Ports: Preparing to exceed service needs

Latest Logistics News

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA More NewsAs we’ve reported over the last year, even the most dominant U.S. ports can’t afford to become complacent in the face of several factors currently converging.

With the Panama Canal expansion planned to meet its deadline in late 2015, the top port players are working to accommodate the projected increase in the number of super-sized container vessels. In the meantime, smaller, niche ports are ratcheting up their games to catch residual volumes.

Meanwhile, even more strategic complexity for both ports and shippers will be introduced with further consolidation of ocean carrier services. Even though the proposed P3 Network was recently nixed, that by no means put an end to the formation of future carrier alliances.

In mid-July, two of the world’s biggest carriers—Maersk Line and Mediterranean Shipping Co (MSC)—created the 2M Network based on a 10-year contract deal to share vessels on some of the world’s busiest trade routes.

Analysts say the creation of any new alliance will find a review of services and a revised list of port calls, but the shift in initial deployments tend to be subtle. Over time, however that could change. According to industry analysts, in any massive freight aggregation situation, only the large ocean cargo gateways would receive more business—leaving smaller seaports battling one another for direct inbound carrier calls.

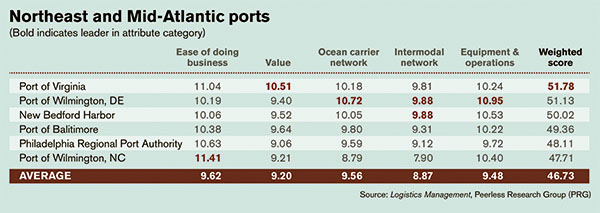

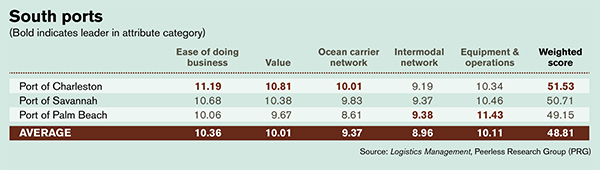

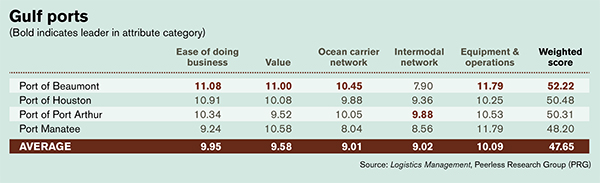

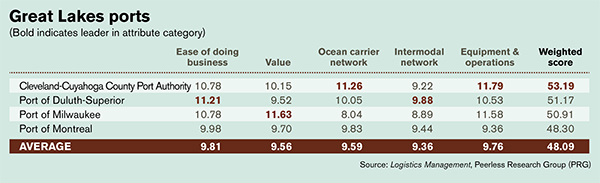

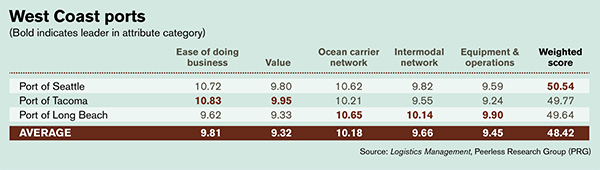

While much is yet to be determined in the nation’s ports over next year, we can report with certainty that the facilities listed below have met and often exceeded service expectations for LM readers over the past 12 months.

2014 Quest for Quality Winners Categories NATIONAL LTL | REGIONAL LTL | TRUCKLOAD | RAIL/INTERMODAL | OCEAN CARRIERS | PORTS | 3PL | AIR CARRIERS and FREIGHT FORWARDERS |  home page |

Article Topics

Latest in Logistics

Understanding the FTC’s ban on noncompetes UPS rolls out fuel surcharge increases U.S. rail carload and intermodal volumes, for week of April 20, are mixed, reports AAR Baltimore suing ship that crashed into bridge, closing port, costing jobs Intermodal growth volume remains intact in March, reports IANA Descartes announces acquisition of Dublin, Ireland-based Aerospace Software Developments Amid ongoing unexpected events, supply chains continue to readjust and adapt More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

April 2023 Logistics Management

Latest Resources