Rail/Intermodal: Going above and beyond on the rails

Latest Logistics News

Intermodal growth volume remains intact in March, reports IANA Shipment and expenditure decreases trend down, notes Cass Freight Index Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report U.S. rail carload and intermodal volumes are mixed, for week ending April 6, reports AAR LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch More Rail & IntermodalThrough record-high investments and a sharp focus on service, rail and intermodal providers are still delivering on their service promise to shippers—and doing it with improved efficiency, say LM readers.

As Group News Editor Jeff Berman reported in his 2014 Rail/Intermodal Roundtable that appeared in our June issue, perhaps the most impressive fact revolving around the rail/intermodal success story is the flexibility that the sector has illustrated, as it’s been able to roll with the economic changes and demand trends since the depths of the Great Recession.

And since that time, the modes have made steady annual gains and are on track to meet or exceed pre-recession volumes on the intermodal side—with carload volumes not that far behind.

“Amid a flurry of concerns over the regulatory framework of the industry as well as safety concerns, the railroads continue to do their part, making annual record-level capital investments in their infrastructure and network to meet shipper objectives for things like improved transit time gains and increased network efficiency,” says Berman.

However, in the midst of this storied progress, rail carriers still face an array of mounting challenges, including recovering from weather-related service issues caused from this past winter; the possibility of re-regulation; and increasing pushback from shippers that are less than pleased with rates as underlying demand for service remains strong.

How rail and intermodal service providers manage through these unfolding challenges is yet to be seen, but what we can report this month is that the 12 service providers listed below have gone above and beyond to deliver world-class service for the readers of LM.

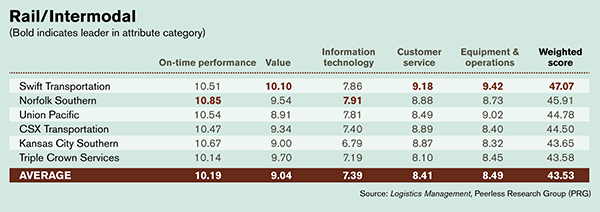

Leading the way in the 2014 Rail/Intermodal category this year we find Swift Transportation (47.07) putting up the highest weighted score. Swift posted top marks in Value (10.10), Customer Service (9.18), and Equipment & Operations (9.42). Pulling in just behind is Norfolk Southern (NS) with a weighted score of 45.91. NS took the lead in two attributes this year, posting a category-high 10.85 in On-time Performance and 7.91 in Information Technology.

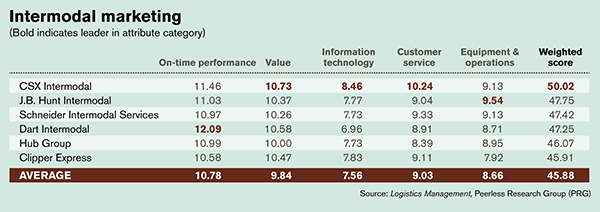

In this year’s Intermodal Marketing category we find CSX Intermodal posting an impressive 50.02 weighted score. CSX leads the way in Value (10.73), Information Technology (8.46), and Customer Service (10.24). Pulling in first in terms of On-time Performance is Dart Intermodal (12.09), and taking the top spot in Equipment & Operations is J.B. Hunt Intermodal (9.54).

2014 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL | OCEAN CARRIERS | PORTS | 3PL | AIR CARRIERS and FREIGHT FORWARDERS |  home page |

Article Topics

Rail & Intermodal News & Resources

Intermodal growth volume remains intact in March, reports IANA Shipment and expenditure decreases trend down, notes Cass Freight Index Four U.S. railroads file challenges against FRA’s two-person crew mandate, says report U.S. rail carload and intermodal volumes are mixed, for week ending April 6, reports AAR LM Podcast Series: Examining the freight railroad and intermodal markets with Tony Hatch Norfolk Southern announces preliminary $600 million agreement focused on settling East Palestine derailment lawsuit Railway Supply Institute files petition with Surface Transportation Board over looming ‘boxcar cliff’ More Rail & IntermodalLatest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources