Quest for Quality 2014: Reaching new service heights

Which carriers, third-party logistics providers, and U.S. ports have reached the summit of service excellence over the past year? Our readers have cast their votes, and now it’s time to introduce this year’s winners of the coveted Quest for Quality Awards.

Latest Logistics News

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA More NewsThe editorial staff of Logistics Management (LM) is proud to unveil the results of the 31st Annual Quest for Quality Awards. This year, a record 155 providers of transportation and logistics services have received the ultimate vote of confidence, posting the highest scores across our lists of critical service criteria.

For three decades, LM’s Quest for Quality Survey has been regarded in the transportation and logistics industry as the most important measure of customer satisfaction and performance excellence. To determine the best of the best, qualified LM readers rate carriers, third-party logistics (3PL) service providers, and now U.S. port operators strictly on the basis of service quality—making it the only survey of its kind in the market.

To determine who wins the vote, LM readers evaluate companies in all modes and service disciplines, choosing the top performers in categories including motor carriers, railroad and intermodal services, ocean carriers, airlines, freight forwarders, and third party/contract logistics services. From January through May of this year, LM and Peerless Research Group (PRG), a division of Peerless Media, surveyed readers who are qualified buyers of logistics and transportation services.

This year our research group received 7,451 total responses—1,272 more than last year. In order to be a “winner,” a company had to receive at least five percent of the category vote. The result of this overall effort offers the logistics market a crystal clear look at not only the overall winner in any given category, but a broad list of companies that finished above the average.

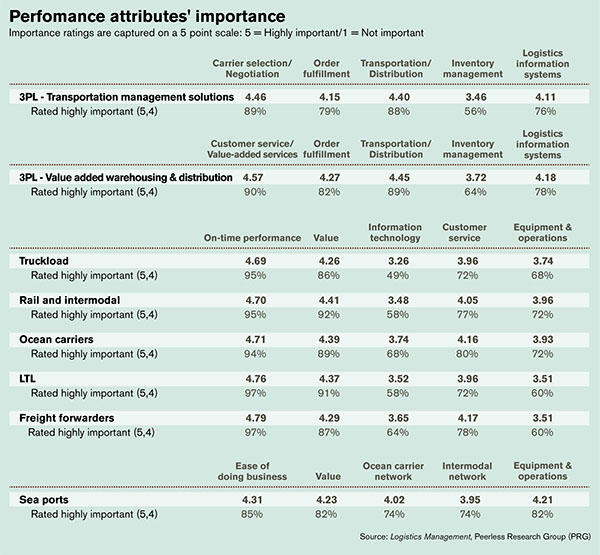

Transportation service providers are rated on LM’s five key criteria: On-time Performance; Value; Information Technology; Customer Service; and Equipment & Operations. Due to the nature of services offered by third-party players, a different set of criteria is used to judge this category. Third-party logistics providers are rated on the following attributes: Carrier Selection & Negotiation; Order Fulfillment; Transportation & Distribution; Inventory Management; and Logistics Information Systems.

Again this year we split our 3PLs into two categories in our ballot questionnaires with the help Armstrong & Associates Inc., the leading third-party logistics analyst firm in the market. “Customers evaluate and select 3PLs based upon their core competencies,” says Armstrong. “While larger 3PLs have integrated capabilities, the majority tends to be either transportation management or value-added warehousing and distribution operations centric. Therefore, it makes sense to evaluate providers separately in each segment,” he says.

Two years ago we re-established our Ports category, using Ease of Doing Business; Value; Ocean Carrier Network; Intermodal Network; and Equipment & Operations as the five key criteria to measure service success. We’re pleased to be delivering the scores of the top North American Ports once again this year—and for many years to come.

Evaluating the “best of the best”

The evaluation itself is a weighted metric. The scores take into account the importance readers attach to each attribute. Each year, readers are first asked to rank the attributes in each category on a five-point scale, with 5 representing the highest value and 1 representing the lowest value.

The PRG research team then uses those attributes’ rankings to create weighted scores in each category. For example, readers have historically placed the single highest value on the On-time Performance attribute—and they’ve done so again in 2014. In fact, the attribute was rated between 4.79 and 4.69 across the various carrier categories.

After readers have ranked these key attributes in order of importance, they then grade each provider that they currently use on each of the five core Quest for Quality attributes, rating them on a scale of 1 to 3 (1=poor, 2=average, 3=outstanding).

To produce a weighted score, the research team then multiplies the provider’s average scores for each attribute by the attribute’s ranking. Next, the weighted scores are calculated for all five attributes for a given vendor and added together to create an aggregate number.

Companies score a win when their total scores exceed the average total weighted score in their category. But remember, providers must receive a minimum number of reader responses to qualify for a win—at least five percent of the total base for the category.

2014 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL | OCEAN CARRIERS | PORTS | 3PL | AIR CARRIERS and FREIGHT FORWARDERS |  home page |

Article Topics

Latest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources