29th Annual Quest for Quality Awards: Ocean carrier’s lead the way on the water

Unlike their brethren on the highways, ocean carriers will not be reporting capacity restraint issues from their unique position on the high seas over the next 12 months.

Latest Logistics News

2024 State of Freight Forwarders: What’s next is happening now UPS reports first quarter earnings decline 2024 Air Cargo Update: Cleared for take off Supply Chain Currents Part I: Is there a different way to move freight more effectively? Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes More Air Freight

As Executive Editor Patrick Burnson reported last month in our expansive State of Logistics Report (logisticsmgmt.com/sol2012), nearly 60 new vessels of at least 10,000 twenty-foot equivalent units (TEUs) are being staged for deployment.

In the meantime, LM has been reporting that the active global ocean cargo container fleet has grown by 2 percent so far in 2012, and analysts feel that it will expand more than 7 percent by the end of this year. With this news, ocean carrier analysts will now be looking closely to see if the buying spree of last year will pay off. “Most indicators reveal that overspending and rate cutting to win market share proved to be profoundly damaging strategies for all but a few ocean carriers,” reported Burnson.

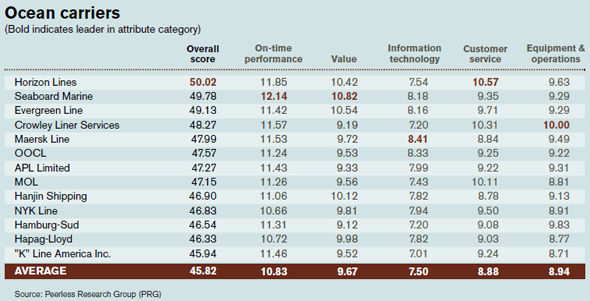

Well, the 13 carriers listed below have certainly seen their way through the fog of their recession strategies in terms of service performance in the eyes of LM readers. In fact, we’re happy to report that the overall weighted average jumped up 2.7 points, signaling a slightly more satisfied shipper base.

Horizon Lines posted an impressive 50.02 overall weighted score, a category high this year and a whopping 6.73 jump from its overall score in 2011. Horizon got there by posting a top mark in Customer Service (10.57). On Horizon’s heels are Seaboard Marine (49.78) and Evergreen Line (49.13). Seaboard posted the best scores in On-time Performance (12.14) and Value (10.82) and makes it back to the winner’s podium after missing the cut in our 2011 survey.

Crowley Liner Services put up the top mark in Equipment & Operations this year (10.00), while Maersk Line posted the highest score in Information Technology (8.41). Along with Seaboard, LM readers welcomed MOL (47.15) and Hamburg-Sud (46.54) back to the podium this year after those carriers missed the cut in our 2011 survey.

2012 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL |  home page |

2012 Quest for Quality Ocean Carrier Winners

APL provides customers around the world with container transportation services through a network combining high-quality intermodal operations with state-of-the-art information technology. More About APL

APL provides customers around the world with container transportation services through a network combining high-quality intermodal operations with state-of-the-art information technology. More About APL

Article Topics

Air Freight News & Resources

2024 State of Freight Forwarders: What’s next is happening now UPS reports first quarter earnings decline 2024 Air Cargo Update: Cleared for take off Supply Chain Currents Part I: Is there a different way to move freight more effectively? Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes UPS fourth quarter earnings see more declines GRI Impact Analysis: Getting a Handle on Parcel Costs More Air FreightLatest in Logistics

Following USTR review, White House announces tariff increases on certain U.S.-bound imports from China Insider Q&A: Improving Freight Transportation: Anticipate scenarios, mitigate disruption, think long-term Inflation continues to have a wide-ranging impact on supply chains, notes Blue Yonder survey National diesel average decreases for the fifth consecutive week, reports EIA New Union Pacific service connects Southern California and Chicago Automate and Accelerate: Replacing Pick-to-Light with the Next Generation of Automation STB Chairman Martin J. Oberman retires More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

May 2024 Logistics Management

Latest Resources