Ocean Carriers: Keeping service high despite rough seas

Latest Logistics News

Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes More Ocean FreightEarlier in the year, Executive Editor Patrick Burnson issued the forecast that 2014 would be the year ocean cargo carriers finally return to profitability.

He reported that pent-up demand, depleted inventories, and a greater overall sense of economic security are converging on the high seas. In the meantime, ocean cargo carriers will be determined not to miss this opportunity to make rate hikes stick.

Now that we’re more than halfway through the year, industry analysts still agree with Burnson—and logistics managers are scrambling to readjust forecasts and budgets accordingly.

As we reported in the spring, trans-Pacific cargo demand posted steady growth coming off a healthy holiday season in the first quarter, and container lines serving the Asia-U.S. trade lane say that the gains are so far reflected in freight rates. Based off the recent news, it certainly appears that momentum will continue to build.

At press time, many shippers were still concerned about the progress—or lack thereof—in West Coast labor relations; however, ocean carriers have expressed optimism by announcing a proposed rate hike.

On July 15, container lines in the Transpacific Stabilization Agreement (TSA) moved ahead with a second phase of the revenue recovery plan by implementing a previously announced $200 per 40-foot container (FEU) general rate increase and peak season surcharge for cargo moving to Pacific Southwest ports in California. The bump follows a similar increase taken on July 1.

Now, the world’s largest ocean carriers are looking to reorganize and improve global services while working toward recovering revenue to remain vital. And according to the readers of LM, the following 15 carriers have done a terrific job of balancing this delicate task.

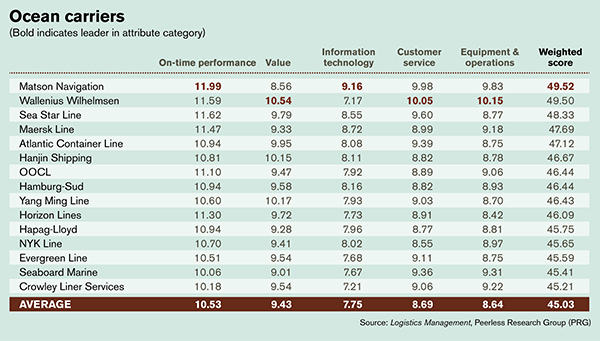

Pulling into port with the highest weighted score among our winners this year is Matson Navigation (49.52). Matson put up top marks in On-time Performance (11.99) and Information Technology (9.16). Wallenius Wilhelmsen had an impressive performance this year, posting high scores in Value (10.54), Customer Service (10.05), and Equipment & Operations (10.15).

Repeat winners from 2013 include Maersk Line (47.69), Atlantic Container Line (47.12), Hanjin Shipping (46.67), OOCL (46.44), Hamburg-Sud (46.44), Hapag-Lloyd (45.75), and Seaboard Marine (45.41).

2014 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL | OCEAN CARRIERS | PORTS | 3PL | AIR CARRIERS and FREIGHT FORWARDERS |  home page |

Article Topics

Ocean Freight News & Resources

Baltimore suing ship that crashed into bridge, closing port, costing jobs Descartes March Global Shipping Report highlights ongoing steady volume momentum U.S.-bound import growth track remains promising, notes Port Tracker report Nimble shippers coping with Baltimore port closing by shifting plans Q&A: Port of Oakland Maritime Director Bryan Brandes Signs of progress are being made towards moving cargo in and out of Baltimore Industry experts weigh in on Baltimore bridge collapse and subsequent supply chain implications More Ocean FreightLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources