Quality winners.

First to the gate again this year is Southwest Airlines with a category-high 50.29 weighted average. To reach this lofty altitude, the carrier posted top marks in On-time performance (12.92), Value (10.98), and Customer Service (10.46). Virgin Atlantic was right on their tail this year with a 49.47 overall weighted average. Virgin tied with Singapore Airlines (47.96) for the top score in Equipment & Operations attribute category (8.50). Lufthansa, which improved its 2010 winning score by more than 10 points this year, put up top marks in the IT attribute category (8.63).

We found quite a bit of continuity in this year’s list of winners. In fact, 9 of the 11 listed won Quest for Quality gold last year—and in nearly the same order. The only 2011 winners that missed the cut in 2010 are Cathay Pacific (46.58) and United Cargo (44.05).

2011 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

Latest in Logistics

Key benefits of being an Amazon Business customer with Business Prime USPS cites continued progress in fiscal second quarter earnings despite recording another net loss U.S. rail carload and intermodal volumes are mixed, for week ending May 4, reports AAR New Ryder analysis takes a close look at obstacles in converting to electric vehicles Norfolk Southern shareholders sign off on 10 board of directors nominees Between a Rock and a Hard Place Inflation and economic worries are among top supply chain concerns for SMBs More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources