2011 Q4Q Winners: NATIONAL LTL

Latest Logistics News

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA More News

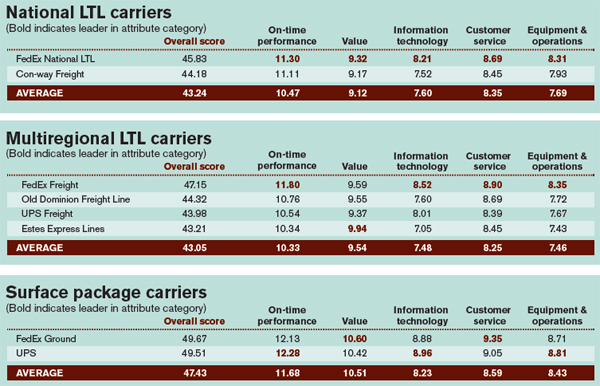

Source: Logistics Management, Peerless Media Research Group

Tough road to the top

When all is said and done, history may reveal that the Great Recession was cruelest to the carriers that make up the national less-than-truckload (LTL) category. As our John Schulz has been reporting over the past year, the overall LTL market has been less than profitable for many of the top carriers in this $27.5 billion sector, which has been plagued by overcapacity, high overhead costs, and staggering losses from its largest players.

Our daily coverage of the market reveals that parent companies of the two largest national, unionized LTL carriers—YRC Worldwide and Arkansas Best Corp.—continue to bleed red ink even as the U.S. economy maintains a slow and sluggish recovery. As shippers will read in this month’s news section, however, there may be some light at the end of the tunnel for YRC as the ailing carrier has completed a new $500 million restructuring that includes a new $400 million lending agreement.

But while it’s been tough going, the eight carriers on our list below have received word that shippers believe their service is second to none despite myriad operating challenges. In the National LTL category we find FedEx National LTL (45.83) and Con-way Freight (44.18) taking highest honors this year. As it did last year, FedEx National just slightly edged by Con-way in every attribute category to post the highest weighted average.

In the Multiregional LTL category, we find that FedEx Freight (47.15), Old Dominion Freight Line (44.32), and UPS Freight (43.98) ring in as repeat winners this year in the same order as the 2010 results. Estes Express Lines (43.21) joins the list this year after missing the cut in 2010.

It was nearly a toss up in this year’s Surface Package category. In perhaps one of the closest categories we measure, FedEx Ground (49.67) and UPS (49.51) came in above the weighted average. FedEx took top marks in Value and Customer Service, while UPS posted highest scores in On-time Performance, IT, and Equipment & Operations.

2011 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

Article Topics

Latest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources