2014 State of Logistics: Truckload—capacity tight and drivers needed

Latest Logistics News

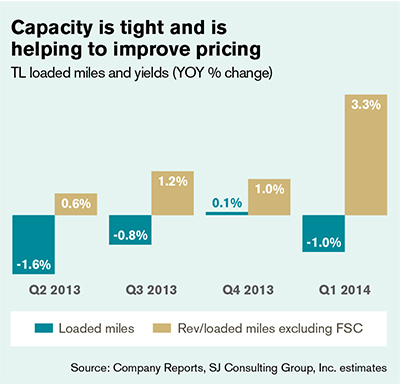

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas More Transportation TrendsThe $300 billion for-hire truckload (TL) sector is enjoying a fairly busy 2014, with most carriers reporting a balanced picture of tighter-than-average capacity against decent if not spectacular demand levels.

“Demand for truckload capacity continues to be firm with some pockets of the country stronger than others, in particular the Texas market,” said Joe Dagnese, president of Con-way Truckload.

The biggest challenge for Con-way Truckload and other leading TL carriers continues to be finding qualified drivers. Demographics, tighter drug and alcohol screening, the government’s Comprehensive Safety Analysis (CSA) crackdown, so-so pay, and the rigors of the job have combined to make the pool of available drivers smaller—and more expensive to find and retain.

“As an industry, we need to be more innovative in how we attract new drivers and develop the next generation,” said Dagnese.

The driver shortage, described by one top TL executive as “horrible” already, promises only to get worse as the economic recovery continues and demand improves. The top TL carriers are working closely with veterans organizations, driving schools, and other outplacement resources to encourage military to consider truck driving as a career of choice after their service.

If they’re willing to learn how to drive a civilian 53-foot tractor-trailer, those vets will find an ample supply of jobs paying around $50,000 to start, jumping up to $60,000 in the second or third year. That’s because there are now more heavy trucks on the road than ever. The U.S. heavy-duty truck fleet grew to a record 3.66 million—the largest size on record during the first quarter and a 3.2 percent increase from a year earlier, according to market research firm IHS Automotive.

First time registrations surged 9.2 percent to just over 48,000 in the first quarter of this year, marking the strongest quarterly rise since the first quarter of 2007.

Eric Starks, president of transportation forecasting for FTR Associates, said recently that the U.S. economy is showing mixed signals, and it’s difficult to make a long-term call with confidence. But his preliminary analysis shows that between now and 2017, the TL sector will need to add an incremental 1.5 million drivers to stay at the current level of 2.7 million long-haul TL drivers.

The TL sector is also coping with what U.S. Chamber of Commerce President and CEO Thomas Donohue calls a “tsunami” of new regulations. These include tweaks to hours of service, CSA, and requirements for electronic on-board recorders. The bottom line for all this is higher costs, with productivity losses in the 3 percent to 5 percent range for most TL fleets.

In turn, TL shippers can expect carriers to be seeking that 3 percent to 5 percent back through rate hikes. Starks is predicting some TL carriers will seek as high as 6 percent rate hikes—but that will depend on geography.

“The West, Southwest, and Southeast are all tight right now, while TL demand in the Northeast and Midwest has slackened a bit from the surge earlier this year,” said Starks.

Given the driver shortage situation, FTR is forecasting Class 8 deliveries to contract from 290,000 units this year to 260,000 next year. But keep in mind, most of that demand is replacement-only purchases, with few TL fleets actually adding brand new capacity.

Article Topics

Transportation Trends News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources Transportation Best Practices/Trends: Private fleet growth soars Cold Chain: Despite challenges, continues to evolve Freight Audit and Payment Update: Take what you need 2018 Ocean Cargo Roundtable: Unsettled seas Trucking Regulations: Washington U-Turns; States put hammer down Transportation Trends and Best Practices: The Battle for the Last Mile More Transportation TrendsLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources