2016 State of Logistics: Truckload

TL carriers hammered on rates in soft, mid-year freight environment

Latest Logistics News

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week More Motor FreightTruckload (TL) carriers, those non-union, low-cost, low-overhead operations that are the backbone of the nation’s motor carrier network, are enduring a buyer’s market right now. Of course, that’s great news for shippers, but not so great for carrier executives.

John White, chief marketing officer of the truckload group of U.S. Xpress, the nation’s seventh-largest TL carrier, described the first half of this year from a supply/demand perspective as “a little soft—not horrible.” However, he doesn’t believe that the softness in TL demand is a long-term phenomenon or a precursor to a recession.

“We’re running 3,000 trucks, and we’re coming in a little short and need some extra freight every day,” says White. “We’re maybe 100 full truckloads short, about 2% to 3%. It’s not terrible, but it’s not like it was in 2014 when demand surged.”

The $310 billion truckload sector is highly fragmented. The largest carrier, $3.5 billion Swift Transportation, barely has 1% market share. In fact, the largest 25 TL carriers have revenue of $27.2 billion—about 8 percent market share. Compare that with the less-than-truckload (LTL) industry, where the top 25 carriers control about 80 percent of that $36 billion market.

“It’s a completely different market from LTL,” says Brad Jacobs, chairman and president XPO Logistics, which operates the 22nd largest stand-alone TL carrier in the country. “It’s not very disciplined. There’s pricing rationality in LTL, and you don’t see that in truckload.”

Such lack of pricing power is causing truckload freight rates to continue to be under intense pressure, at least until the peak-shipping season the last half of the year. This is causing a double whammy for carriers, but also a double boon for shippers.

One large dry van carrier said privately that 90% of its customers are “more or less demanding rate reductions” in what continues to be a soft freight environment. In this situation, carriers can either cut rates or run empty miles as capacity is steady. However, the other shoe is the rising cost of fuel, with crude oil prices rising about $20 a barrel since its 11 year low of $26.55 in mid-January.

With plenty of choices for TL capacity, some shippers are telling carriers that they’ll pull their freight if rates are not cut 10% or more. The double benefit for TL shippers is that their fuel surcharges have dropped significantly since their highs six years ago.

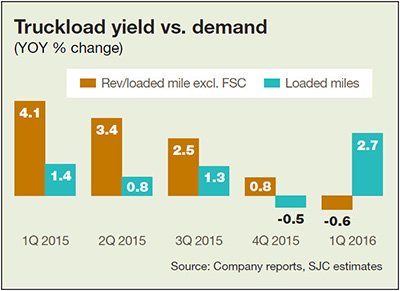

Data prepared exclusively for Logistics Management by SJ Consulting shows that for now, shippers are in the drivers’ seat. TL pricing has deteriorated in wake of lower load volumes and turned negative year over year, according to figures in the first quarter this year.

As the year-over-year truckload yield verses demand data indicates, there was a strong trend favoring shippers in the first quar¬ter. That’s when loaded TL miles surged 2.7 percent, but yield (revenue per loaded mile) actually fell 0.6 percent. That com¬pared with TL loaded miles rising 1.4 percent, with yield surging 4.1 percent in the 2015 first quarter.

With purchasing and procurement departments or brokers increasingly taking over TL purchasing through freight rate auc¬tions, spot market rates have tumbled in the past year. TL carrier executives say privately that this is causing pressure on contract rate renewals, even though shippers are enjoying a double-digit percentage reduction in fuel surcharges.

These online spot market “auctions” are often conducted without any pre-existing strong shipper/carrier relationships. Pri¬vately, TL executives worry that spot market pricing—by lane and direction—is often used as the guideline for targeted rates during contract renewals.

All this is causing pessimism. In a survey of rate expectations by TCP partners at the start of 2015, 79% of TL opera-tors said that they were factoring in rate increases during the year. At the start of this year, that number dwindled to 41 %— the lowest since 2009.

Still, TCP officials and TL executives contend that the truckload market is nothing if not fluid—and liable to change quickly. “We’re seeing more variation of opinions of individual TL carriers than in prior years,” says TCP partner Richard Mikes. “Any further tightening of capacity by a small increase in demand or driver shortages, then we’ll have a proportionately great upward impact on spot and contract rates.”

Article Topics

Motor Freight News & Resources

Shipment and expenditure decreases trend down, notes Cass Freight Index March trucking tonnage trends down, reports ATA FTR Shippers Conditions Index enters negative territory DAT March Truckload Volume Index sees modest March gains National diesel average, for week of April 22, is down for the second straight week LM Podcast Series: Assessing the freight transportation and logistics markets with Tom Nightingale, AFS Logistics XPO opens up three new services acquired through auction of Yellow’s properties and assets More Motor FreightLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources