2014 State of Logistics: Rail rides high

Latest Logistics News

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas More Transportation TrendsWhile there are currently more good signs than bad regarding the economy, it’s safe to say that we may need to “curb our enthusiasm,” as comedian Larry David may observe, until we see more sustained signs of growth and improvement. That is, of course, unless you follow the railroad and intermodal sectors.

It comes as little surprise to learn that both sectors are doing very well amid what has become the new normal—fits and starts in terms of economic growth.

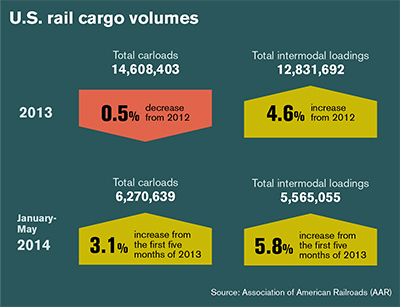

A look at year-to-date numbers on the rails brings this into perspective. Domestic carload volumes are up 3.1 percent through the end of May, while intermodal volumes, which have returned to pre-recession levels, are up 5.8 percent for the same period.

What’s more, the weekly carload average for the month of May, at 296,759, stands as the highest weekly average for any month, according to the Association of American Railroads (AAR). To top it off, the intermodal weekly average for May is the third-best ever recorded. These are better than good growth numbers for this time of year, and are even more impressive when you consider what carriers went through in the first quarter as they endured one of the worst winters in years.

“Rail demand is real and is there,” said Tony Hatch, rail analyst and principal of ABH Consulting. “And shippers anticipate enough rail capacity to handle it. There is plenty of evidence out there supporting volume growth, service improvement, and improving relationships between carriers and shippers.”

One prescient reason for this is the ability of the railroads to truly leverage its strengths in terms of ever-improving service quality. Due to these improvements, more shippers have jumped on board. In turn, the carriers have leveraged these excellent returns and have reinvested into their networks and infrastructure to expand, upgrade, and enhance the U.S. freight rail.

Earlier this year, the AAR said that the seven North American-based Class I railroads plan to invest roughly $26 billion in 2014, adding that since 1980 freight railroads have anted up about $550 billion into their rail networks—with roughly $115 billion alone being invested over the last five years.

“This year’s projected record investments continue a decades-long trend of private railroad dollars that sustain America’s freight rail network so taxpayer’s don’t have to,” said Edward Hamberger, AAR’s president and CEO. “This massive private financial commitment is a demonstration of the industry’s resolve to never stop improving.”

The ability to make these investments comes with a caveat for shippers in the form of increased rates at an average annual clip of about 5 percent per year. This has resulted in what has ostensibly become an age-old dilemma between carriers and shippers, with carriers making the case that hikes are needed in order to make significant capital investments—while rail shippers want more for their money.

In recent years, there’s been shipper momentum to re-regulate the industry in various forms, whether it be to addressing the lack of railroad antitrust, fuel surcharges applied by the rails, and reciprocal switching. But given the tenuous culture in Congress, they’ve not made meaningful forward progress.

Despite the disconnect between rail shippers and carriers at times, industry experts are quick to point out that even with current growth levels, railroads are not revenue adequate, even if it seems that way to shippers.

Article Topics

Transportation Trends News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas Trucking Regulations: Washington U-Turns; States put hammer down Transportation Trends and Best Practices: The Battle for the Last Mile More Transportation TrendsLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources